Is 29Metals (ASX:29M) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that 29Metals Limited (ASX:29M) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is 29Metals's Net Debt?

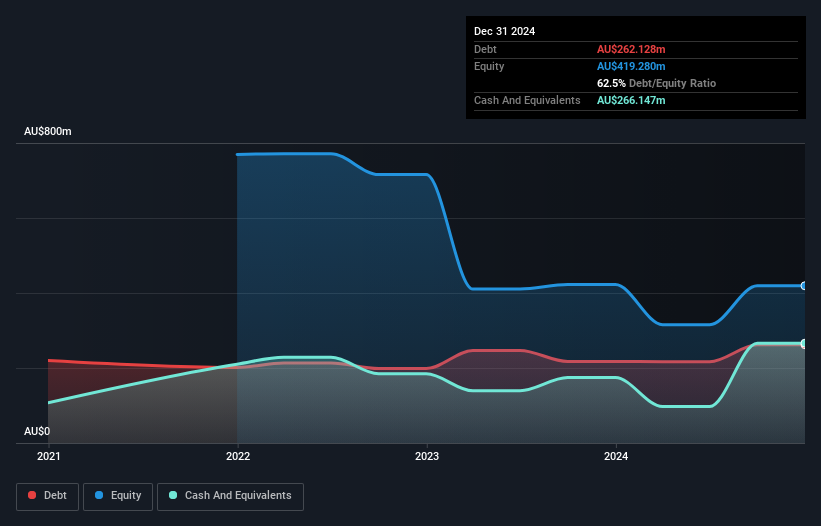

As you can see below, at the end of December 2024, 29Metals had AU$262.1m of debt, up from AU$217.2m a year ago. Click the image for more detail. However, its balance sheet shows it holds AU$266.1m in cash, so it actually has AU$4.02m net cash.

How Strong Is 29Metals' Balance Sheet?

According to the last reported balance sheet, 29Metals had liabilities of AU$269.5m due within 12 months, and liabilities of AU$349.3m due beyond 12 months. Offsetting these obligations, it had cash of AU$266.1m as well as receivables valued at AU$13.1m due within 12 months. So it has liabilities totalling AU$339.6m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the AU$184.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, 29Metals would likely require a major re-capitalisation if it had to pay its creditors today. 29Metals boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if 29Metals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts .

Check out our latest analysis for 29Metals

In the last year 29Metals wasn't profitable at an EBIT level, but managed to grow its revenue by 23%, to AU$551m. With any luck the company will be able to grow its way to profitability.

So How Risky Is 29Metals?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year 29Metals had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through AU$57m of cash and made a loss of AU$178m. But the saving grace is the AU$4.02m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. 29Metals's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with 29Metals .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade 29Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10