Does Retail Food Group (ASX:RFG) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Retail Food Group Limited (ASX:RFG) does use debt in its business. But should shareholders be worried about its use of debt?

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Retail Food Group's Net Debt?

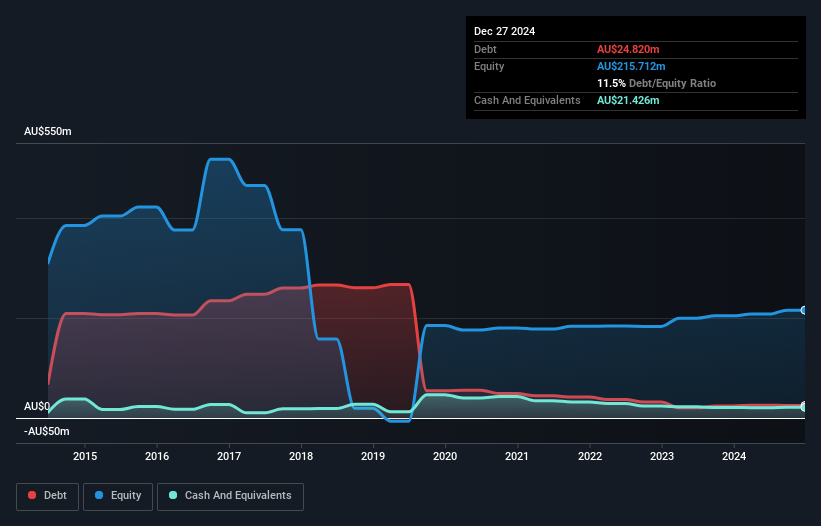

As you can see below, Retail Food Group had AU$24.8m of debt, at December 2024, which is about the same as the year before. You can click the chart for greater detail. However, it does have AU$21.4m in cash offsetting this, leading to net debt of about AU$3.39m.

How Strong Is Retail Food Group's Balance Sheet?

We can see from the most recent balance sheet that Retail Food Group had liabilities of AU$52.5m falling due within a year, and liabilities of AU$106.5m due beyond that. Offsetting this, it had AU$21.4m in cash and AU$33.6m in receivables that were due within 12 months. So it has liabilities totalling AU$103.9m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of AU$109.8m, so it does suggest shareholders should keep an eye on Retail Food Group's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

See our latest analysis for Retail Food Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Given net debt is only 0.24 times EBITDA, it is initially surprising to see that Retail Food Group's EBIT has low interest coverage of 2.5 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Notably, Retail Food Group's EBIT launched higher than Elon Musk, gaining a whopping 390% on last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Retail Food Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Retail Food Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that Retail Food Group's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But we must concede we find its interest cover has the opposite effect. All these things considered, it appears that Retail Food Group can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Retail Food Group , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Retail Food Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10