These Were the 2 Worst-Performing Stocks in the S&P 500 in March 2025

-

Close to 20% of S&P 500 stocks finished March down by at least 10%.

-

Delta lowered both its revenue and earnings-per-share guidance.

-

United said its government-related booking declined by around 50%.

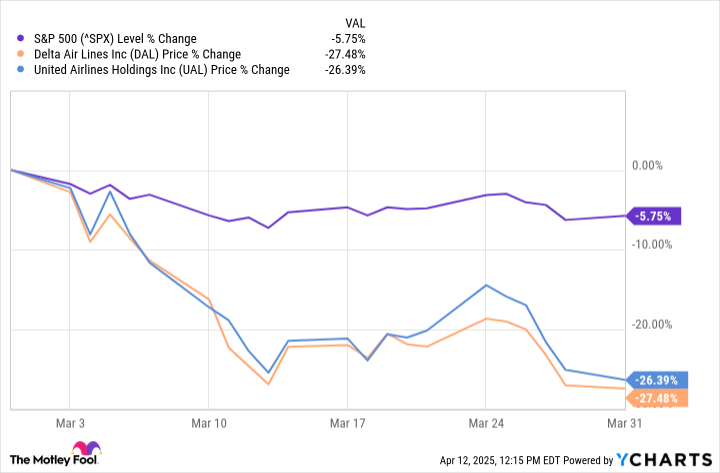

March wasn't the best month for the S&P 500, with the index dropping 5.8%. It was a tough month all around, as 98 of the S&P 500 stocks finished the month down at least 10%, but two especially had a bad month: Delta Air Lines (DAL -0.29%) and United Airlines (UAL 0.36%). Delta and United were the S&P 500's worst-performing stocks in March, falling 27.5% and 26.4%, respectively.

^SPX data by YCharts

Why did both airlines have such a bad March?

Broader economic uncertainty took its toll on both companies, but there were also industry-specific problems that caused the stock price drops. Delta lowered its revenue growth guidance from 6%-8% down to 5% (at the higher end). It also cut its earnings-per-share (EPS) guidance from $0.70 to $1 down to $0.30 to $0.50.

United also lowered its guidance as it projects its revenue will take a hit. It noted a slowdown in corporate and government travel, especially as the federal government focuses on reducing its spending. United says government-related booking decreased by half.

As new tariff plans go into effect and concerns about inflation and a potential recession ramp up, both companies could face some near-term troubles as consumers, companies, and governments cut back on travel. It will take time to see how it all plays out, but investors should expect volatility to continue along with potential drops.

As of market closing on April 11, Delta's and United's stocks are down 30.8% and 31.3% for the year, respectively.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10