Allegion plc (NYSE:ALLE) reported better-than-expected results for the first quarter on Friday.

The company posted quarterly earnings of $1.86 per share which beat the analyst consensus estimate of $1.67 per share. The company reported quarterly sales of $941.90 million which beat the analyst consensus estimate of $919.64 million.

Allegion affirmed its FY2025 adjusted EPS guidance of $7.65-$7.85 and affirmed revenue growth guidance of 1% to 3%.

“Allegion is off to a strong start in 2025. I’m proud of our team’s execution as we remained agile in a very dynamic environment. I’m especially pleased with the results delivered by our Americas non-residential business, which demonstrate the resiliency of our business model, our broad end market exposure and the depth of our relationships with channel partners and end users,” said Allegion President and CEO John H. Stone.

Allegion shares fell 1.5% to trade at $137.38 on Friday.

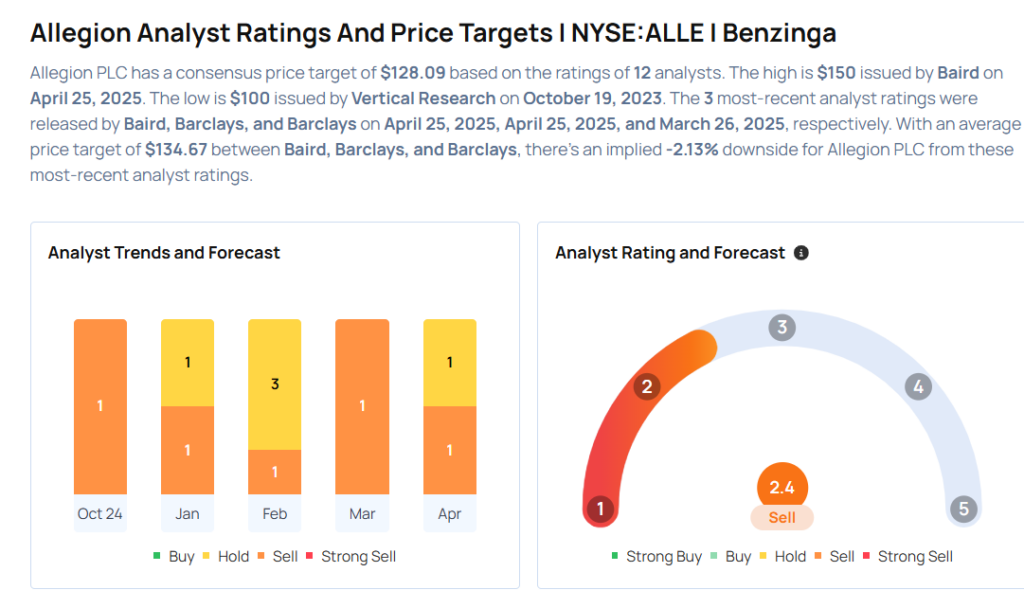

These analysts made changes to their price targets on Allegion following earnings announcement.

Barclays analyst Julian Mitchell maintained Allegion with an Underweight rating and raised the price target from $126 to $128.

Baird analyst Timothy Wojs maintained Allegion with a Neutral and raised the price target from $144 to $150.

Considering buying ALLE stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: OneMain Is ‘Too Risky,’ Recommends Buying Reddit

Photo via Shutterstock