Market Today: Honeywell and Sherwin-Williams Lead Gains Amid Earnings Surprises

Market Overview

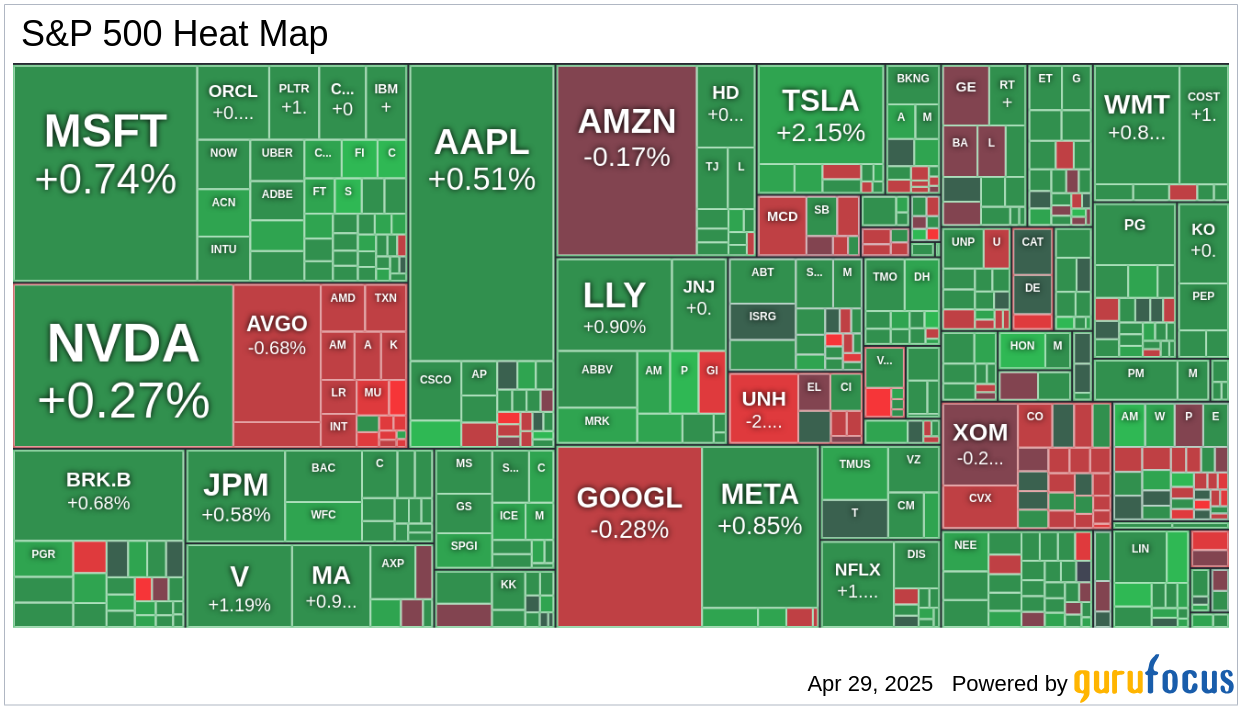

On a volatile trading day, the stock market concluded positively with the Dow Jones Industrial Average climbing 300 points above Monday's closing. The S&P 500 and Nasdaq Composite both achieved a 0.6% increase compared to the start of the week. This upward trend is attributed to ongoing momentum from previous gains, bringing the S&P 500 closer to its 50-day moving average, now less than 1% away.

Trade and Economic Updates

Investors faced initial caution due to uncertainties surrounding tariffs, especially after Treasury Secretary Bessent mentioned upcoming discussions with 17 key trade partners, excluding China, which is not currently engaged in tariff talks with the U.S. An executive order from President Trump aimed at preventing duplicate tariffs on specific imports, such as vehicles and parts, provided relief, especially after consumer confidence data indicated a decline.The April Consumer Confidence Index dropped to 86.0, below expectations of 88.3, influenced by the lowest Expectations Index since October 2011. Meanwhile, 12-month inflation expectations surged to 7.0%, the highest since November 2022.Sector and Earnings Highlights

In the S&P 500, all sectors but energy ended the day positively. The financial, materials, and consumer staples sectors led with gains of 1.0%, 0.9%, and 0.8% respectively. Conversely, the energy sector fell due to declining oil prices, closing at $60.42 per barrel, a 2.7% drop.Earnings reports were mixed, with General Motors (GM) slipping by 0.6% after announcing results that did not factor in tariff effects. On the brighter side, Honeywell (HON, Financial) soared 5.4% and Sherwin-Williams (SHW, Financial) rose 4.8%, reflecting strong earnings.Economic Data Review

Recent economic data displayed the following: - March's Advanced International Trade showed a deficit of $162.0 billion. - Retail inventories slightly decreased by 0.1%. - Wholesale inventories increased by 0.5%. - The FHFA Housing Price Index saw a minor rise of 0.1%. - The S&P Case-Shiller Home Price Index for February reported a 4.5% increase. - Job openings for March dropped to 7.192 million, after a revised prior figure of 7.480 million.Upcoming Economic Indicators

Looking forward to upcoming reports, market participants should keep an eye on: - Weekly MBA Mortgage Index - April ADP Employment Change - Q1 Employment Cost Index - Advance Q1 GDP and GDP Deflator - April Chicago PMI - March Pending Home Sales along with various personal income and spending data - Weekly crude oil inventoriesGlobal and Commodity Markets

European markets showed gains with the DAX and FTSE increasing by 0.7% and 0.6% respectively, while the CAC dipped by 0.2%. In Asia, trading was relatively flat with the Nikkei on holiday, Hang Seng gaining 0.2%, and the Shanghai Composite down 0.1%.Commodities experienced mixed movements: - Crude Oil decreased by $1.65, priced at $60.42 - Natural Gas gained $0.48 at $3.18 - Gold dropped $13.20 to $3335.10 - Silver increased by $0.57, reaching $33.57 - Copper slightly decreased by $0.01, at $4.87GM,HON,SHW

Guru Stock Picks

Chuck Royce has made the following transactions:

- Reduce in ASYS by 60.25%

Today's News

Honeywell (HON, Financial) experienced a significant boost, with shares rising 5.4% following its quarterly earnings report. The industrial conglomerate reported an 8% year-over-year increase in sales, reaching $9.8 billion, surpassing Wall Street estimates. Notably, Honeywell raised its full-year profit forecast despite potential tariff impacts of up to $500 million, driven by strong demand in Building Automation and other segments.

Sherwin-Williams (SHW, Financial) also saw a post-earnings surge of 4.8%. Despite a revenue decline, the company surpassed bottom-line expectations, showcasing resilience in its paint and coatings sector. These results contributed to the Dow's outperformance among major indices.

Visa (V, Financial) reported a strong fiscal second quarter, with Non-GAAP EPS of $2.76, beating estimates by $0.08. Revenue increased by 9.1% year-over-year to $9.6 billion, driven by growth in payments volume and cross-border transactions. The company's consistent performance underscores its robust position in the payments industry.

Amazon (AMZN, Financial) faces a strategic dilemma as tariff costs rise, threatening its retail margins. Mark Mahaney of Evercore ISI highlighted that Amazon must choose between absorbing these costs or risking market share. The e-commerce giant is expected to prioritize maintaining its market position, even if it means reversing recent margin gains.

United Parcel Service (UPS, Financial) reported Q1 2025 results with consolidated revenue of $21.5 billion, a slight decrease year-over-year. However, operating profit increased, and the company is aggressively reducing Amazon-related volume by over 50% by June 2026 as part of a strategic shift toward higher-margin business.

Regeneron Pharmaceuticals (REGN, Financial) faced mixed results, with a 39% drop in U.S. net sales of EYLEA due to increased off-label competition. However, Dupixent global sales grew by 20% year-over-year, reaching $3.7 billion, demonstrating strength across its portfolio.

Booking Holdings (BKNG, Financial) reported impressive Q1 results, with Non-GAAP EPS of $24.81, significantly exceeding expectations. Revenue grew 7.7% year-over-year to $4.76 billion, driven by a 7% increase in room nights. Despite strong financials, shares fell 5.08%, reflecting market volatility.

Starbucks (SBUX, Financial) reported incremental sales progress under CEO Brian Niccol, though it fell short of consensus expectations. Global comparable store sales declined by 1%, with a notable 2% decline in U.S. comparable transactions. The company continues to adapt its strategies to navigate challenging consumer dynamics.

Snap Inc. (SNAP, Financial) delivered a Q1 GAAP EPS of -$0.08, beating expectations by $0.05. Revenue increased by 14.3% year-over-year to $1.36 billion, driven by a 9% increase in Daily Active Users. Despite positive user growth, shares declined by 2% amid broader market pressures.

GuruFocus Stock Analysis

- Kraft Heinz (KHC) Lowers 2025 Forecasts as Tariffs, Weak Demand Weigh by Faizan Farooque

- General Motors (GM) Beats Q1 Estimates, Reassesses 2025 Outlook Amid Tariff Turmoil by Faizan Farooque

- UPS (UPS, Financial) to Cut 20,000 Jobs, Citing Amazon Volume Drop and Tariff Pressures by Faizan Farooque

- Meta Unveils Standalone Meta AI App by Moz Farooque

- Apple Bolsters Supply Chain with India Plants by Moz Farooque

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10