Colgate-Palmolive Analysts Increase Their Forecasts After Upbeat Results

Colgate-Palmolive Co (NYSE:CL) posted better-than-expected first-quarter FY25 earnings on Friday.

The company’s first-quarter FY25 sales declined 3% year over year to $4.91 billion, beating the analyst consensus estimate of $4.86 billion. Non-GAAP EPS of $0.91 beat the consensus estimate of $0.86.

“As we look ahead, uncertainty and volatility in global markets, including the impact of tariffs, remain challenging. We are confident in our strategy and will continue to execute with focus and agility to mitigate these factors and achieve our revised 2025 financial targets,” said Chairman, President, and CEO Noel Wallace.

For FY25, Colgate said it expects net sales to be up in the low single digits, including a negative impact from foreign exchange in the low single digits. The company anticipates organic sales growth to be 2% to 4%.

Colgate shares fell 3% to trade at $91.08 on Monday.

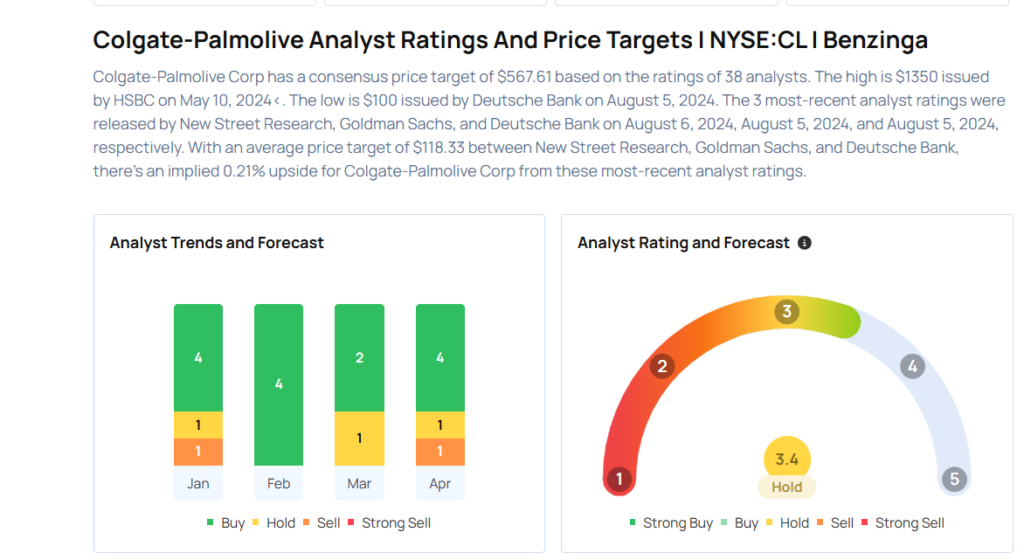

These analysts made changes to their price targets on Colgate following earnings announcement.

- JP Morgan analyst Andrea Teixeira maintained Colgate-Palmolive with an Overweight rating and raised the price target from $95 to $103.

- Citigroup analyst Filippo Falorni maintained Colgate-Palmolive with a Buy and raised the price target from $103 to $108.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That May Fall Off A Cliff This Quarter

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10