Qualcomm Plans $22 Billion In 'Non-Handset' Revenue By 2029—With AI As Its Trojan Horse

Semiconductor giant Qualcomm Inc. (NASDAQ:QCOM) made a bold bet on its future, involving diversification across lucrative new verticals, with AI as the foundational enabler for this expansion over the course of this decade.

What Happened: During its second quarter earnings call on Wednesday, Qualcomm reported $6.9 billion in handset chip sales, out of $10.8 billion in total revenue. The company plans to change this by doubling down on four different non-handset verticals, targeting $22 billion in sales from them by 2029.

“We remain focused on driving the next wave of AI smartphones and growing our non-handset revenues to $22 billion by fiscal 2029,” the company’s CEO, Christiano Amon, said during the call.

Qualcomm outlined four key growth verticals, each with revenue targets for 2029. Leading the list was its personal computing segment, where it aims to generate $4 billion in sales by the end of the decade through its Snapdragon platform, with 100 device designs expected to be commercialized by 2026.

See More: Microsoft Plans To Leverage A ‘Malleable Resource’ To Thrive In A Recession, Satya Nadella Explains

The automotive segment follows, with Qualcomm targeting $8 billion in sales by 2029. Extended Reality (XR) and Industrial IoT are projected to contribute $2 billion and $4 billion, respectively. Altogether, these segments are expected to bring in $18 billion, with the remaining $4 billion coming from consumer and networking IoT, edge networking, and AI software.

AI is at the center of Qualcomm's growth strategy, as the company advances on-device AI for mobile and PCs, followed by powering intelligent cockpit and ADAS systems in vehicles via its Snapdragon platform. Its recent acquisition of Edge Impulse further supports this push, enabling developers to build industrial AI solutions across a range of edge use cases.

“As AI accelerates the next phase of digital transformation, EdgeImpulse, combined with our AI hub, creates a true world-class industrial development platform for the age of intelligence,” Amon said during the call.

Why It Matters: Qualcomm has made a series of acquisitions in recent months to strengthen its AI capabilities. The most recent was MoviaAI, acquired last month, just weeks after the company announced its purchase of Edge Impulse in March.

The company’s diversification push comes on the heels of a major shift in its customer base. Apple Inc. (NASDAQ:AAPL), its largest client, recently unveiled its own in-house modem chip. Qualcomm executives said they expect to supply just 20% of Apple's modem chips by 2026, a development that has raised concerns among investors.

Price Action: Despite beating estimates on its second quarter results, Qualcomm shares are down 5.69% in pre-market trade.

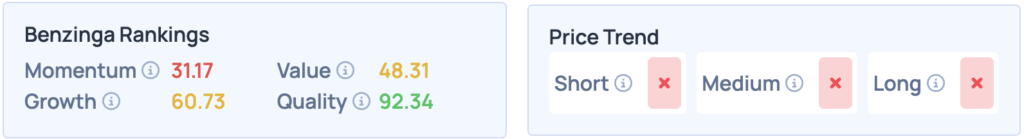

According to Benzinga’s Edge Stock Rankings, Qualcomm’s price trend is unfavorable in the short, medium, and long term. For more such insights, sign up for Benzinga Edge.

Read More:

- ‘Dr Doom’ Sees US Potential Growth At 4% By 2030 Despite Possibility Of Trump Tariffs Triggering A Brief Recession: ‘Exceptional Growth’ Around The Corner?

Image Via Shutterstock

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10