Air Products & Chemicals Inc Reports Q2 Adjusted EPS of $2.69, Exceeding Estimates; Revenue at $2.9 Billion, Slightly Below Expectations

On May 1, 2025, Air Products & Chemicals Inc (APD, Financial) released its 8-K filing for the fiscal 2025 second quarter. The company reported a GAAP loss per share of $7.77 and a net loss of $1.7 billion, primarily due to a $2.3 billion after-tax charge related to strategic business and asset actions. Adjusted earnings per share (EPS) came in at $2.69, missing the analyst estimate of $0.22. Air Products, a leading global industrial gas supplier, operates in 50 countries and is the largest supplier of hydrogen and helium worldwide.

Company Overview

Founded in 1940, Air Products & Chemicals Inc (APD, Financial) has established itself as a major player in the industrial gas sector, serving diverse industries such as chemicals, energy, healthcare, metals, and electronics. The company reported $12.1 billion in revenue for fiscal 2024, underscoring its significant market presence.

Performance and Challenges

The fiscal 2025 second quarter results reflect a challenging period for Air Products & Chemicals Inc (APD, Financial), marked by strategic exits from several U.S. projects and a global cost reduction plan. These actions resulted in substantial charges, impacting the company's financial performance. The adjusted EPS of $2.69, although a non-GAAP measure, highlights the underlying business performance excluding these strategic charges. However, it still represents a 6% decrease from the prior year, driven by lower volumes and higher costs.

Financial Achievements and Industry Importance

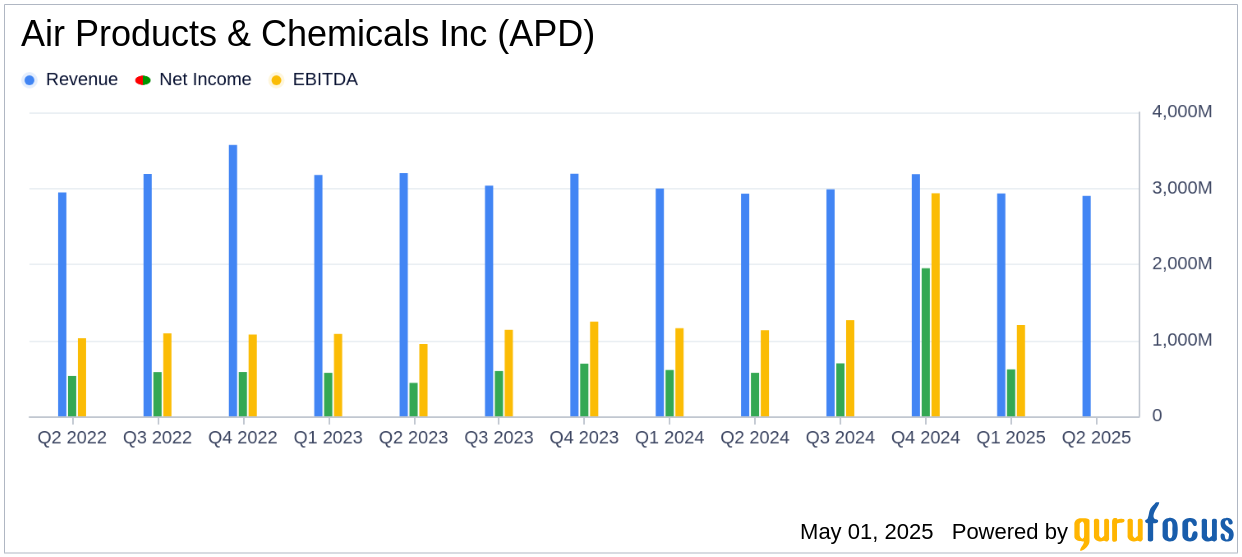

Despite the challenges, Air Products & Chemicals Inc (APD, Financial) achieved an adjusted EBITDA of $1.2 billion, albeit a 3% decline from the previous year. The company's ability to maintain a strong EBITDA is crucial in the chemicals industry, where operational efficiency and cost management are key to sustaining profitability. The increase in quarterly dividends to $1.79 per share, marking the 43rd consecutive year of dividend increases, underscores the company's commitment to returning value to shareholders.

Key Financial Metrics

Second quarter sales were $2.9 billion, flat compared to the previous year. The sales performance was influenced by a 4% higher energy cost pass-through and a 1% increase in pricing, offset by a 3% decline in volumes and a 2% unfavorable currency impact. The company's balance sheet shows total assets of $38.9 billion, with a notable decrease in cash and cash items from $2.98 billion to $1.49 billion, reflecting significant cash outflows for strategic actions and investments.

| Metric | Q2 FY25 | Q2 FY24 |

|---|---|---|

| Sales | $2,916.2 million | $2,930.2 million |

| Net Income (Loss) | ($1,737.5 million) | $580.9 million |

| Adjusted EPS | $2.69 | $2.57 |

Segment Performance

In the Americas, sales increased by 3% to $1.3 billion, driven by higher energy cost pass-through and pricing. However, operating income decreased by 2% due to higher maintenance costs. In Asia, sales slightly decreased by 1% to $774 million, with operating income down by 6% due to lower helium pricing and currency impacts. Europe saw a 9% increase in sales to $727 million, but operating income fell by 3% due to higher costs and unfavorable business mix.

Analysis and Outlook

The strategic decisions taken by Air Products & Chemicals Inc (APD, Financial) to exit certain projects and implement cost reduction measures are aimed at streamlining operations and focusing on high-value projects. While these actions have led to significant charges in the short term, they are expected to position the company for long-term growth. The revised full-year adjusted EPS guidance of $11.85 to $12.15 reflects management's confidence in the company's underlying business performance.

Explore the complete 8-K earnings release (here) from Air Products & Chemicals Inc for further details.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10