IDEX (NYSE:IEX) Surprises With Q1 Sales

Manufacturing company IDEX (NYSE:IEX) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 1.7% year on year to $814.3 million. Its non-GAAP profit of $1.75 per share was 6.7% above analysts’ consensus estimates.

Is now the time to buy IDEX? Find out in our full research report.

IDEX (IEX) Q1 CY2025 Highlights:

- Revenue: $814.3 million vs analyst estimates of $805.4 million (1.7% year-on-year growth, 1.1% beat)

- Adjusted EPS: $1.75 vs analyst estimates of $1.64 (6.7% beat)

- Adjusted EBITDA: $208 million vs analyst estimates of $195.5 million (25.5% margin, 6.4% beat)

- Management reiterated its full-year Adjusted EPS guidance of $8.27 at the midpoint

- Operating Margin: 17.4%, down from 20.1% in the same quarter last year

- Free Cash Flow Margin: 11.2%, down from 17.1% in the same quarter last year

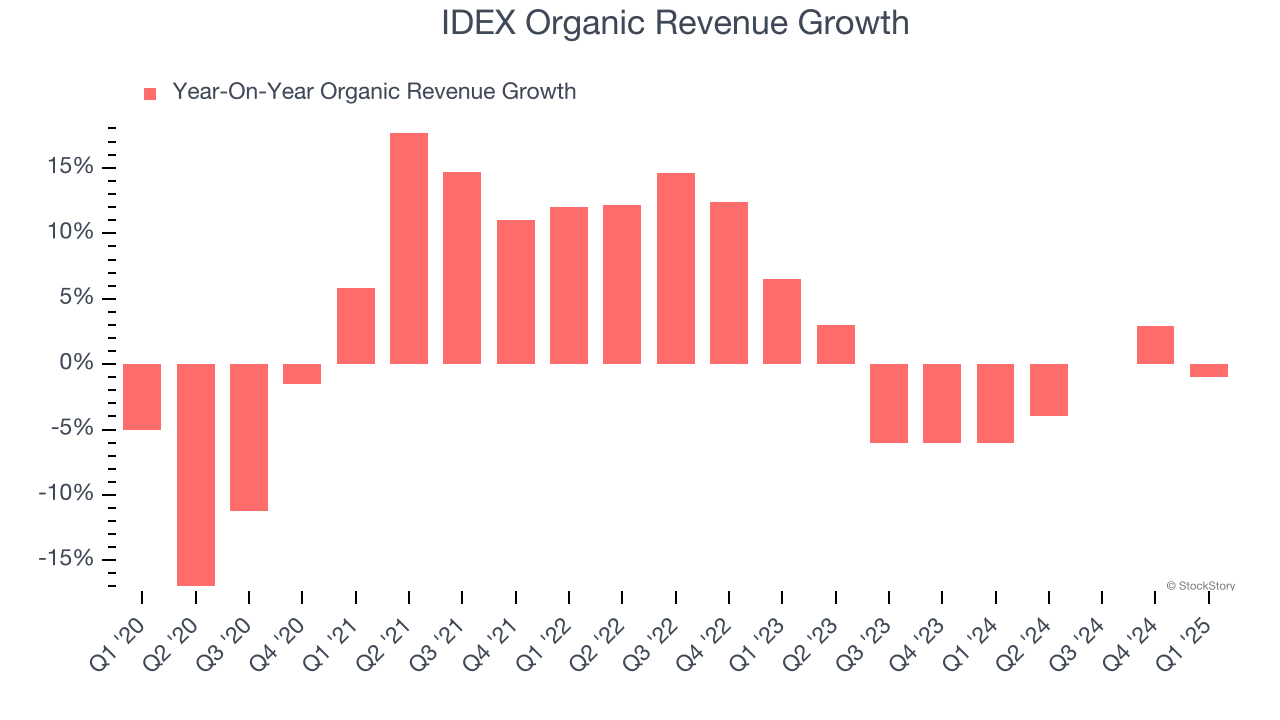

- Organic Revenue fell 1% year on year (-6% in the same quarter last year)

- Market Capitalization: $13.14 billion

“Our IDEX teams delivered better than expected revenue and profitability in the first quarter of 2025, with all segments exceeding our expectations. Most encouragingly, all of our segments built backlog, mostly accumulating within HST, fueled by an impressive large clean water project win from the Mott team,” said Eric Ashleman, IDEX Corporation President and Chief Executive Officer.

Company Overview

Founded in 1988, IDEX (NYSE:IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, IDEX’s sales grew at a tepid 5.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. IDEX’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, IDEX’s organic revenue averaged 2.1% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, IDEX reported modest year-on-year revenue growth of 1.7% but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

IDEX has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 22.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, IDEX’s operating margin decreased by 2.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, IDEX generated an operating profit margin of 17.4%, down 2.7 percentage points year on year. Since IDEX’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

IDEX’s unimpressive 6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

IDEX’s two-year annual EPS declines of 3.1% were bad and lower than its flat revenue.

In Q1, IDEX reported EPS at $1.75, down from $1.89 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.7%. Over the next 12 months, Wall Street expects IDEX’s full-year EPS of $7.75 to grow 7.8%.

Key Takeaways from IDEX’s Q1 Results

We enjoyed seeing IDEX beat analysts’ EBITDA expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $173.97 immediately after reporting.

Sure, IDEX had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10