HF Sinclair Corporation (NYSE:DINO) reported mixed first-quarter 2025 results on Thursday.

The company suffered an adjusted net loss of $50 million, or 27 cents per share. That's above the Wall Street expectation of a 44-cent loss. First-quarter revenue declined 9.4% year-over-year to $6.37 billion, below the consensus of $6.67 billion.

HF Sinclair’s Chief Executive Officer, Tim Go, commented, “For the first quarter, we delivered strong results in our Marketing, Midstream and Lubricants & Specialties businesses, and saw sequential improvement in Refining, despite the market headwinds and uncertainty caused by tariffs. Looking forward, we are encouraged by the recent improvement in refining margins and continue to focus on the execution of our strategic priorities to capture value across all of our business segments.”

HF Sinclair shares gained 2% to trade at $31.89 on Friday.

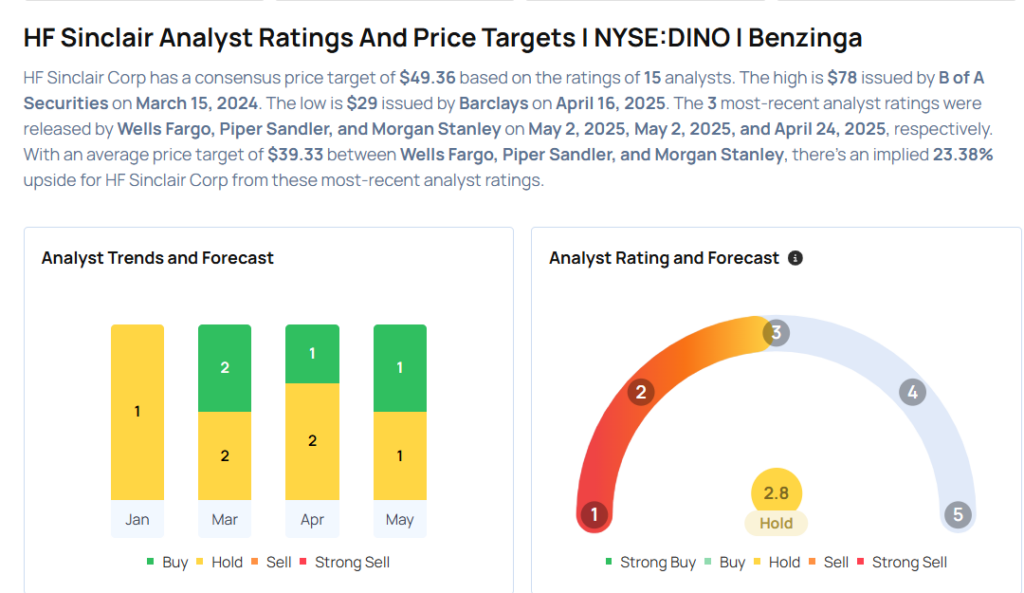

These analysts made changes to their price targets on HF Sinclair following earnings announcement.

- Piper Sandler analyst Ryan Todd maintained HF Sinclair with an Overweight rating and lowered the price target from $46 to $40.

- Wells Fargo analyst Roger Read maintained the stock with an Equal-Weight rating and cut the price target from $44 to $34.

Considering buying DINO stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Tyson Foods Stock Ahead Of Q2 Earnings

Photo via Shutterstock