Zimmer Biomet Holdings, Inc (NYSE:ZBH) reported better-than-expected earnings for the first quarter on Monday.

The company posted first-quarter adjusted EPS of $1.81, down from $1.94 a year ago, beating the Street estimates of $1.77. The orthopedic giant reported sales of $1.91 billion, up 1.1% on a reported basis (+2.3% on constant currency), almost in line with the consensus of $1.9 billion.

“We are proud of our team’s continued execution and performance to start the year, as we delivered solid first quarter results and advanced our bold innovation agenda,” said Ivan Tornos, Zimmer Biomet’s President and Chief Executive Officer.

The company expects fiscal year 2025 adjusted EPS of $7.90-$8.10, down from prior guidance of $8.15-$8.35 versus consensus of $8.19.

The company expects 2025 revenue growth of 5.7% – 8.2% compared to 1%-3.5% expected earlier. It expects a foreign currency exchange impact of 0.0%-0.5%.

Zimmer Biomet shares gained 0.7% to trade at $91.08 on Tuesday.

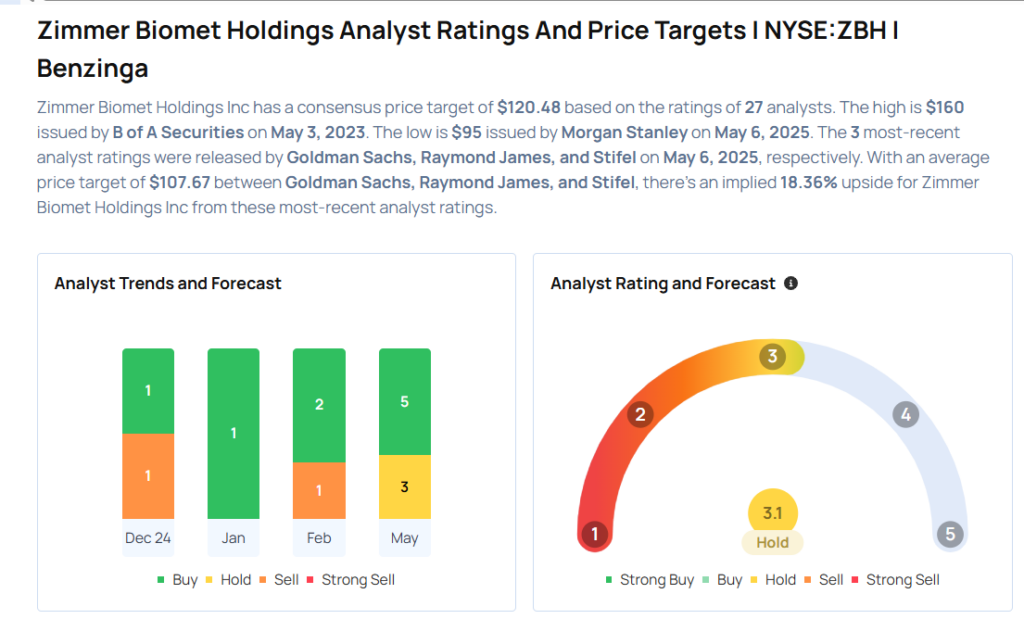

These analysts made changes to their price targets on Zimmer Biomet following earnings announcement.

- Baird analyst Jeff Johnson maintained Zimmer Biomet Holdings with an Outperform rating and lowered the price target from $130 to $115.

- Wells Fargo analyst Larry Biegelsen maintained the stock with an Equal-Weight rating and lowered the price target from $113 to $98.

- JP Morgan analyst Robbie Marcus maintained the stock with an Overweight rating and lowered the price target from $128 to $105.

- Morgan Stanley analyst Cecilia Furlong maintained the stock with an Equal-Weight rating and lowered the price target from $115 to $95.

- RBC Capital analyst Shagun Singh maintained Zimmer Biomet with an Outperform and lowered the price target from $125 to $112.

- Stifel analyst Rick Wise maintained Zimmer Biomet with a Buy and lowered the price target from $138 to $115.

- Raymond James analyst Jayson Bedford maintained Zimmer Biomet with an Outperform rating and lowered the price target from $119 to $104.

- Goldman Sachs analyst David Roman maintained the stock with a Neutral and lowered the price target from $120 to $104.

Considering buying ZBH stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Applied Materials Is An ‘Excellent’ Company, But Likes This Tech Stock More

Photo via Shutterstock