Arthur Hayes Emphasizes Treasury Over Fed for Bitcoin's Future

- Investors should focus on the US Treasury's actions over the Federal Reserve.

- Treasury uses repurchase agreements and auctions to manage US debt.

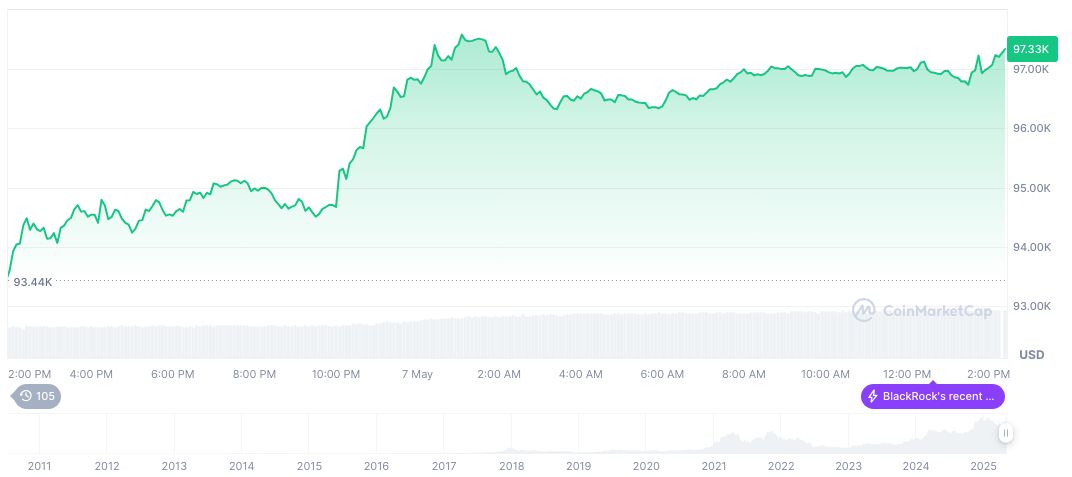

- Bitcoin approaches a significant milestone of $100,000.

Investors are advised to concentrate on the US Treasury's actions rather than the Federal Reserve's frequent announcements. Hayes emphasizes Yellen's techniques in managing liquidity through repurchase agreements and auctions to handle expanding US debt.

Following Hayes's remarks, several key market participants emphasized how the Treasury's maneuvers could lead to substantial changes in liquidity, impacting global finance. Numerous industry experts are considering Hayes's views as Bitcoin approaches the $100,000 mark.

US Treasury's Role in Bitcoin's Path to $1 Million

Arthur Hayes of BitMEX recently drew attention to the US Treasury's evolving role in global monetary policy, suggesting a shift away from the Federal Reserve. He argues that the Treasury's strategies, under Secretary Yellen, shape global liquidity significantly.

In past financial climates, such as the 2008 crisis, the Treasury's financial policies significantly influenced global liquidity, impacting multiple asset classes, including cryptocurrencies.

Bitcoin could break $1 million USD by the close of the decade. - Arthur Hayes

Market Data and Insights

Did you know? The US Treasury's actions have historically influenced various asset classes, including cryptocurrencies, during financial crises.

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $99,679.79, with a market cap of $1.98 trillion, reflecting its dominant role in the crypto market at 64.12%. The 24-hour trading volume surged by 67.10%, reaching $53.80 billion. Recent price changes include a 2.76% increase over 24 hours and a 25.94% rise over 30 days.

Insights from the Coincu research team highlight that the active financial strategies and partnerships between the US and China could bolster Bitcoin's trajectory, supporting Hayes's predictions. Market trends, combined with easing global tensions, may propel Bitcoin to new heights.

Read original article on coincu.com免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10