Wendy's Co (NASDAQ:WEN) reported downbeat sales for the first quarter on Friday.

The company posted a first-quarter 2025 sales decline of 2.1% year-on-year to $523.47 million, missing the analyst consensus estimate of $525.41 million. Adjusted EPS of 20 cents was in-line with the consensus estimate.

“We continued to deliver for our customers during the first quarter. In the U.S. we held both traffic and dollar share in a challenging consumer environment, and in our International business we grew systemwide sales by 8.9%,” said President and CEO Kirk Tanner.

Wendy’s lowered FY25 adjusted EPS outlook from 98 cents-$1.02 to 92 cents-98 cents. WEN sees FY25 global systemwide sales growth of (-2.0%) – flat. The company expects FY25 adjusted EBITDA of $530 million – $545 million.

Wendy’s shares gained 0.4% to trade at $299.95 on Monday.

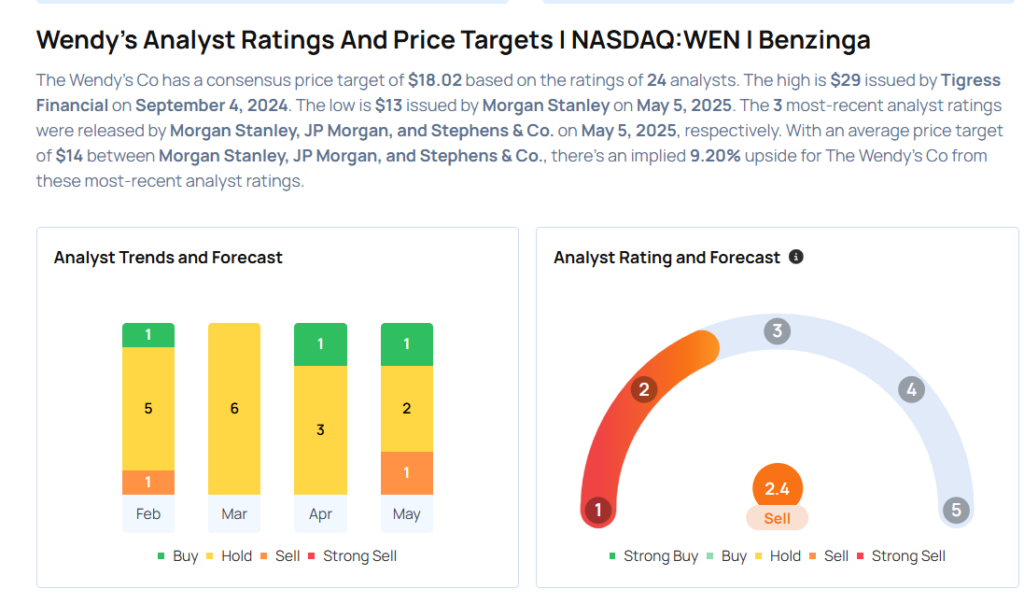

These analysts made changes to their price targets on Wendy’s following earnings announcement.

- Morgan Stanley analyst John Glass maintained Wendy’s with an Underweight rating and lowered the price target from $14 to $13.

- JP Morgan analyst John Ivankoe upgraded Wendy’s from Neutral to Overweight but lowered the price target from $17 to $15.

- Stephens & Co. analyst Jim Salera reiterated Wendy’s with an Equal-Weight rating and maintained a $14 price target.

Considering buying WEN stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech And Telecom Stocks That May Jump This Quarter

Photo via Shutterstock