TransDigm Group Inc (TDG) Q2 Earnings: EPS Surpasses Estimates at $8.24, Revenue Reaches $2,150 Million

On May 6, 2025, TransDigm Group Inc (TDG, Financial) released its 8-K filing for the fiscal second quarter ended March 29, 2025. The company, a leading global designer and supplier of highly engineered aircraft components, reported impressive financial results, surpassing analyst estimates for both earnings per share (EPS) and revenue.

Company Overview

TransDigm Group Inc (TDG, Financial) specializes in manufacturing and servicing a diverse range of specialized parts for commercial and military aircraft. The company operates through three segments: power and control, airframes, and a small non-aviation segment serving off-road vehicles and mining equipment. Known for its acquisitive strategy, TransDigm focuses on firms producing proprietary aerospace products with significant aftermarket demand, often leveraging financial strategies to enhance operating results.

Quarterly Performance and Challenges

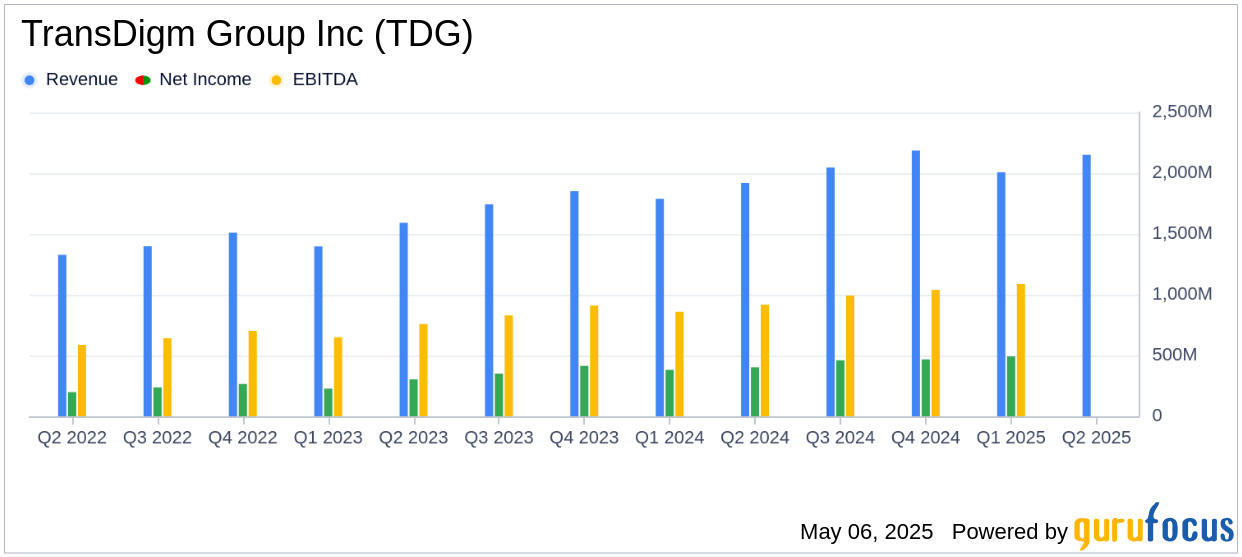

TransDigm reported net sales of $2,150 million for the quarter, marking a 12% increase from the previous year's $1,919 million. This growth was driven by strong performance in the commercial aftermarket and defense markets. The company's net income rose by 19% to $479 million, while EPS increased by 18% to $8.24, surpassing the analyst estimate of $8.10. Despite higher interest and income tax expenses, the company's value-driven operating strategy and reduced one-time refinancing costs contributed to these positive results.

Financial Achievements and Industry Importance

TransDigm's EBITDA As Defined reached $1,162 million, a 14% increase from the previous year, with a margin of 54.0%. The adjusted EPS was $9.11, up from $7.99, reflecting a 14% increase. These achievements underscore the company's robust operational efficiency and strategic positioning within the Aerospace & Defense industry, where maintaining high margins and strong cash flows is crucial for sustaining growth and competitiveness.

Key Financial Metrics

TransDigm's financial statements reveal significant improvements across various metrics. The company's EBITDA increased by 18.5% to $1,089 million, while adjusted net income rose by 14.5% to $529 million. These metrics are vital for assessing the company's ability to generate cash flow and manage debt, which are critical factors for investors in the aerospace sector.

| Metric | Q2 2025 | Q2 2024 | Change |

|---|---|---|---|

| Net Sales | $2,150 million | $1,919 million | +12% |

| Net Income | $479 million | $404 million | +19% |

| EPS | $8.24 | $7.00 | +18% |

| EBITDA As Defined | $1,162 million | $1,021 million | +14% |

Analysis and Commentary

TransDigm's President and CEO, Kevin Stein, expressed satisfaction with the company's performance, stating,

I am very pleased with the operating results for the second quarter. We continued to see strong performance as we closed out the first half of our fiscal year."The company's strategic focus on the commercial aftermarket and defense markets has been pivotal in driving revenue growth and maintaining robust margins.

Share Repurchase and Future Outlook

During the quarter, TransDigm repurchased approximately $53 million worth of its common stock, with additional repurchases of $131 million post-quarter. This strategic capital allocation reflects the company's confidence in its long-term growth prospects and commitment to enhancing shareholder value.

TransDigm reaffirmed its fiscal 2025 guidance, anticipating net sales between $8,750 million and $8,950 million, and EPS ranging from $32.27 to $34.19. The company remains focused on leveraging its operational strengths and market opportunities to drive sustained growth.

Explore the complete 8-K earnings release (here) from TransDigm Group Inc for further details.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10