DoorDash Inc (DASH) Q1 2025 Earnings: EPS of $0.44 Beats Estimates, Revenue at $3.0 Billion Misses Expectations

On May 6, 2025, DoorDash Inc (DASH, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. Founded in 2013 and headquartered in San Francisco, DoorDash is a leading online delivery demand aggregator, offering on-demand delivery services for food, groceries, and other retail items. The company has expanded its services to Europe and Asia through the acquisition of Wolt in 2022 and is continuously innovating with technologies like drone delivery.

Performance Overview

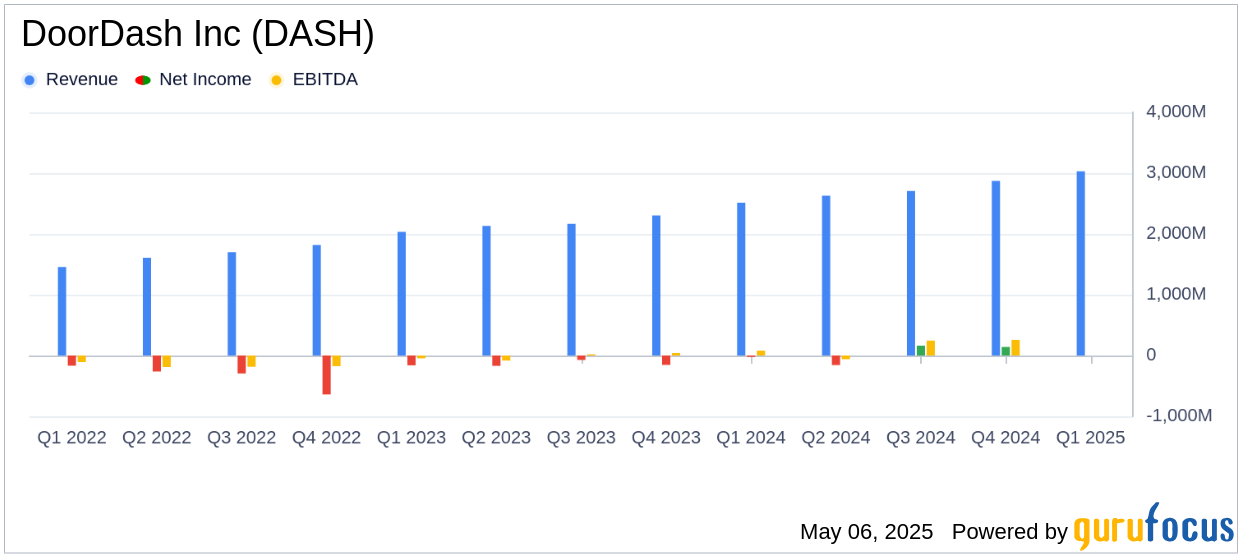

DoorDash Inc (DASH, Financial) reported a 21% year-over-year increase in revenue, reaching $3.0 billion for Q1 2025. However, this figure fell short of the analyst estimate of $3,094.37 million. The company's GAAP net income attributable to common stockholders rose to $193 million, a significant improvement from a net loss of $23 million in Q1 2024, and exceeded the estimated earnings per share of $0.39. The actual EPS was $0.44.

The company achieved new quarterly records in Total Orders and Marketplace Gross Order Value (GOV), with Total Orders increasing by 18% year-over-year to 732 million and Marketplace GOV rising by 20% to $23.1 billion. These metrics are crucial as they reflect the company's ability to attract and retain consumers and merchants, driving revenue growth.

Financial Achievements and Challenges

DoorDash's financial achievements in Q1 2025 include a 59% year-over-year increase in Adjusted EBITDA, reaching $590 million. This growth highlights the company's operational efficiency and ability to scale its business model effectively. The company's net revenue margin remained flat year-over-year at 13.1%, indicating stable profitability despite increased competition and market expansion efforts.

Despite these achievements, DoorDash faces challenges such as maintaining its net revenue margin amidst affordability initiatives and shifts in volume to categories with lower margins. The company's ongoing investments in new categories and international markets also pose risks, particularly in terms of geopolitical and currency fluctuations.

Key Financial Metrics

| Metric | Q1 2024 | Q1 2025 | Year-over-Year Change |

|---|---|---|---|

| Total Orders (millions) | 620 | 732 | 18% |

| Marketplace GOV ($ billions) | 19.2 | 23.1 | 20% |

| Revenue ($ billions) | 2.513 | 3.032 | 21% |

| GAAP Net Income ($ millions) | (23) | 193 | N/A |

| Adjusted EBITDA ($ millions) | 371 | 590 | 59% |

Operational Highlights and Strategic Moves

DoorDash made significant progress in expanding its offerings and improving its services in the U.S. and international markets. The company reported growth in monthly active users and membership programs like DashPass and Wolt+. Additionally, DoorDash announced agreements to acquire SevenRooms Inc., a hospitality technology leader, and Deliveroo plc, which are expected to enhance its service capabilities and market presence.

“We are very pleased with our financial performance and ability to execute against key strategic priorities so far in 2025,” the company stated in its earnings release.

Analysis and Outlook

DoorDash's Q1 2025 performance underscores its strong market position and growth potential in the interactive media industry. The company's ability to increase Total Orders and Marketplace GOV reflects its successful consumer engagement strategies. However, maintaining profitability amidst expansion and competitive pressures remains a challenge.

Looking ahead, DoorDash's strategic acquisitions and focus on innovation are likely to drive further growth. The company's financial outlook for Q2 2025 anticipates Marketplace GOV between $23.3 billion and $23.7 billion, with Adjusted EBITDA ranging from $600 million to $650 million, indicating continued confidence in its growth trajectory.

Explore the complete 8-K earnings release (here) from DoorDash Inc for further details.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10