ON Semiconductor Corp (NASDAQ:ON) reported better-than-expected fiscal first-quarter 2025 results on Monday.

The company reported a quarterly revenue decline of 22.4% year-on-year to $1.45 billion, topping the analyst consensus estimate of $1.40 billion. The adjusted EPS of $0.55 beat the analyst consensus estimate of $0.51.

“Our results in the first quarter reflect the disciplined approach we have maintained through this downturn – managing our cost structure, right-sizing our manufacturing footprint, and rationalizing our portfolio – enabling us to generate increased free cash flow. We are committed to long-term value creation and we are accelerating our capital return to shareholders while investing in our future growth,” said Hassane El-Khoury, president and CEO, onsemi. “We continue to see strong design win momentum, driven by the industry-leading performance of our products and have secured key wins with major global customers across all end-markets.”

ON Semiconductor expects second-quarter adjusted revenue of $1.40 billion—$1.45 billion, compared to the analyst consensus estimate of $1.42 billion. The company expects quarterly adjusted EPS of $0.48–$0.58 (above the analyst consensus estimate of $0.45) and an adjusted gross margin of 36.5%-38.5%.

ON Semiconductor shares dipped 8.4% to close at $38.41 on Monday.

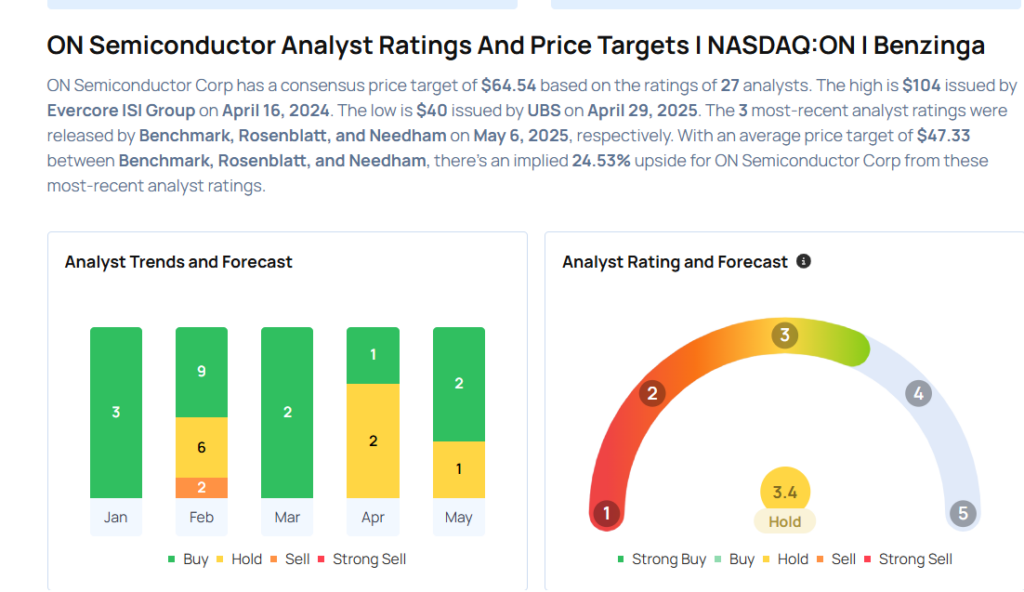

These analysts made changes to their price targets on ON Semiconductor following earnings announcement.

- Needham analyst Quinn Bolton maintained ON Semiconductor with a Buy and lowered the price target from $57 to $50.

- Benchmark analyst David Williams maintained ON Semiconductor with a Buy and lowered the price target from $60 to $50.

- Rosenblatt analyst Kevin Cassidy maintained the stock with a Neutral and maintained a $42 price target.

Considering buying ON stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Applied Materials Is An ‘Excellent’ Company, But Likes This Tech Stock More

Photo via Shutterstock