Theater chain, AMC Entertainment Holdings Inc. (NYSE:AMC), isn’t losing sleep over its rough first quarter, as it doubles down on its bold outlook for the full year.

What Happened: On Wednesday, during its first quarter earnings call, AMC’s CEO, Adam Aron, acknowledged the company’s grim start to the year, with box office collections dropping to their lowest for a non-COVID period since 1996.

“How slow was it? Really slow,” Aron said, referring to the period as a “distorting outlier,” rather than a long-term downtrend in demand for theatrical releases. He, however, remains upbeat with a strong outlook for the rest of this year.

“We continue to believe that movie-going demand in theaters for the balance of '25 and again, in all 2026 will show enormous strength,” Aron said, pointing to a packed slate of major studio releases slated for the summer and beyond, which he described as “barn burners, one after another.”

See More: iPod Creator Says Apple’s Hard-Edged Work Culture Beats Google’s ‘Take The Bus In For Lunch, Grab Yogurt, And Head Home’ Lifestyle

He says, “the tide has finally turned,” with box office collections during April and early-May having already doubled year-over-year, helping build momentum following a weak slate during the first quarter.

AMC now expects the 2025 domestic box office to land at the upper end of its prior forecast, potentially $500 million to $1 billion higher than last year.

Why It Matters: The company recently made major upgrades to its screens and movie viewing experience, in anticipation of the big lineup of popular movies in the coming months.

This included an IMAX Laser upgrade across 180 locations, making it IMAX’s biggest deal in the U.S. since 2018.

The company reported $862.5 million in revenue during its first quarter, down 9% year-over-year, while beating consensus estimates at $837.1 million. It posted a loss of $0.58 per share, which was once again ahead of estimates at $0.57 per share.

Price Action: The stock was up 0.93% on Wednesday, but is down 0.37% after hours following the company’s first quarter earnings release.

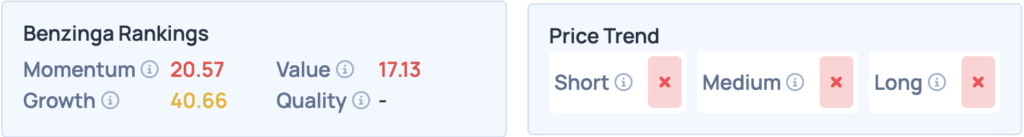

AMC’s stock scores low on Benzinga’s Edge Stock Rankings across most indicators. For more insights, sign up for Benzinga Edge.

Photo Courtesy: Colleen Michaels On Shutterstock.com

Read More:

- Bob Iger Admits Marvel Lost Focus By Making Too Much Content, Saying ‘Quantity Does Not Necessarily Beget Quality’ — Here’s What Disney Plans To Do Now