After Soaring 361% in Just 1 Year, Can Palantir Stock Keep Climbing? History Offers a Clear Answer.

-

Palantir Technologies has been one of the best-performing stocks in the S&P 500 and Nasdaq-100 over the last year.

-

While enthusiasm over Palantir's AI opportunities have driven its stock to new heights, investors should look closely at the company's valuation trends.

Over the last two years, artificial intelligence (AI) has come into focus as the next megatrend. In the capital markets, megacap technology stocks have attracted the lion's share of the attention and hype as it relates to the prospects of AI.

But some smaller players are proving they also can compete with big tech. I can't think of a better example of this than enterprise software developer Palantir Technologies (PLTR -1.49%), which has seen its stock soar by 361% over the past year (as of May 6).

While Palantir has become one of the most popular AI stocks, smart investors are wondering if the company's parabolic gains in share price can persist. Let's explore its valuation trends and compare these dynamics to share behavior around other important historical events in the technology sector. From there, it should become more clear which direction the stock could be headed.

Analyzing Palantir's valuation

In just one year, Palantir's market capitalization has risen from about $46 billion to more than $250 billion.

PLTR Market Cap data by YCharts.

As of this writing, the company's price-to-sales ratio (P/S) is about 91. Looking at that figure in isolation doesn't tell us too much, so let's consider it in the context of some notable examples from the tech sector's history.

Image Source: Getty Images.

How does Palantir's valuation trajectory compare to other notable tech giants throughout history?

A couple of months ago, my fellow Fool.com contributor Sean Williams wrote an astounding article referencing valuation trends during the dot-com bubble and the current AI revolution, and he subsequently indexed those results against Palantir.

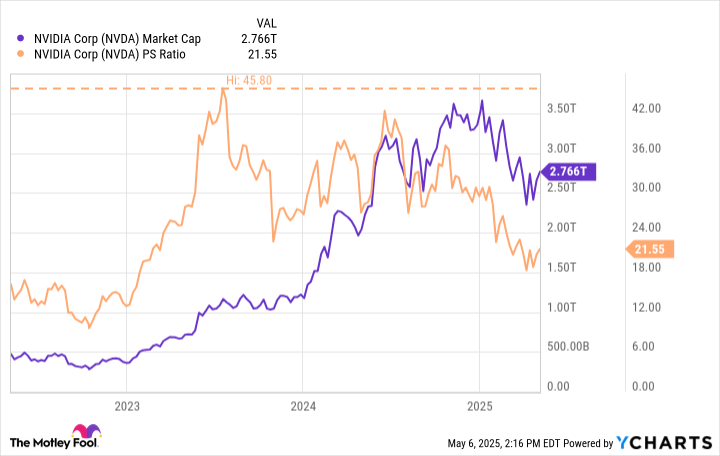

Prior to the dot-com crash, the price-to-sales ratios of hot names such as Cisco and Amazon peaked around 40. That's similar to what Nvidia has experienced throughout the AI boom -- its P/S ratio reached a record of 46 a couple of years ago.

Yes, Palantir's P/S is now more than double what some leading tech players have traded at during periods of pronounced stock market euphoria.

In that light, it's clear that Palantir's valuation is overstretched. But investors still need to consider what happened in the fallout from the dot-com boom and more recent trends in the AI arena to get a better understanding of where the stock may be headed.

What does history suggest will happen to Palantir stock?

As of this writing, Cisco, Amazon, and Nvidia trade at P/S multiples of 4.4, 3.1, and 21.6, respectively. At a high level, I think the historical context here strongly suggests that Palantir's valuation multiples could begin to compress significantly.

While such a notion might inspire some panic selling, I wouldn't encourage acting on that emotion. The reason I say that is because it is completely reasonable for valuation multiples to normalize over long time horizons. As companies mature, so do their valuation ratios. In other words, as sales and profits grow over time, so does the market value of the company -- hence, valuation multiples begin to smooth out.

CSCO Market Cap data by YCharts.

Moreover, just because valuation multiples begin to compress does not necessarily mean a company's market value will decline. Amazon is a much more valuable enterprise today than it was 26 years ago during the dot-com boom, when its multiples were peaking.

While Cisco's valuation never fully recovered, the company's current market cap of $236 billion is still far greater than it was during the mid-2000s. This underscores the idea that holding stocks for the long run (several years or even decades) can lead to outsize gains.

Furthermore, Nvidia's market cap is more than twice what it was just two years ago, when its P/S peaked at around 46.

NVDA Market Cap data by YCharts.

Is Palantir a buy right now?

One of the key differences between Palantir and the examples above is that I do not think the AI sector is in a bubble. I think Palantir's growth prospects now are much clearer than those of Cisco or Amazon during the dot-com era, thanks in large part to surging demand for AI software. While this suggests its long-run prospects are robust, I would still encourage investors to understand the opportunity cost of investing in the company at a historically high valuation.

Although history suggests that Palantir could well eclipse its current market value of $250 billion eventually, there is also quite a bit of evidence suggesting that it will be trading at more reasonable prices for new buyers at some point. For investors who want to build a position in it now, I think the best strategy to use would be dollar-cost averaging. And I'd say that to get the most out of that investment, they should be prepared to hold the stock for many years.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10