Dow drops 180 points as caution prevails ahead of U.S.-China talks 7 seconds ago

U.S. stocks erased their gains from earlier in the trading day, as traders became increasingly cautious ahead of trade talks between the U.S. and China.

Despite some positive news on the trade front, investors remain skeptical. On Friday, May 9, major U.S. stock indices were down across the board. The Dow Jones lost nearly 200 points or 0.48%, the S&P 500 fell 0.24%, while the tech-focused Nasdaq declined 0.19%.

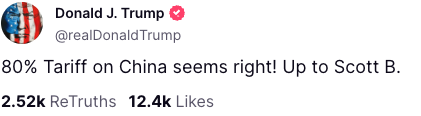

The markets are eagerly awaiting developments in trade talks between the U.S. and China. U.S. President Donald Trump signaled that he was prepared to lower tariffs on all Chinese goods to 80%. He added that the decision would ultimately be up to Treasury Secretary Scott Bessent.

While this rate remains prohibitively high for many exporters, it is lower than the previous 145% imposed earlier. More importantly, Trump’s rhetoric suggests a tone of de-escalation ahead of the crucial trade negotiations with China. The talks could help reduce reciprocal tariffs between the two countries, as China had retaliated with its own 125% tariff on U.S. goods.

Strategy, Palantir, among the biggest losers, gold gains

Among tech stocks, Palantir was among the worst performers, down 2.23% today. The stock is set to close the week down 5% as investors reassess its high valuation. Notably, on Tuesday, its shares dropped 12%, losing 35 million in market cap due to a drop in quarterly earnings.

Interestingly, shares of Strategy, a leveraged Bitcoin investment firm, were also down 1.78% since market open. This is despite Bitcoin (BTC) posting a 1.23% increase over the last 24 hours and a 5% increase over seven days.

On the other hand, bearish sentiment in the stock market prompted many traders to increase their gold exposure. The precious metal was up 1.16%, reaching $3,344 per ounce.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10