Multinational retailer Walmart Inc.‘s (NYSE:WMT) e-commerce businesses turned profitable for the first time in the U.S. and globally during the first quarter of the ongoing fiscal year despite looming tariff uncertainties.

What Happened: CEO Doug McMillon expressed optimism over the company’s e-commerce initiatives during the earnings call and highlighted that it’s not only serving its customers and members but also making their business more profitable with higher returns over time.

“We achieved eCommerce profitability, both in the U.S. as well as for the global enterprise in Q1 for the first time, an important milestone for our company,” he said.

Globally, Walmart’s e-commerce business grew by 22%, with each segment delivering growth of at least 20%.

The three segments of its e-commerce businesses encompassed growth from Walmart U.S., Walmart International, and its Sam’s Club U.S. businesses.

“We’re encouraged by the fact that eCommerce growth across all three segments continues to be strong, all three segments growing more than 20%,” added McMillon.

Meanwhile, while addressing the tariff issue, he thanked President Donald Trump and Treasury Secretary Scott Bessent for the progress made recently. He hoped for a longer-term agreement with China amid the ongoing 90-day pause.

However, he added that “We will do our best to keep our prices as low as possible. But given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins.”

“All of the tariffs create cost pressure for us, but the larger tariffs on China have the biggest impact,” explained McMillon.

See Also: Warren Buffett Shows How Patience Pays: 98% Of His $160 Billion Wealth Came After Turning 65, Thanks The Power Of ‘Compound Interest’

Why It Matters: Walmart’s first-quarter revenue marginally missed the analyst consensus estimate of $165.88 billion and came in at $165.60 billion, higher by 2.5% year-on-year.

It reported adjusted EPS of 61 cents, beating the consensus estimate of 58 cents.

Walmart anticipates second-quarter fiscal year 2026 sales to increase by 3.5% to 4.5% on a constant currency basis, projecting revenues between $173.67 billion and $175.35 billion. This range falls slightly below the consensus estimate of $175.21 billion.

Shares of WMT fell 0.50% on Thursday. However, the stock was up 7.06% on a year-to-date basis and 50.52% higher over a year.

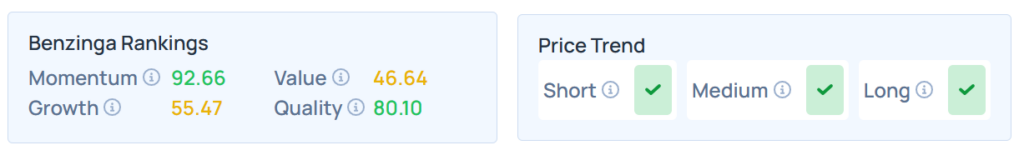

Benzinga Edge Stock Rankings shows that WMT had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid at the 92.66th percentile, whereas its value ranking was moderate at the 46.64th percentile; the details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher on Thursday. The SPY was up 0.49% to $590.46, while the QQQ advanced 0.11% to $519.25, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Dow Jones and Nasdaq 100 indices were trading flat.

Read Next:

- Gordon Johnson Warns Of Potential ‘Liberation Day 2.0’ As 30-Year Treasury Yields Approach 5% Amid Dollar Weakness

image via shutterstock