Coinbase Witnesses Unusual $35 Million Ethereum (ETH) Whale Activity

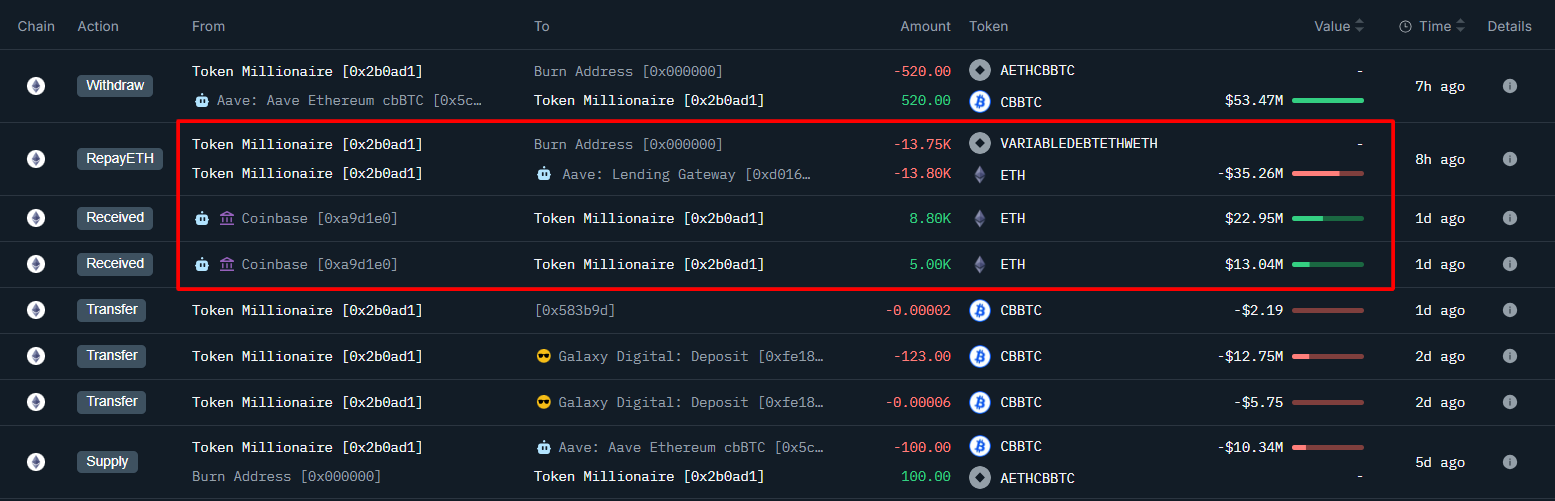

An unidentified wallet made a major on-chain move by withdrawing 13,800 ETH from the leading cryptocurrency exchange in the U.S., Coinbase. Based on current prices, this withdrawal is the equivalent of $35.26 million. Soon after, the same address repaid a portion of its outstanding ETH loan on Aave.

The wallet, labeled "0x2b0aD," used the funds to repay variable-rate Ethereum debt borrowed against cBTC, a version of Bitcoin wrapped on the Coinbase platform. The blockchain data shows that 13,750 ETH of the loan token was burned and about 13,800 ETH were sent back to Aave’s lending pool.

However, this repayment is only partial. Having sent back a large amount of ETH, the wallet still has an open debt of 32,377.6 WETH, valued at around $82.61 million.

Whether this move signals a wider deleveraging strategy or a short-term adaptation will become clearer over time. Either way, it reduces the account’s exposure and improves its collateral position, possibly as a way to manage volatility or prepare for further changes in the market.

The price of Ethereum has been fluctuating around the $2,600 level, displaying some recovery momentum in recent days. So has the ETH/BTC pair, though it remains in a longer-term downtrend. What motivates this whale’s activity - price expectations or internal portfolio rebalancing - is still unknown.

So far, no further movement has been made by the wallet.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10