Dynatrace, Inc. (NYSE:DT) posted better-than-expected fourth-quarter earnings and issued strong guidance on Wednesday.

The company reported quarterly revenue growth of 17% year-over-year to $445.17 million, beating the analyst consensus estimate of $434.78 million. Adjusted EPS was 33 cents, up from 30 cents, beating the analyst consensus estimate of 30 cents.

Dynatrace expects revenue of $465.00 million-$470.00 million (analyst consensus $454.51 million). Dynatrace expects adjusted EPS of $0.37-$0.38 (consensus estimate $0.35).

For 2026, Dynatrace expects revenue of $1.950 billion-$1.965 billion versus the analyst consensus of $1.940 billion. ARR is expected to be $1.975 billion-$1.990 billion. Dynatrace expects adjusted EPS of $1.56-$1.59 versus the consensus estimate of $1.54.

Dynatrace shares fell 1.6% to trade at $52.63 on Thursday.

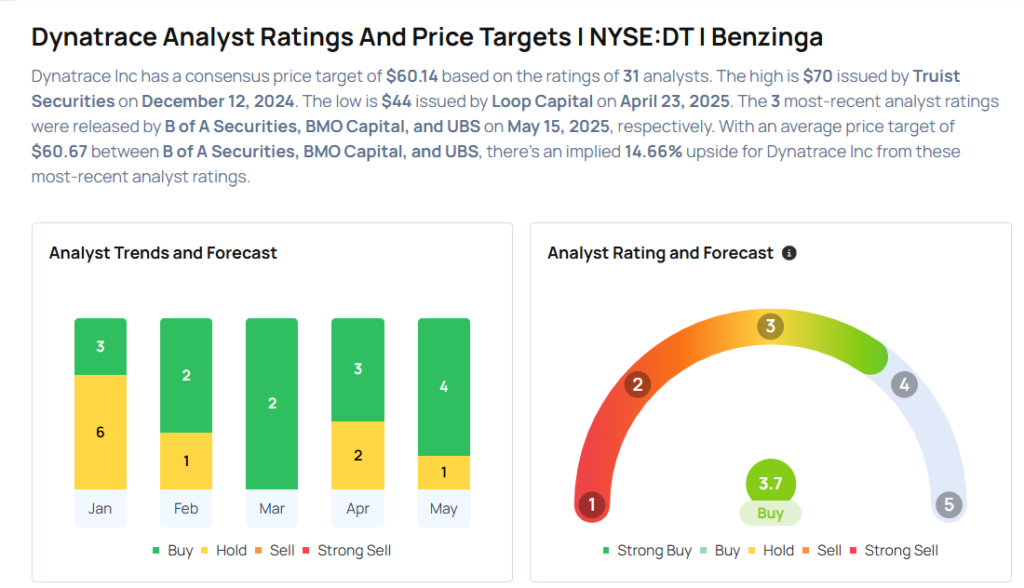

These analysts made changes to their price targets on Dynatrace following earnings announcement.

- Barclays analyst Raimo Lenschow maintained Dynatrace with an Overweight rating and raised the price target from $55 to $62.

- UBS analyst Karl Keirstead maintained the stock with a Neutral and raised the price target from $50 to $55.

- BMO Capital analyst Keith Bachman maintained Dynatrace with an Outperform rating and raised the price target from $60 to $63.

- B of A Securities analyst Koji Ikeda maintained the stock with a Buy and raised the price target from $62 to $64.

Considering buying DT stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: SoFi Goes To ‘New Highs,’ Recommends Not Buying This Health Care Stock

Photo via Shutterstock