Intuit Inc. (NASDAQ:INTU) reported stronger-than-expected third-quarter financial results and raised its full-year guidance on Thursday.

Intuit reported third-quarter revenue of $7.75 billion, beating analyst estimates of $7.56 billion, according to Benzinga Pro. The QuickBooks and TurboTax parent company reported third-quarter adjusted earnings of $11.65 per share, beating analyst estimates of $10.91 per share.

"We have exceptional momentum with outstanding performance across our platform. We're redefining what's possible with AI by becoming a one-stop shop of AI-agents and AI-enabled human experts to fuel the success of consumers and small and mid-market businesses," said Sasan Goodarzi, CEO of Intuit.

Intuit said it expects fourth-quarter revenue of $3.72 billion to $3.76 billion versus estimates of $3.76 billion. The company sees third-quarter adjusted earnings in the range of $2.63 to $2.68 per share versus estimates of $2.59 per share.

Intuit also raised its full-year guidance. The company expects full-year 2025 revenue of $18.72 billion to $18.76 billion, up from prior guidance of $18.16 billion and $18.35 billion. The company anticipates full-year earnings of $20.07 to $20.12 per share, up from prior guidance of $19.16 to $19.36, Analysts are currently looking for full-year revenue of $18.35 billion and full-year adjusted earnings of $19.34 per share, per Benzinga Pro.

Intuit shares gained 8.8% to trade at $721.19 on Friday.

These analysts made changes to their price targets on Intuit following earnings announcement.

- Piper Sandler analyst Arvind Ramnani reiterated Intuit with an Overweight rating and raised the price target from $785 to $825.

- Jefferies analyst Brent Thill maintained the stock with a Buy and raised the price target from $735 to $850.

- Evercore ISI Group analyst Kirk Materne maintained Intuit with an Outperform rating and raised the price target from $685 to $785.

- JP Morgan analyst Mark Murphy maintained the stock with an Overweight rating and raised the price target from $660 to $770.

- Keybanc analyst Alex Markgraff maintained Intuit with an Overweight rating and raised the price target from $770 to $850.

- Morgan Stanley analyst Keith Weiss maintained the stock with an Overweight rating and raised the price target from $720 to $785.

- Barclays analyst Raimo Lenschow maintained Intuit with an Overweight rating and raised the price target from $775 to $815.

- Stifel analyst Brad Reback maintained the stock with a Buy and raised the price target from $725 to $850.

- BMO Capital analyst Daniel Jester maintained Intuit with an Outperform rating and raised the price target from $714 to $820.

- RBC Capital analyst Rishi Jaluria maintained the stock with an Outperform rating and raised the price target from $760 to $850.

- Citigroup analyst Steven Enders maintained Intuit with a Buy and raised the price target from $726 to $789.

- UBS analyst Taylor McGinnis maintained the stock with a Neutral and raised the price target from $720 to $750.

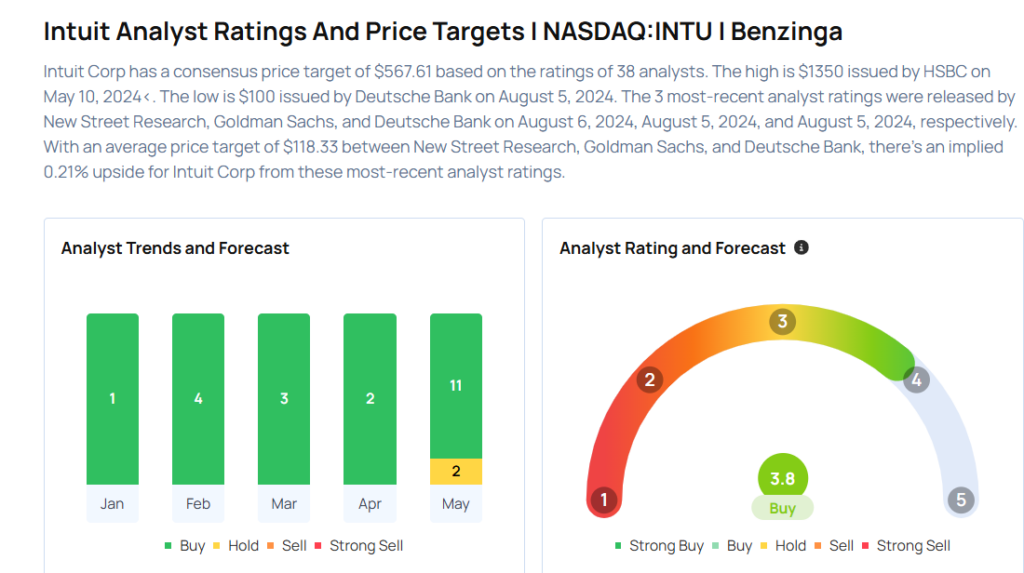

Considering buying INTU stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Medical Properties Trust Has ‘Too Much Risk,’ Likes This Industrial Stock

Photo via Shuterstock