Ralph Lauren Corporation (NYSE:RL) reported better-than-expected fourth-quarter financial results on Thursday.

The luxury fashion company reported sales growth of 8% year-on-year (Y/Y) to $1.70 billion, beating the analyst consensus estimate of $1.64 billion. Adjusted EPS of $2.27 beat the consensus estimate of $2.00.

Patrice Louvet, President and Chief Executive Officer, said, "As we enter Fiscal 2026, we remain on offense — with a focus on driving our multiple engines of growth across lifestyle categories, geographies, and channels. At the same time, we will stay agile and prudent — leaning into our diversified supply chain, operating discipline, and strong balance sheet as we manage through ongoing macroeconomic uncertainty."

On a constant currency basis, the company projects revenue growth of around single digits for the first quarter compared to the same period last year.

For FY26, Ralph Lauren anticipates revenue growth in the low-single digits compared to the previous year on a constant currency basis, with most of this growth expected to occur in the first half of the fiscal year.

Ralph Lauren shares fell 1.4% to $273.58 on Friday.

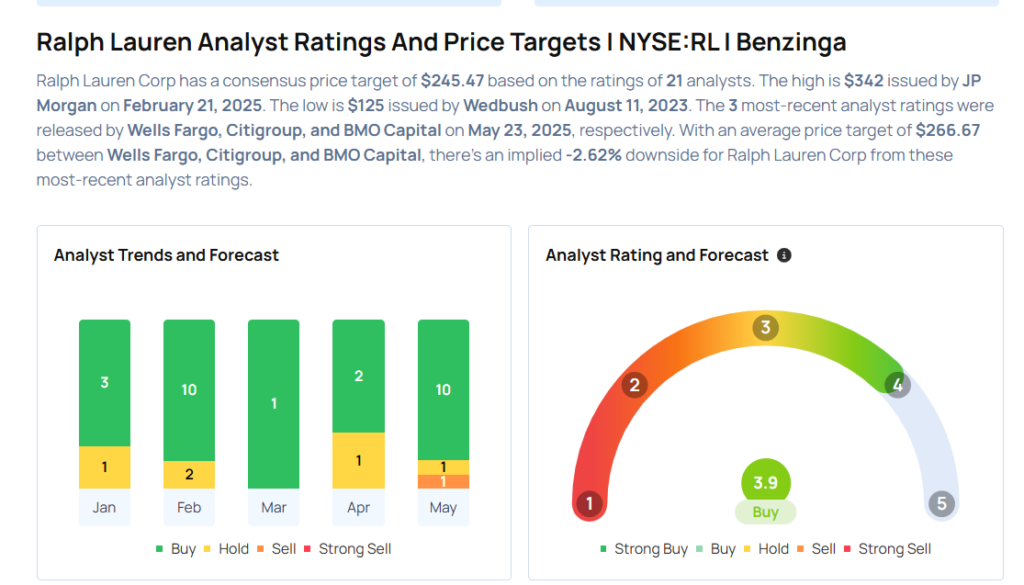

These analysts made changes to their price targets on Ralph Lauren following earnings announcement.

- Jefferies analyst Ashley Helgans maintained Ralph Lauren with a Buy and raised the price target from $250 to $328.

- Barclays analyst Adrienne Yih maintained the stock with an Overweight rating and raised the price target from $260 to $321.

- BMO Capital analyst Simeon Siegel maintained Ralph Lauren with an Underperform rating and raised the price target from $197 to $205.

- Citigroup analyst Paul Lejuez maintained the stock with a Neutral and raised the price target from $250 to $295.

- Wells Fargo analyst Ike Boruchow maintained Ralph Lauren with an Overweight rating and raised the price target from $275 to $300.

Considering buying RL stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Medical Properties Trust Has ‘Too Much Risk,’ Likes This Industrial Stock

Photo via Shutterstock