TradingKey - Before and after returning to the White House, U.S. President Donald Trump has strongly advocated for tax cuts and tariffs as part of his “Make America Great Again” (MAGA) agenda — aiming to make the U.S. wealthier, revive manufacturing, and boost economic growth.

Despite the loud rhetoric and clear objectives, Trump’s fiscal policies under his Trump 2.0 administration have faced mounting resistance and criticism. In addition to widespread discontent over high tariffs aimed at boosting federal revenue, Trump’s so-called “One Big, Beautiful Bill Act” has not only drawn fierce opposition from Democrats but also deep internal divisions within the Republican Party.

The core of Trump’s tax and spending plan centers around two controversial pillars: tax cuts and welfare spending reductions. The former aims to increase disposable income and stimulate economic activity, while the latter is intended to offset the fiscal costs of tax cuts — a long-standing Republican policy stance.

However, key questions remain: Does the U.S. still have room for further tax cuts amid its massive fiscal deficit? Will adjustments to the State and Local Tax (SALT) cap truly benefit ordinary Americans or merely enrich the wealthy? Can Congress and society accept the welfare cuts? And most importantly — will the U.S. fiscal deficit and Treasury market stability continue to deteriorate?

What Are the Key Components of the Trump 2.0 Tax Bill?

Broadly speaking, Trump’s tax and spending legislation includes personal and corporate tax cuts, social welfare reforms, immigration restrictions, education policy changes, energy policy shifts, increased defense budgets, and debt ceiling adjustments.

Policy | Description |

Personal & Corporate Tax Cuts | Make 2017 tax cuts permanent; eliminate taxes on tips, overtime pay, and auto loan interest; raise SALT deduction limits; offer tax benefits for small businesses |

Social Welfare Reform | Cuts to Medicare; impose work or education requirements for Medicaid access; cut federal food assistance programs |

Immigration Restrictions | Fund construction of the U.S.-Mexico border wall; charge fees for asylum seekers |

Education Policy Reform | Increase tax rates on university endowment earnings; encourage private schooling or homeschooling through tax incentives |

Energy Policy Shifts | Eliminate EV tax credits; promote traditional energy development |

Defense Budget Expansion | Allocate an additional$150 billionfor the "Golden Dome" defense initiative |

Debt Ceiling Adjustment | Current debt limit already reached; Treasury’s extraordinary measures expected to expire byAugust 2025 |

Source: TradingKey compilation based on AP News and official documents

On May 21, 2025 , the House Republican leadership finalized a revised version of the 1,100-page “Beautiful Big Bill” after more than 20 hours of negotiations. Key revisions include:

- Higher SALT deduction limits

- Tighter Medicaid work requirements

- Earlier phase-out of green energy tax credits

- Reduced federal employee retirement benefits

SALT Cap – Widening Wealth Gap?

While lowering taxes for citizens is generally seen as positive, one provision in Trump’s tax plan has sparked intense debate — the adjustment to the SALT cap .

The SALT cap refers to the maximum amount of state and local taxes (such as income tax, sales tax, and property tax) that taxpayers can deduct from their federal taxable income. A higher SALT cap means lower federal tax burdens.

1. Does the SALT Deduction Widen Income Inequality?

Under the current version of the bill, Republicans plan to raise the SALT cap from $10,000 to $40,000 for individuals earning under $500,000 , with a projected annual 1% increase over the next decade.

Research shows that about 90% of those benefiting from the SALT deduction are high-income earners. Experts from the Tax Foundation note that only a small portion of taxpayers (around 5 million) itemize deductions — meaning only a minority actually benefit from the current $10,000 cap.

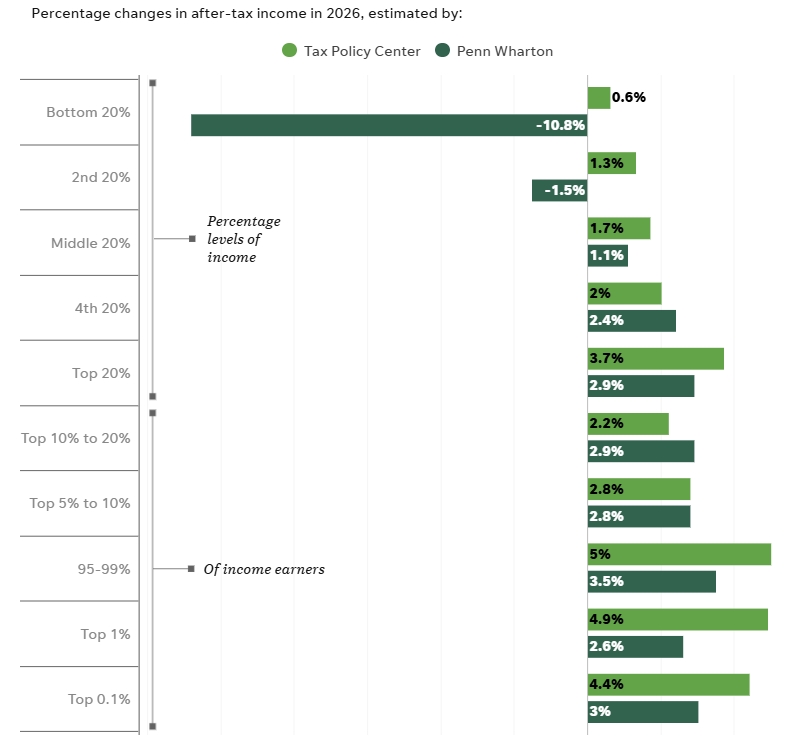

According to the nonpartisan Congressional Budget Office (CBO) , Trump’s tax plan would redistribute more government resources to families — but in a highly uneven way. It projects that income for the bottom 10% of households would fall , while income for the top 10% would rise significantly.

The CBO labeled this potential outcome as the largest wealth transfer from poor to rich in U.S. legislative history .

Impact of Trump's Tax Bill on Different Income Groups, Source: USA Today, Tax Policy Center, Penn Wharton

2. Democratic Opposition and Republican Division

Democrats oppose the large-scale tax reform package — not only due to partisan politics, but also because they argue it would worsen income inequality.

Within the Republican Party, there is a sharp divide between fiscal hawks and lawmakers from high-tax states like New York and New Jersey.

Fiscal conservatives worry that raising the SALT cap contradicts the goal of targeting middle- and low-income groups and could further widen budget deficits.

In contrast, lawmakers from high-tax states want even higher caps — some proposing increases up to $750,000 — to serve their constituents, who are often affluent homeowners and taxpayers who benefit most from SALT deductions.

Trump has reportedly grown frustrated with the internal GOP disputes over SALT cap.

Medicaid Cuts – 14 Million Americans at Risk

Although Trump promised during the 2024 campaign not to cut healthcare programs, his administration may be forced to reduce spending to offset the cost of sweeping tax cuts.

The CBO estimates that Trump’s tax plan would result in $500 billion in Medicare cuts from FY2026 to FY2034 , saving nearly $800 billion over a decade — but also stripping 7.6 million people of Medicaid coverage and 1.4 million losing health insurance .

House Minority Leader Hakeem Jeffries condemned the plan as stripping healthcare from nearly 14 million Americans and depriving millions of children and seniors of food assistance — calling any alternative narrative deliberate deception.

Some lawmakers have warned that these Medicaid cuts are both morally indefensible and politically suicidal.

Revenue Up, Spending Down? Not Likely – Fiscal Deficit Still Out of Control

Against the backdrop of record-high U.S. fiscal deficits and soaring Treasury debt, economists and policymakers are deeply concerned about Trump’s tax plan.

Although Trump claims to pursue both revenue enhancement and spending reduction, most analyses suggest the U.S. will still face growing budget shortfalls — with rising deficit-to-GDP ratios and increasing debt levels.

Fiscal Revenue Challenges:

- Trump’s main tool for boosting revenue is raising tariffs , but tariff revenue accounts for only a small share of total federal income and faces retaliation from trade partners.

- He also hopes to use tariffs as leverage to negotiate better trade deals for U.S. industries.

Fiscal Spending Challenges:

- Elon Musk-led DOGE has tried to cut federal spending, but savings have fallen far short of expectations.

- Cutting EV tax credits, reducing Medicaid and food aid, and slashing international organization funding has triggered widespread backlash.

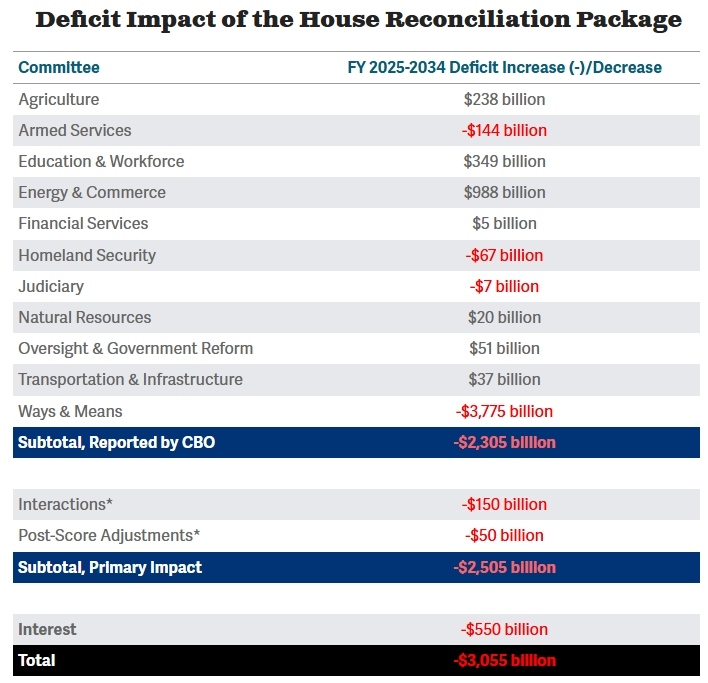

According to the Joint Committee on Taxation (JCT) , Trump’s plan would add $3.8 trillion to the deficit by 2034 — equivalent to 1.1% of GDP. If all expiring provisions were made permanent, the deficit could swell to $5.3 trillion .

The CBO projects a $2.3 trillion increase in the deficit over ten years, while the CRFB estimates a $3.1 trillion increase.

Projected U.S. Fiscal Deficit Breakdown Over Next Decade, Source: CRFB

Deutsche Bank recently reported that the Trump administration appears to have taken no serious steps to rein in historically high deficits — projecting that deficits will remain above 6% of GDP for years to come.

Market Reaction to Trump’s Push for Tax Cuts

As the Republican Party pushes forward with the “Beautiful Big Bill,” Wall Street institutions have raised red flags over U.S. fiscal and financial markets — and investors have responded with a broad-based selloff across stocks, bonds, and the dollar .

Amid concerns over worsening U.S. fiscal conditions — particularly rising interest costs and aggressive stimulus plans — Fitch Ratings stripped the U.S. of its last AAA sovereign credit rating in mid-May.

This downgrade dealt a blow to U.S. Treasuries and further eroded confidence in dollar assets — as evidenced by the weak demand in the subsequent 20-year Treasury auction .

Overall, capital markets have adopted a cautious stance toward the tax bill. On one hand, concerns over Treasury demand and the “sell America” sentiment need to be monitored for signs of renewed market panic. On the other hand, following the first wave of tariff shocks, markets are watching whether the tax bill will trigger similar responses — such as the temporary suspension of reciprocal tariffs — offering a so-called “Trump Put” to ease deficit fears.

Find out more