Zoom Communications Inc. (NASDAQ:ZM) reported stronger-than-expected earnings for its first quarter after Wednesday's closing bell.

Zoom reported quarterly earnings of $1.43 per share which beat the analyst consensus estimate of $1.31. Quarterly revenue came in at $1.17 billion which met the Street estimate.

"We delivered another solid quarter, exceeding guidance in both revenue and profitability — a testament to the strength of our platform and AI-first innovation," said Eric S. Yuan, Zoom's CEO. "In an uncertain macro-economic environment, customers are turning to Zoom to drive efficiency, improve customer and employee experiences, and future-proof their businesses."

Zoom also raised its fiscal 2026 adjusted EPS guidance from $5.34 to $5.37 to $5.56 to $5.59, versus the $5.41 analyst estimate, and raised its revenue outlook from a range of $4.79 billion to $4.79 billion to a new range of $4.8 billion to $4.81 billion, versus the $4.79 billion estimate.

Zoom shares fell 1.5% to trade at $81.03 on Thursday.

These analysts made changes to their price targets on Zoom following earnings announcement.

- Rosenblatt analyst Catharine Trebnick maintained Zoom Communications with a Buy and raised the price target from $90 to $100.

- Morgan Stanley analyst Meta Marshall maintained the stock with an Equal-Weight rating and raised the price target from $79 to $85.

- Wells Fargo analyst Michael Turrin maintained Zoom with an Equal-Weight rating and boosted the price target from $75 to $80.

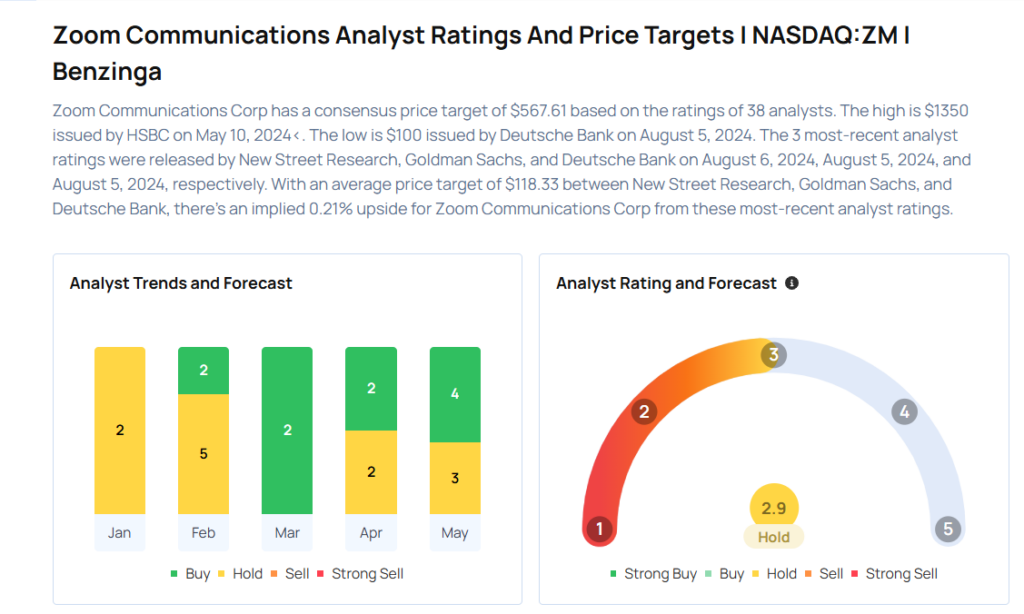

Considering buying ZM stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock

Photo via Shutterstock