Wix.com Analysts Slash Their Forecasts After Q1 Results

Wix.com Ltd (NASDAQ:WIX) reported mixed results for its fiscal first quarter on Wednesday.

The quarterly revenue grew 13% year-over-year to $473.7 million, topping the analyst consensus estimate of $472.9 million. Adjusted EPS of $1.55 missed the analyst consensus estimate of $1.60.

Wix.com reiterated fiscal 2025 revenue outlook of $1.97 billion to $2 billionversus the analyst consensus estimate of $2.02 billion and bookings of $2.03 billion to $2.06 billion. This company said this outlook reflects conservatism due to macro uncertainty, specifically the Business Solutions segment, with potential volatility offset by fully dissipating foreign exchange headwinds.

Lior Shemesh, CFO at Wix, said, "Our strong first quarter results demonstrate the critical value of the Wix platform to anyone and everyone requiring an online presence globally amid an ever-evolving macro environment, particularly SMBs. Top of funnel demand was very strong with Q1'25 new user cohort bookings finishing 12% higher than the bookings generated by the Q1'24 cohort in its first quarter."

Wix.com shares gained 3.1% to trade at $157.06 on Thursday.

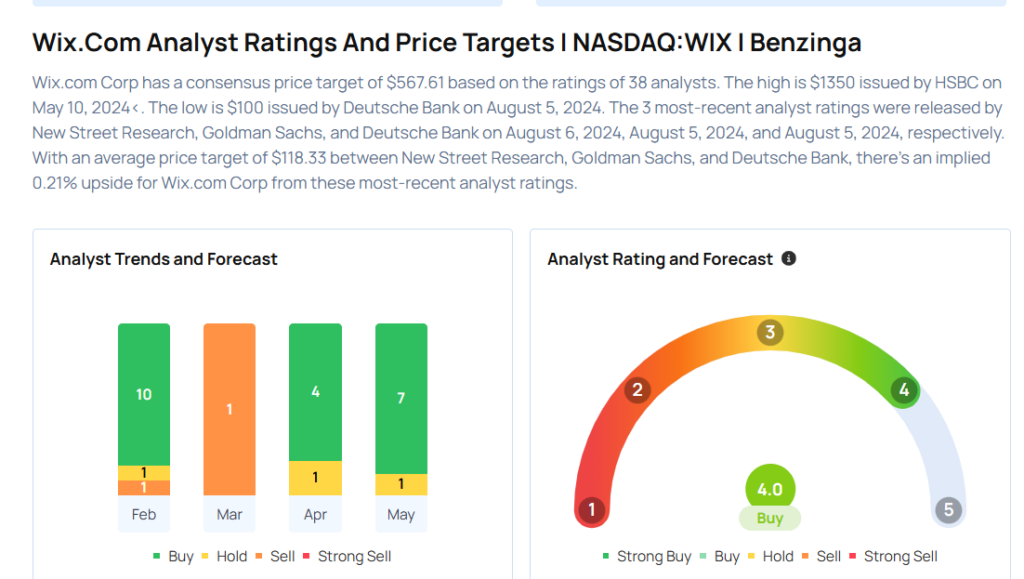

These analysts made changes to their price targets on Wix.com following earnings announcement.

- Piper Sandler analyst Clarke Jeffries maintained Wix.com with an Overweight rating and lowered the price target from $262 to $225.

- Benchmark analyst Mark Zgutowicz maintained the stock with a Buy and lowered the price target from $245 to $230.

- Wells Fargo analyst Alec Brondolo maintained Wix.com with an Equal-Weight rating and lowered the price target from $176 to $173.

- UBS analyst Chris Zhang maintained the stock with a Buy and slashed the price target from $255 to $230.

Considering buying WIX stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock

Photo via Shutterstock

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10