V.F. Corporation (NYSE:VFC) reported mixed fourth-quarter results on Wednesday.

The company reported quarterly adjusted earnings per share of 13 cents loss, beating the street view of 14 cents loss. Quarterly sales of $2.14 billion (down 5% year over year) missed the analyst consensus estimate of $2.18 billion.

"The transformation of VF is well underway," said Bracken Darrell, president and CEO. "In FY25, we achieved our goals to lower our cost base and strengthen our balance sheet. We delivered on our initial target of $300 million gross cost savings and are on track towards our medium-term targets of $500 to $600 million net operating income expansion."

VF Corp said it expects first-quarter revenue to decline 3% to 5% year over year, with an adjusted operating loss between $110 million and $125 million.

VF Corp shares fell 0.7% to trade at $12.06 on Thursday.

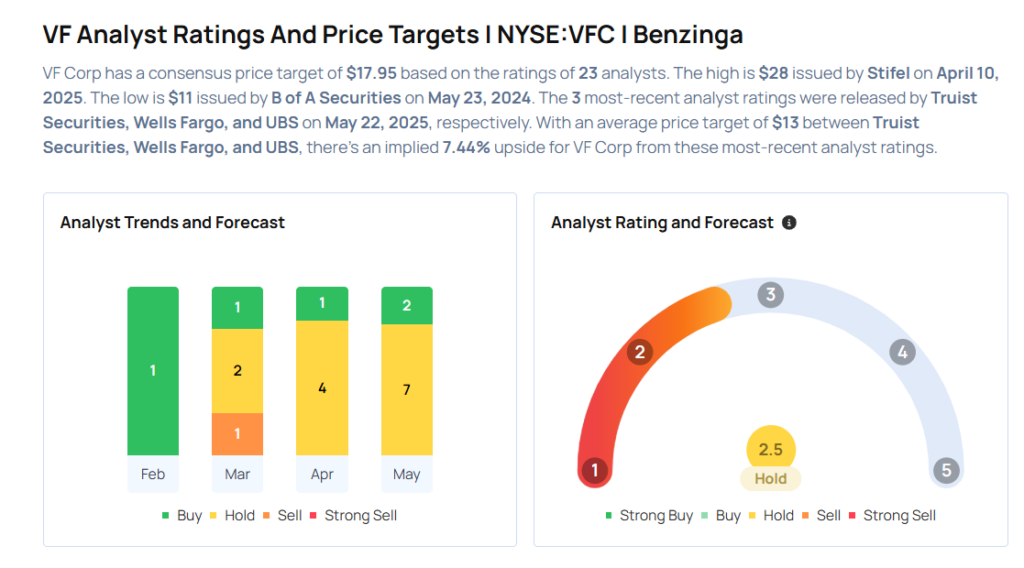

These analysts made changes to their price targets on VF Corp following earnings announcement.

- UBS analyst Jay Sole maintained VF with a Neutral and lowered the price target from $16 to $14.

- Wells Fargo analyst Ike Boruchow maintained the stock with an Equal-Weight rating and lowered the price target from $13 to $12.

- Truist Securities analyst Joseph Civello maintained VF with a Hold and lowered the price target from $24 to $13.

Considering buying VFC stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock

Photo via Shutterstock