As housing affordability reaches a critical point, homebuilding company Toll Brothers Inc. (NYSE:TOL) CEO Douglas Yearley gave insights about the customer base during the second-quarter earnings call on Wednesday.What Happened: Yearly said, “Over 70% of our business serves the move-up and empty-nester segments.” He revealed that “these buyers are wealthier, have greater financial flexibility, and most have equity in their existing homes,” highlighting the affluence of Toll’s average buyer.

According to the company, the average price of homes in its backlog has climbed to $1.13 million, a record high, and on top of the base pricing, buyers spent an additional $200,000 on upgrades.

See Also: Tesla Bull Dan Ives Thinks Elon Musk’s EV Giant Could Be Entering A ‘Golden Era,’ Says 2 Trillion Market Cap ‘On The Table’

“The average spend on design studio selections, structural options, and lot premiums was approximately $200,000 per home in Q2,” Yearley said, “these upgrades benefit our margins as they tend to be highly accretive.”

When asked about mortgage rates and their impact on the business, Yearley said, “a little tick in mortgage rate” doesn’t affect the company’s clientele all that much. This is because 24% of its buyers pay in cash, and even those who rely on financing have an average loan-to-value ratio of just 70%.

Yearley also added that “a good part of the 30% of first-time buyers we sell to are getting some help from mom and dad with generational wealth transfer,” underscoring the financial strength of its core customer base.

Despite the recent softness in housing demand, Toll reaffirmed full-year guidance and raised its stock buyback target to $600 million.

Why It Matters: This comes at a time when the U.S. is experiencing a housing affordability crisis, with buyers having to spend 42.4% of their monthly income to make payments on their homes, according to John Burns Research & Consulting, underscoring the sharp divide between the entry-level and luxury housing segments.

When accounting for U.S. incomes, U.S. home prices, mortgage rates, property taxes, and home-insurance, U.S. housing affordability is at its most strained level in nearly four decades—only exceeded by the early 1980s, when mortgage rates briefly topped 18%via @JBREC pic.twitter.com/4s3ukWIg5G

— Lance Lambert (@NewsLambert) May 17, 2025

Lance Lambert, the co-founder of the ResidentialClub newsletter, shared the Burns Affordability Index chart on X, highlighting that housing affordability is at its “most strained level in nearly four decades,” and is only exceeded by the early 1980s, when mortgage rates touched 18%.

Recently, BMO Bank said in a report that “the financial hurdles to owning a home have rarely been higher, especially for young households that don't yet have their foot in the door,” highlighting the fact that the median first-time homebuyer age reached 38 last year.

During its second quarter results on Tuesday, Toll Brothers reported $2.71 billion in revenue, beating consensus estimates of $2.48 billion. It posted a profit of $3.50 per share, significantly ahead of estimates at $2.92 per share.

Price Action: Toll Brothers shares were down 0.48% on Wednesday, trading at $104.01 per share, and are up 0.09% after hours.

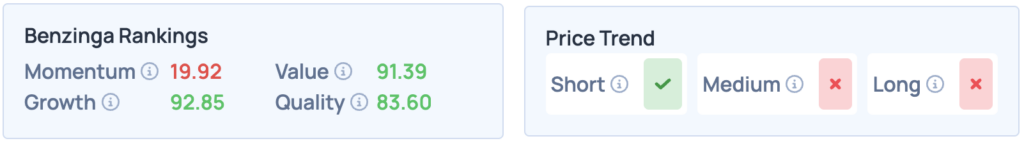

According to Benzinga’s Edge Stock Rankings, Toll Brothers scores well across the board, except for Momentum. It has a favorable price trend in the short term, but lags in the medium and long term. Click here for deeper insights into the stock.

Photo Courtesy: Andy Dean Photography on Shutterstock.com

Read More:

- Jim Cramer Says Bonds Will ‘Overshoot And Then Settle,’ Predicts Turbocharged Economy From Budget Agreement