Crypto Expert Chris Burniske Highlights Favorable Market Conditions

- Chris Burniske's remarks stabilize crypto market sentiment post-pullback.

- Favorable conditions could benefit long-term investors.

- Solana seen potentially outperforming Bitcoin and Ethereum.

Chris Burniske emphasizes the crypto market's favorable dynamics amid recent pullbacks impacting Bitcoin and other assets.

Chris Burniske, a partner at Placeholder, addressed market sentiments on May 30 concerning a crypto market pullback. Sharing his insights on social media, Burniske suggested the market's current state should not be confused with a downturn. His confidence remained robust, supported by his previous bullish statements highlighting favorable conditions for investing in crypto, particularly in Solana. Placeholder is actively involved with major blockchain projects, although no new funding was announced alongside his comments.

Crypto Expert Chris Burniske Highlights Favorable Market Conditions

Chris Burniske, a partner at Placeholder, addressed market sentiments on May 30 concerning a crypto market pullback. Sharing his insights on social media, Burniske suggested the market's current state should not be confused with a downturn. His confidence remained robust, supported by his previous bullish statements highlighting favorable conditions for investing in crypto, particularly in Solana. Placeholder is actively involved with major blockchain projects, although no new funding was announced alongside his comments.

The market conditions he described suggest a potential for continued growth. His comments reinforce the notion that Bitcoin, Ethereum, and Solana stand to benefit. Placeholder's strategic focus remains on developing core networks, mirroring Burniske's optimism.

"Loving where the market is right now. BTC is making PTSD people fear a precipice when it’s already filled the liquidation wick and fell as far as ~15% from its recent highs. ... The setup is sweet for our entry into 2025. … if you’re a long-term investor with conviction, you should be salivating." — Chris Burniske, Partner, Placeholder

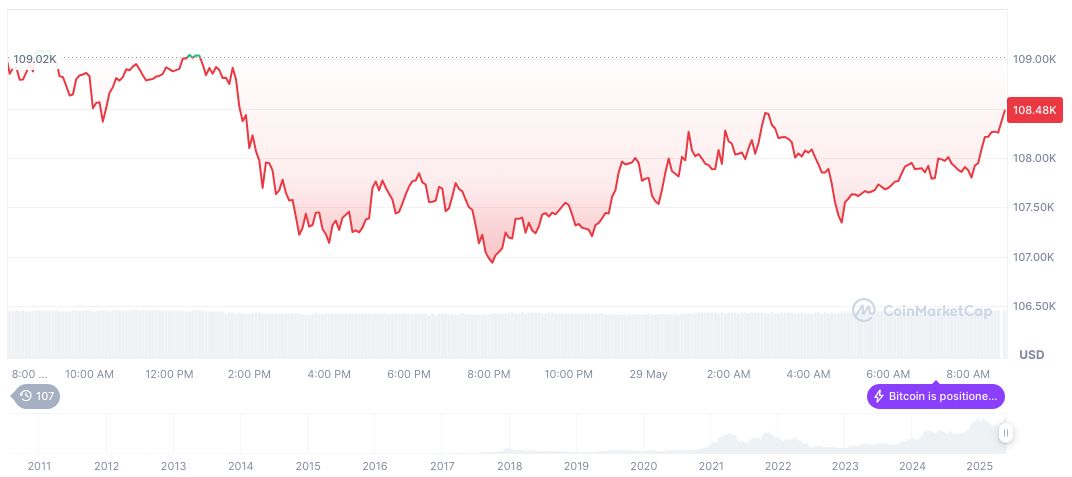

Bitcoin Dips Yet Shows Long-Term Recovery Potential

Did you know? The cryptocurrency market has experienced multiple cycles of boom and bust, often influenced by regulatory news and technological advancements.

Bitcoin (BTC) traded at $105,981.87, with a market cap reaching 2,106,052,808,253, according to CoinMarketCap. Despite a 1.89% decline in 24-hours, Bitcoin maintained a market dominance of 62.95%. It experienced a 7-day price drop of 4.94% but noted increases over the past 30 and 60 days. The circulating supply stood at 19,871,821 as of May 30, 2025.

Coincu research highlights the potential for new technological innovations and infrastructure improvements in key blockchain ecosystems. Experts anticipate regulatory shifts could arise, enhancing framework stability, thereby affecting long-term adoption strategies. The favorable market view suggested by Burniske affirms the resilience of quality assets in ongoing cycles.

Read original article on coincu.com免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10