The Toro Company (NYSE:TTC) reported mixed results for its second quarter and lowered its full-year guidance on Thursday.

The company said second-quarter fiscal 2025 sales decreased 2% year-over-year (Y/Y) to $1.32 billion on Thursday, missing the consensus of $1.35 billion. Adjusted EPS of $1.42 (+1% Y/Y) beat the consensus of $1.40.

Toro lowered its guidance for FY25 adjusted EPS from $4.25-$4.40 to $4.15-$4.30, compared to the consensus of $4.31. The company now sees an FY25 net sales growth outlook of flat to -3%, compared to 0% to 1 % earlier.

Richard M. Olson, chairman and chief executive officer said, "We are taking decisive steps to strategically position the company to navigate near-term headwinds. Our strong portfolio and disciplined execution continue to sustain our performance, and we remain confident in our ability to manage controllable factors while mitigating macroeconomic risks."

Toro shares dipped 6.5% to trade at $68.51 on Friday.

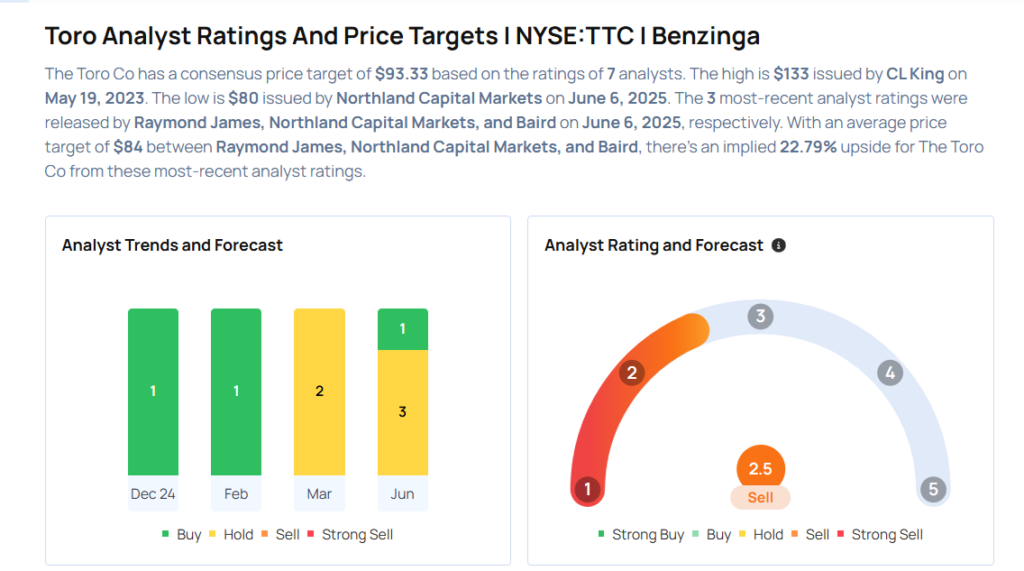

These analysts made changes to their price targets on Toro following earnings announcement.

- Baird analyst Timothy Wojs maintained Toro with a Neutral and lowered the price target from $85 to $82.

- Northland Capital Markets analyst Ted Jackson downgraded Toro from Outperform to Market Perform and lowered the price target from $100 to $80.

- Raymond James analyst Sam Darkatsh maintained the stock with an Outperform rating and lowered the price target from $95 to $90.

Considering buying TTC stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock