Designer Brands Inc. (NYSE:DBI) reported worse-than-expected first-quarter financial results and withdrew its FY25 guidance due to macroeconomic uncertainty on Tuesday.

The footwear and accessories company reported an adjusted loss of 26 cents per share, missing the Street view of 6 cents loss. Quarterly sales of $686.91 million (down 8% year over year) missed the analyst consensus estimate of $732.81 million. Total comparable sales decreased by 7.8%.

"We experienced a soft start to 2025 amid an unpredictable macro environment and deteriorating consumer sentiment," stated CEO Doug Howe.

Designer Brands is retracting its full-year 2025 guidance. This decision stems from macroeconomic uncertainties, largely attributed to global trade policies.

The company said it will pay a dividend of 5 cents per share on June 18 to shareholders of record at the close of business on June 5.

Designer Brands shares fell 3.5% to trade at $2.94 on Wednesday.

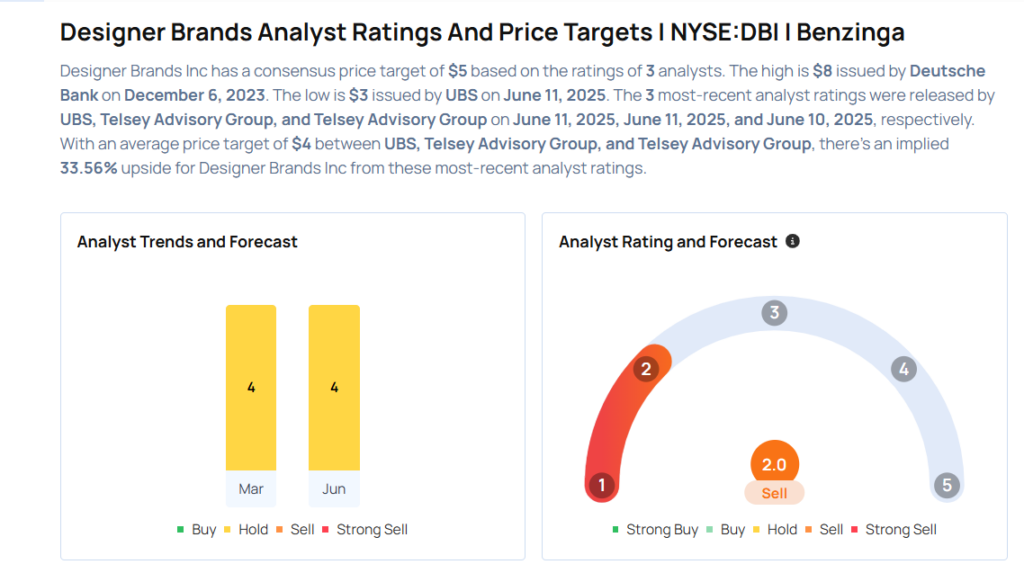

These analysts made changes to their price targets on Designer Brands following earnings announcement.

- Telsey Advisory Group analyst Dana Telsey maintained Designer Brands with a Market Perform and lowered the price target from $5 to $4.

- UBS analyst Jay Sole maintained the stock with a Neutral and lowered the price target from $3.5 to $3.

Considering buying DBI stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech And Telecom Stocks You May Want To Dump In Q2

Photo via Shutterstock