United Natural Foods Inc (NYSE:UNFI) posted better-than-expected fiscal third-quarter 2025 earnings on Tuesday.

The company reported a quarterly sales increase of 7.5% year-on-year to $8.06 billion, beating the analyst consensus estimate of $7.78 billion. This increase was driven by a 4% increase in wholesale unit volumes. Adjusted EPS of 44 cents beat the analyst consensus estimate of 21 cents.

United Natural Foods reiterated fiscal 2025 sales guidance of $31.3 billion-$31.7 billion, against the analyst consensus of $31.57 billion. It reaffirmed the adjusted EPS guidance of 70-90 cents against a consensus estimate of 82 cents. The company also maintained the adjusted EBITDA outlook of $550 million-$580 million.

As part of a strategic pruning, the company announced the termination of a major supply agreement to enhance profitability.

United Natural Foods shares fell 2.1% to trade at $21.67 on Thursday.

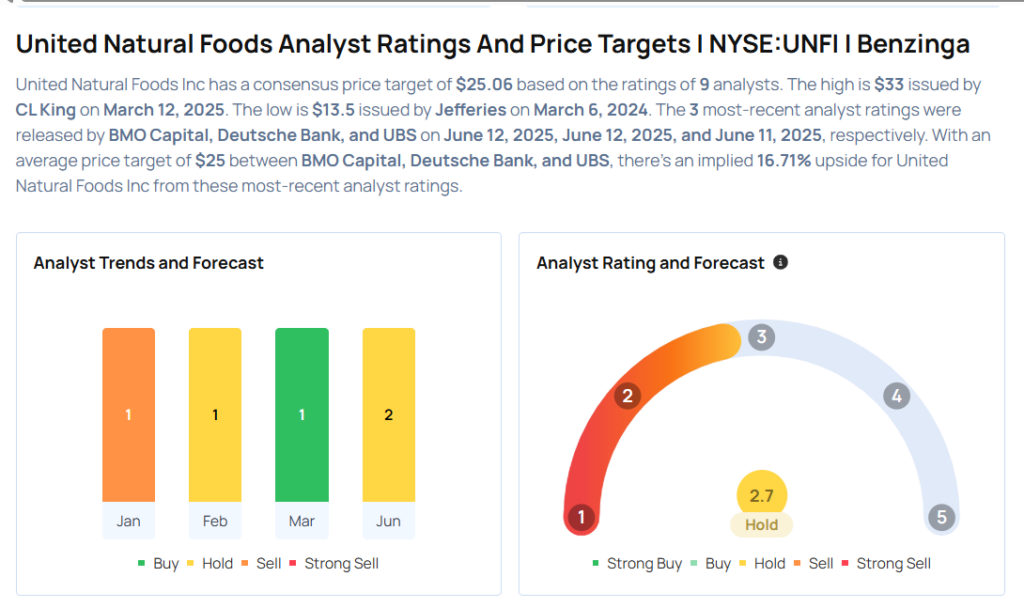

These analysts made changes to their price targets on United Natural Foods following earnings announcement.

- BMO Capital analyst Kelly Bania maintained United Natural Foods with a Market Perform and lowered the price target from $32 to $25.

- Deutsche Bank analyst Krisztina Katai maintained the stock with a Hold and lowered the price target from $33 to $24.

- UBS analyst Mark Carden, on Wednesday, maintained United Natural Foods with a Neutral and lowered the price target from $30 to $26.

Considering buying UNFI stock? Here’s what analysts think:

Read This Next:

- Adobe Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Photo via Shutterstock