GMS Inc. (NYSE:GMS) posted better-than-expected fourth-quarter fiscal 2025 results on Wednesday.

Topping analyst estimates of $1.30 billion, the company announced quarterly net sales of $1.33 billion, a 5.6% decrease from a year ago. The specialty building products distributor's adjusted EPS of $1.29 was above the consensus of $1.11.

"We reported solid results for our fourth quarter and full-year fiscal 2025 despite the deterioration in end-market conditions as we moved through the year," commented John C. Turner, Jr., president and CEO of GMS, regarding the company's performance.

On Thursday, GMS also confirmed the receipt of $95.20 per share unsolicited buyout proposal from QXO.

GMS shares rose 28.3% to trade at $103.92 on Friday.

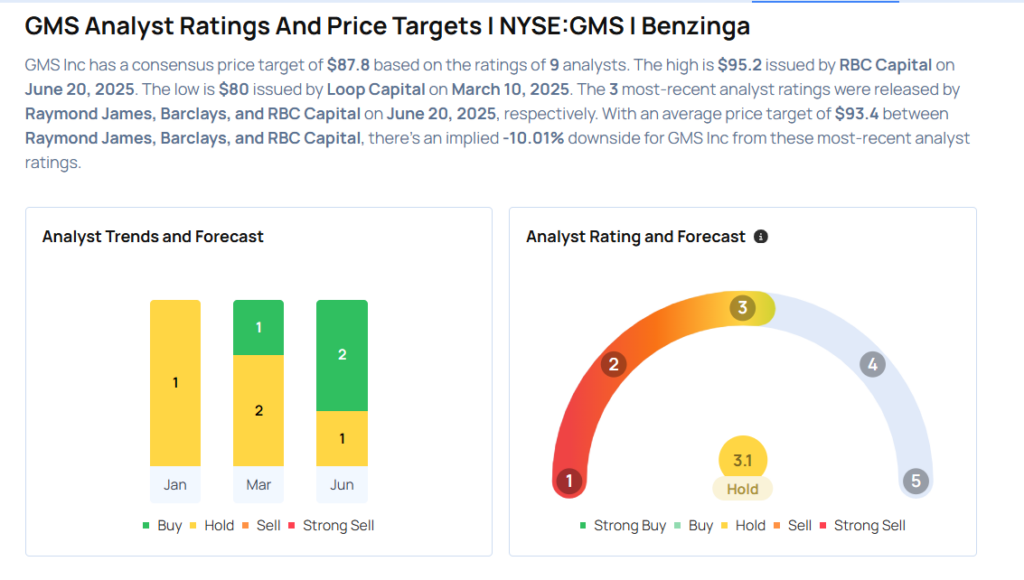

These analysts made changes to their price targets on GMS following earnings announcement.

- Stephens & Co. analyst Trey Grooms maintained GMS with an Overweight rating and raised the price target from $90 to $95.

- RBC Capital analyst Mike Dahl maintained the stock with a Sector Perform and raised the price target from $65 to $95.2.

- Barclays analyst Matthew Bouley maintained GMS with an Equal-Weight rating and raised the price target from $71 to $95.

- Raymond James analyst Sam Darkatsh maintained the stock with an Outperform rating and increased the price target from $80 to $90.

Considering buying GMS stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Commercial Metals Stock Ahead Of Q3 Earnings

Photo via Shutterstock