Think Delta Air Lines Is Expensive? This Chart Might Change Your Mind.

-

Delta Air Lines consistently adds value for its shareholders.

-

The current trading environment heavily favors network airlines over low-cost carriers.

-

Loyalty programs and co-brand credit cards are diversifying Delta's revenue streams.

Investors might not consider Delta Air Lines (DAL -4.37%) stock expensive due to its low price-to-earnings ratio of just over 8 times earnings. Still, some of them do stress over Delta's adjusted net debt of $16.9 billion and the traditional cyclicality of its revenue and earnings. That said, I think the risk is a lot less than in previous years. Here's why.

Airline profitability

One of the longstanding, and justified, criticisms of the airline industry is that it hasn't generated a return on invested capital (ROIC) sufficient to cover its weighted average cost of capital (WACC). While airlines will all have different WACCs, a rough estimate interpolated from International Air Transport Association (IATA) figures suggests it averages around 8% or 9%.

Image source: Getty Images.

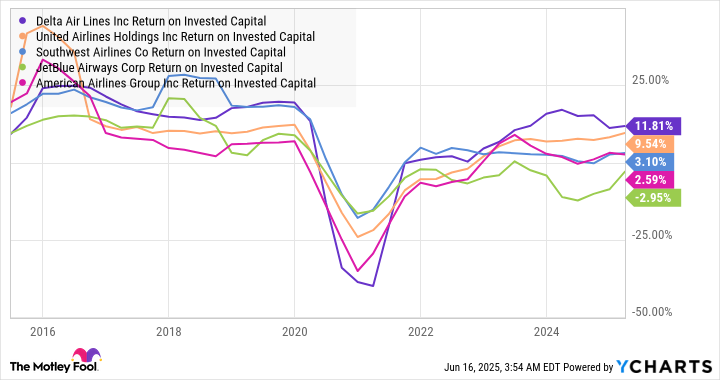

The following chart illustrates a clear bifurcation in the industry over recent years, with Delta and United Airlines' return on invested capital (ROIC) exceeding 8%, significantly ahead of American Airlines and the budget carriers. Moreover, note that the ROIC of Delta, United, and American Airlines is similar both before and after the pandemic lockdown period, while the ROIC of budget airlines has declined.

Data by YCharts.

Why Delta will continue to outperform

There are many reasons for this bifurcation:

- Rising labor, airport, and supply chain costs disproportionately hit budget airlines' low-cost and low-margin business models.

- It's easier for premium airlines to adjust and offer economy seats than it is for budget airlines to "go premium."

- Delta and other network airlines have substantial loyalty programs and also generate revenue through co-brand credit cards.

It all comes together to create an environment where Delta and United are likely to be more resilient in a downturn, particularly against budget airlines, as demonstrated by their ROIC. As such, a lower risk should result in a more favorable risk-reward calculation for Delta, meaning it's not as expensive a stock as many think.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10