Constellation Brands, Inc. (NYSE:STZ) will release earnings results for the first quarter, after the closing bell on Tuesday, July 1.

Analysts expect the Rochester, New York-based company to report quarterly earnings at $3.29 per share, down from $3.57 per share in the year-ago period. Constellation Brands projects to report quarterly revenue at $2.56 billion, compared to $2.66 billion a year earlier, according to data from Benzinga Pro.

On June 2, Constellation Brands announced delivery of notices of redemption for 4.75% Senior Notes due 2025 and 5.00% Senior Notes due 2026.

Constellation Brands shares fell 0.1% to close at $161.32 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

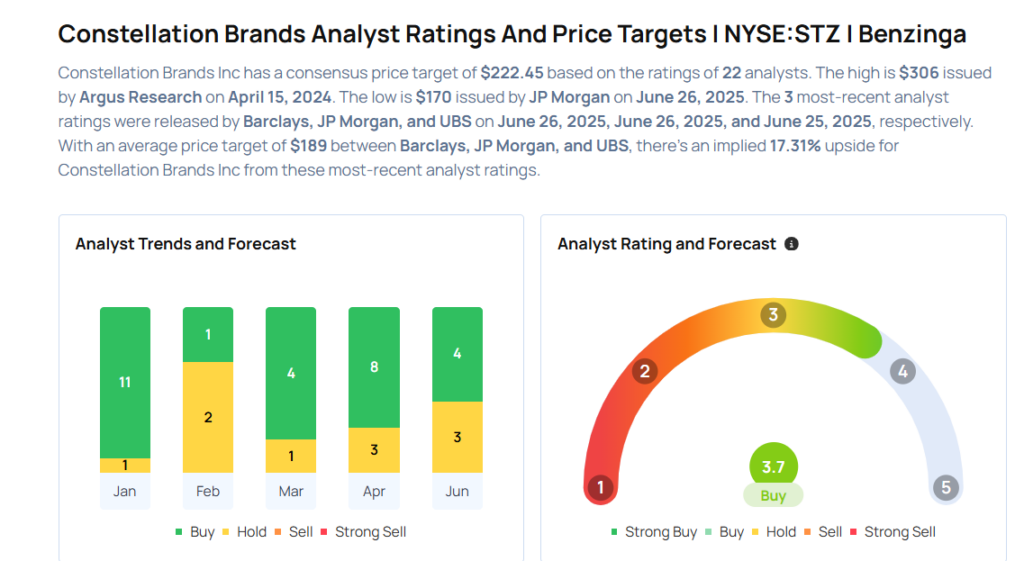

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Lauren Lieberman maintained an Overweight rating and cut the price target from $207 to $202 on June 26, 2025. This analyst has an accuracy rate of 61%.

- JP Morgan analyst Andrea Teixeira maintained a Neutral rating and cut the price target from $194 to $170 on June 26, 2025. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Chris Carey maintained an Overweight rating and cut the price target from $210 to $196 on June 25, 2025. This analyst has an accuracy rate of 61%.

- B of A Securities analyst Bryan Spillane maintained a Neutral rating and slashed the price target from $195 to $180 on June 18, 2025. This analyst has an accuracy rate of 61%.

- Goldman Sachs analyst Boonie Herzog maintained a Buy rating and cut the price target from $260 to $225 on April 11, 2025. This analyst has an accuracy rate of 68%.

Considering buying STZ stock? Here’s what analysts think:

Read This Next:

- Top 2 Utilities Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock