Quantum Computing (NasdaqCM:QUBT) Ships First Commercial Photon Source to South Korea

Quantum Computing (NasdaqCM:QUBT) recently joined several major indices, enhancing its visibility among investors. Its 172% surge this quarter can be further illuminated by recent changes, including a successful private placement and executive leadership updates, as well as shipping its first commercial photon source to South Korea. The addition to indices and these strategic initiatives align with the broader market's rise, buoyed by tech sector resilience and positive economic data, which saw the S&P 500 and Nasdaq achieving new highs. While the company's index inclusions and placements align with the market rally, they offer additional impetus to its price trajectory.

Every company has risks, and we've spotted 6 risks for Quantum Computing (of which 3 are a bit concerning!) you should know about.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The company’s total shareholder return over the past year, reaching a very large percentage, highlights the dramatically positive performance of Quantum Computing Inc.'s stock. While recent developments in indices inclusion, a private placement, and executive changes helped drive a rise in share price, the broader tech sector's resilience further supported this upswing. Compared to a tech industry decline of 4.5% over the past year, Quantum Computing Inc.'s returns stand out significantly. Meanwhile, the general market delivered a 13.2% increase over the same period, against which the company's longer-term performance is quite exceptional.

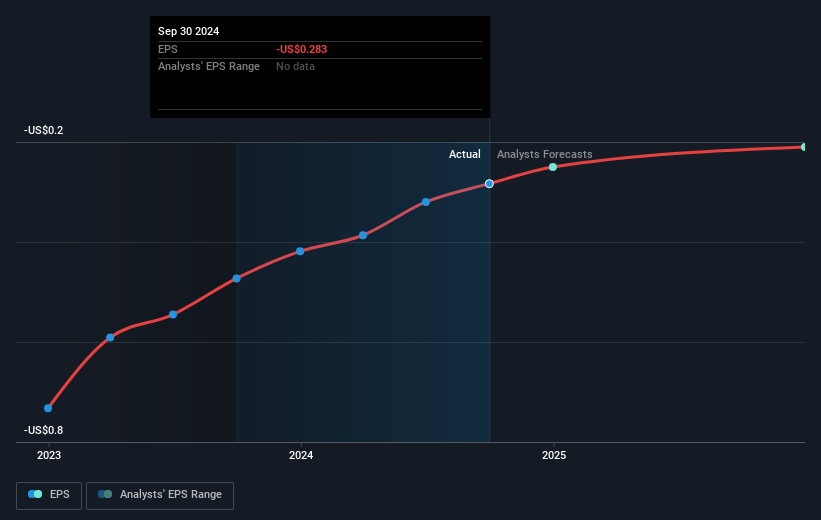

The introduction of commercial photon technology, coupled with recent index inclusions, could positively influence revenue forecasts, suggested to grow swiftly at over 114.4% annually. Despite this, earnings predictions remain less optimistic amid dilution and operational challenges, with profitability not in sight for the next three years. The current share price, trading under its consensus price target of US$18.50, reflects market tensions and speculative investor sentiment. However, the high valuation relative to peers and industry could continue to play a pivotal role in future pricing dynamics.

Our valuation report here indicates Quantum Computing may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10