Is Beng Kuang Marine Limited's (SGX:BEZ) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Most readers would already be aware that Beng Kuang Marine's (SGX:BEZ) stock increased significantly by 18% over the past week. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Beng Kuang Marine's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Beng Kuang Marine is:

74% = S$21m ÷ S$28m (Based on the trailing twelve months to December 2024).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every SGD1 worth of equity, the company was able to earn SGD0.74 in profit.

Check out our latest analysis for Beng Kuang Marine

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Beng Kuang Marine's Earnings Growth And 74% ROE

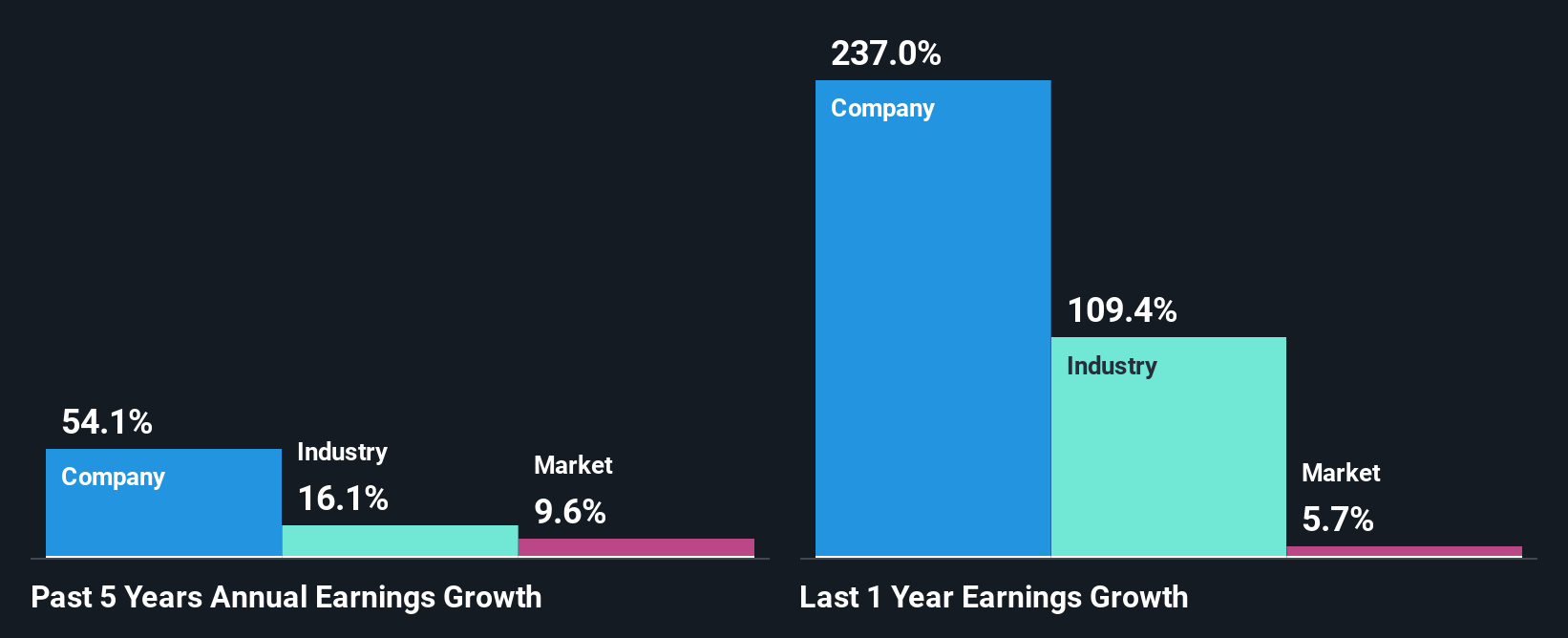

Firstly, we acknowledge that Beng Kuang Marine has a significantly high ROE. Secondly, even when compared to the industry average of 9.6% the company's ROE is quite impressive. Under the circumstances, Beng Kuang Marine's considerable five year net income growth of 54% was to be expected.

As a next step, we compared Beng Kuang Marine's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 16%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Beng Kuang Marine's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Beng Kuang Marine Using Its Retained Earnings Effectively?

Beng Kuang Marine has a really low three-year median payout ratio of 10%, meaning that it has the remaining 90% left over to reinvest into its business. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

Our latest analyst data shows that the future payout ratio of the company is expected to rise to 19% over the next three years.

Conclusion

Overall, we are quite pleased with Beng Kuang Marine's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Beng Kuang Marine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10