Do Its Financials Have Any Role To Play In Driving Diamondback Energy, Inc.'s (NASDAQ:FANG) Stock Up Recently?

Diamondback Energy (NASDAQ:FANG) has had a great run on the share market with its stock up by a significant 13% over the last three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. In this article, we decided to focus on Diamondback Energy's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Diamondback Energy is:

11% = US$4.4b ÷ US$42b (Based on the trailing twelve months to March 2025).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.10 in profit.

See our latest analysis for Diamondback Energy

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Diamondback Energy's Earnings Growth And 11% ROE

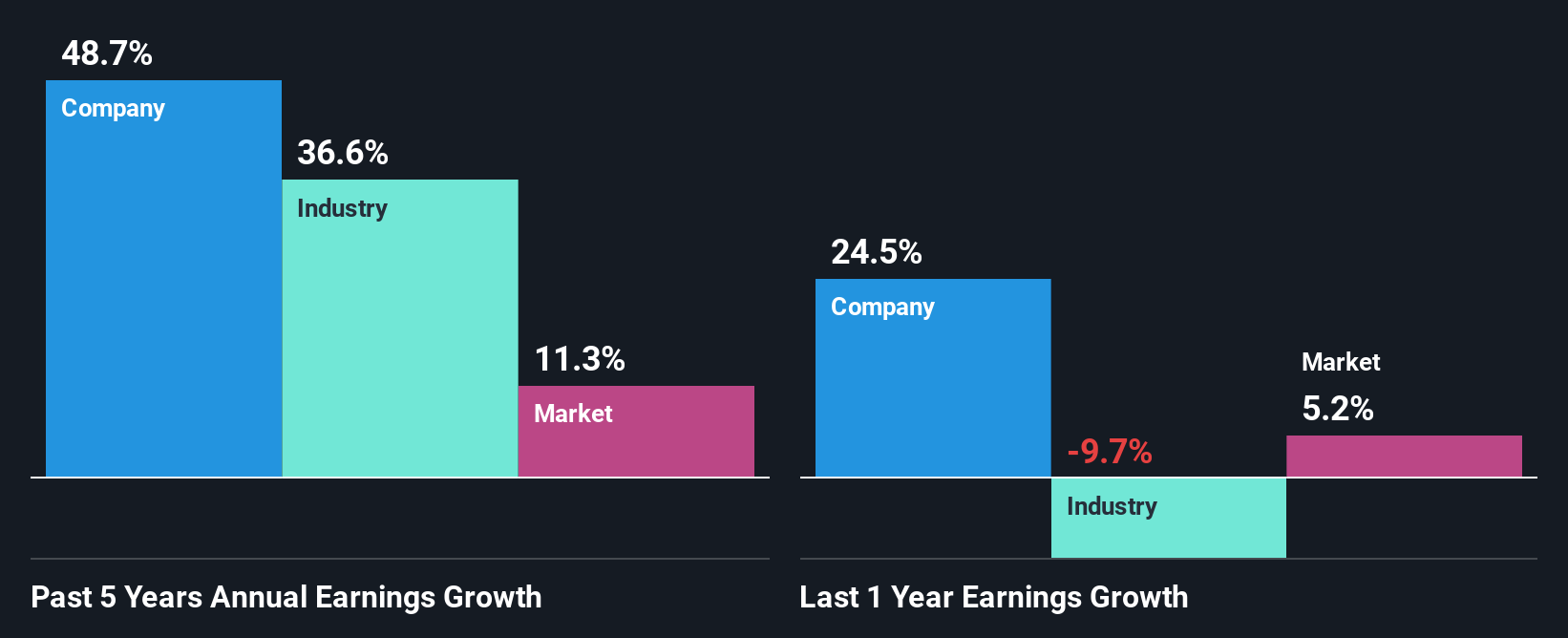

On the face of it, Diamondback Energy's ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 13%. Particularly, the exceptional 49% net income growth seen by Diamondback Energy over the past five years is pretty remarkable. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Diamondback Energy's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 37%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Diamondback Energy is trading on a high P/E or a low P/E, relative to its industry.

Is Diamondback Energy Making Efficient Use Of Its Profits?

Diamondback Energy has a three-year median payout ratio of 40% (where it is retaining 60% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Diamondback Energy is reinvesting its earnings efficiently.

Moreover, Diamondback Energy is determined to keep sharing its profits with shareholders which we infer from its long history of seven years of paying a dividend. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 33% of its profits over the next three years. Accordingly, forecasts suggest that Diamondback Energy's future ROE will be 9.1% which is again, similar to the current ROE.

Conclusion

Overall, we feel that Diamondback Energy certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10