Insider Buying: Sunshine Oilsands Executive Chairman Bought CA$489k Of Shares

Whilst it may not be a huge deal, we thought it was good to see that the Sunshine Oilsands Ltd. (HKG:2012) Executive Chairman, Kwok Ping Sun, recently bought HK$489k worth of stock, for HK$0.67 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Sunshine Oilsands Insider Transactions Over The Last Year

The insider Jun Zhang made the biggest insider purchase in the last 12 months. That single transaction was for HK$19m worth of shares at a price of HK$0.38 each. We do like to see buying, but this purchase was made at well below the current price of HK$0.48. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

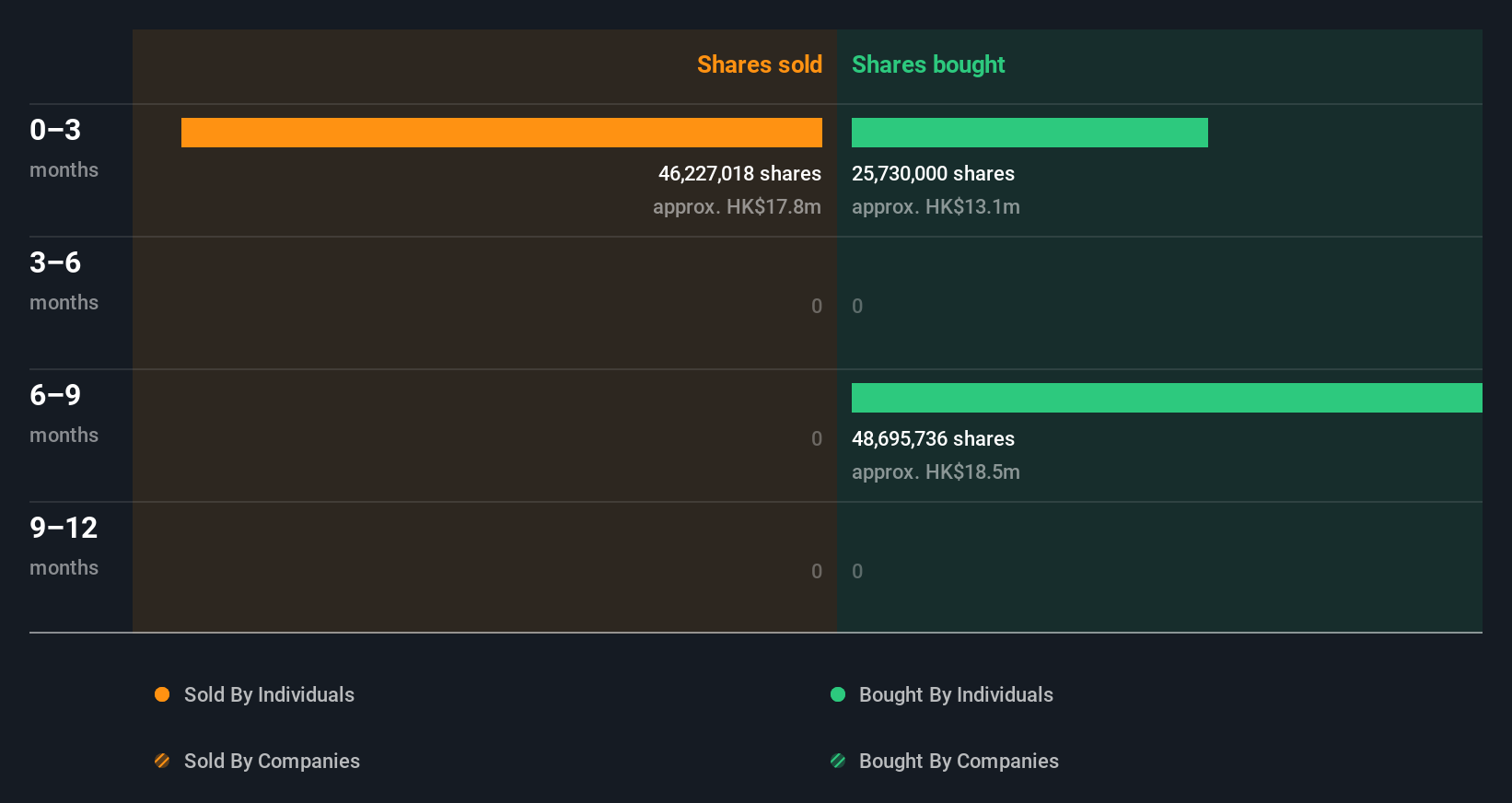

Happily, we note that in the last year insiders paid HK$28m for 74.43m shares. But insiders sold 46.23m shares worth HK$18m. In the last twelve months there was more buying than selling by Sunshine Oilsands insiders. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

View our latest analysis for Sunshine Oilsands

Sunshine Oilsands is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Does Sunshine Oilsands Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Sunshine Oilsands insiders own about HK$92m worth of shares. That equates to 38% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Sunshine Oilsands Insiders?

The stark truth for Sunshine Oilsands is that there has been more insider selling than insider buying in the last three months. In contrast, they appear keener if you look at the last twelve months. It's good to see insiders are shareholders. So the recent selling doesn't worry us too much. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we've found that Sunshine Oilsands has 6 warning signs (4 make us uncomfortable!) that deserve your attention before going any further with your analysis.

Of course Sunshine Oilsands may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10