Hon Kwok Land Investment Company (HKG:160) Will Pay A Smaller Dividend Than Last Year

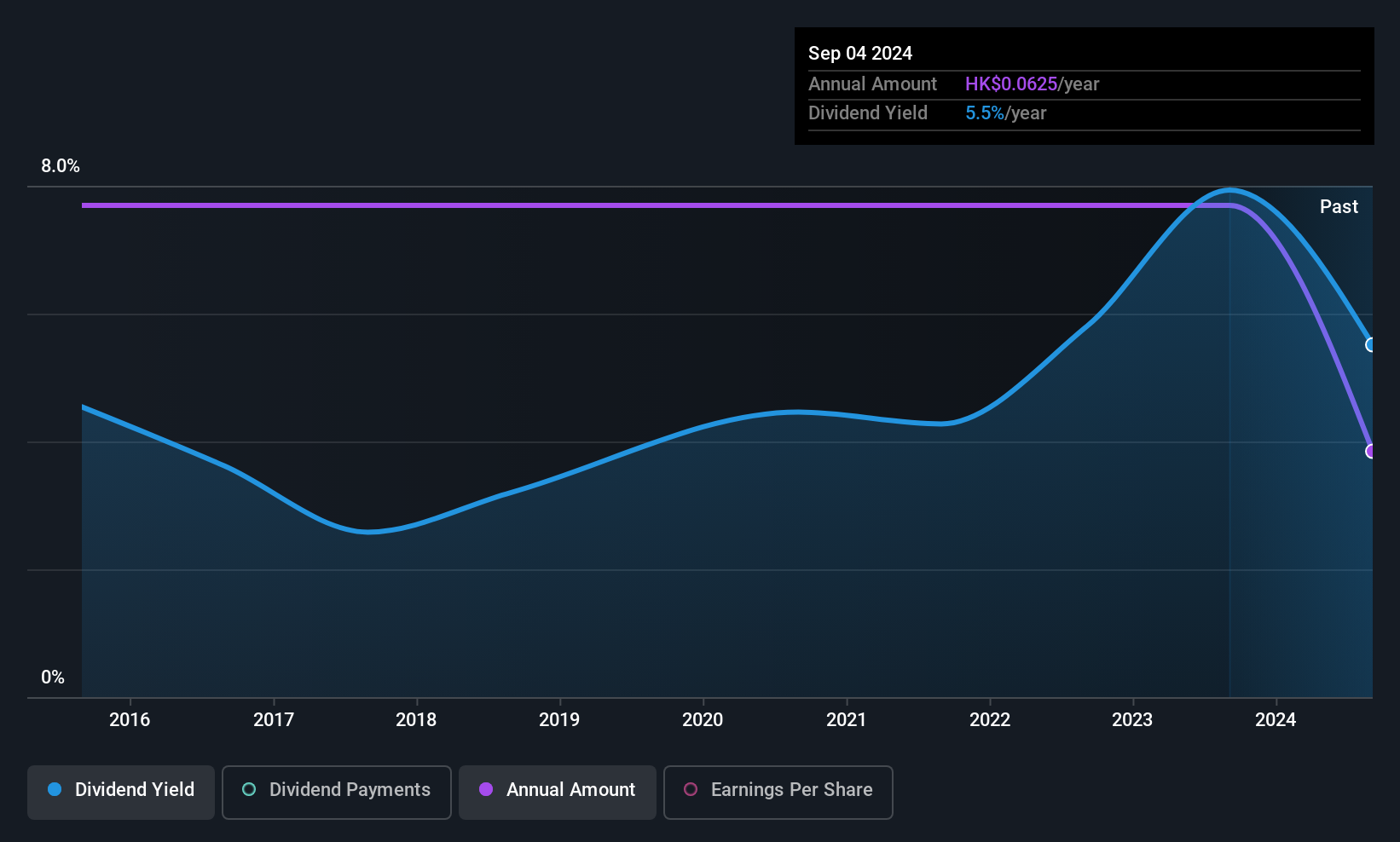

Hon Kwok Land Investment Company, Limited (HKG:160) has announced that on 6th of October, it will be paying a dividend ofHK$0.03, which a reduction from last year's comparable dividend. This means that the annual payment is 2.8% of the current stock price, which is lower than what the rest of the industry is paying.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

Hon Kwok Land Investment Company Might Find It Hard To Continue The Dividend

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Even though Hon Kwok Land Investment Company isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 36.1% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

See our latest analysis for Hon Kwok Land Investment Company

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the annual payment back then was HK$0.125, compared to the most recent full-year payment of HK$0.03. The dividend has fallen 76% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Hon Kwok Land Investment Company's earnings per share has shrunk at 36% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Hon Kwok Land Investment Company's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Hon Kwok Land Investment Company is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Hon Kwok Land Investment Company has 4 warning signs (and 2 which are a bit concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Hon Kwok Land Investment Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10