Republic Services (NYSE:RSG) Faces Union Strikes Amid Fair Wage Dispute With Teamsters

Republic Services (NYSE:RSG) is currently facing significant labor challenges as over 90% of Teamsters Local 25 members voted to strike, demanding wages competitive with rivals. Despite these challenges, Republic's latest quarterly share price move of 2.43% aligns closely with the market's 2.1% rise over the same period. The company's performance, including a 6% revenue increase to $16 billion and $1.18 billion returned to shareholders, reflects resilience in a volatile environment. Furthermore, efforts like the biogas joint venture with OPAL Fuels and a new recycling center in Bridgeton, MO, contribute positively to the company’s outlook amidst these challenges.

We've spotted 1 risk for Republic Services you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The ongoing labor challenges faced by Republic Services could potentially exert pressure on its operational efficiency and cost structure, which may influence revenue and earnings forecasts. The demand for competitive wages could lead to increased costs, impacting the company's profit margins. However, Republic's initiatives, such as the biogas joint venture and new recycling center, may help buffer these challenges by providing additional revenue streams and aligning with sustainability trends, thereby offsetting some financial impact.

Over the past five years, Republic Services has achieved a significant total return of 220.81%, showcasing strong long-term performance. This growth is reflective of its strategic growth initiatives and resilience in addressing operational challenges. Additionally, the company's one-year return has exceeded the US Market return of 13.2% and outperformed the US Commercial Services industry, which saw a 9.7% return, further emphasizing its market competitiveness.

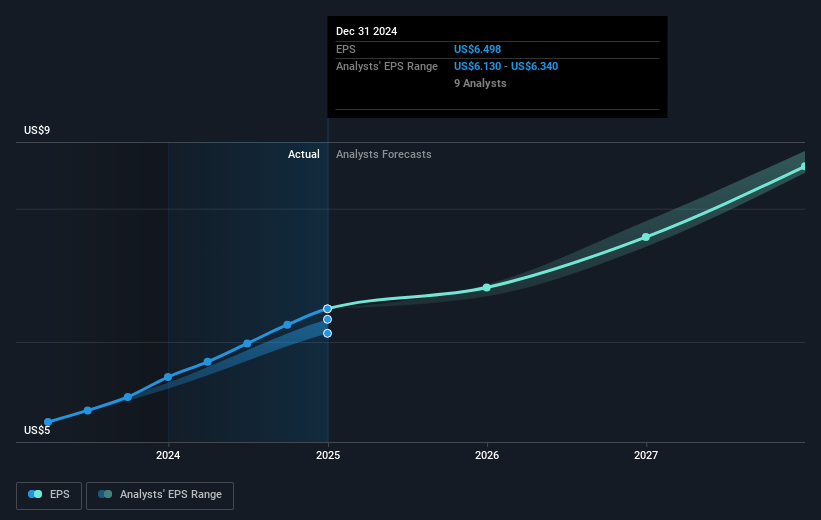

Currently, Republic Services' share price of US$244.67 is trading closely with the analyst consensus price target of US$259.01, a gap indicating modest potential upside. While the stock's short-term movements mirror the market, the longer-term price trajectory may hinge on successful resolution of labor issues and execution of growth initiatives. Analyst expectations anticipate revenue and earnings growth, but challenges such as declining volumes and acquisition risks must be carefully managed to achieve these targets.

According our valuation report, there's an indication that Republic Services' share price might be on the expensive side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10