Shoals Technologies Group Leads These 3 Stocks Estimated Below Intrinsic Value

The United States market has seen a positive trend, climbing by 2.1% over the past week and rising 14% over the past year, with earnings forecasted to grow by 15% annually. In this environment, identifying stocks estimated to be below their intrinsic value can offer potential opportunities for investors seeking to capitalize on growth prospects while maintaining a focus on value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.65 | $50.98 | 49.7% |

| UMH Properties (UMH) | $17.34 | $34.40 | 49.6% |

| SharkNinja (SN) | $107.24 | $210.61 | 49.1% |

| Roku (ROKU) | $88.27 | $173.98 | 49.3% |

| Privia Health Group (PRVA) | $22.11 | $43.37 | 49% |

| MAC Copper (MTAL) | $12.03 | $23.79 | 49.4% |

| Insteel Industries (IIIN) | $39.23 | $76.74 | 48.9% |

| Carter Bankshares (CARE) | $18.25 | $35.50 | 48.6% |

| Atlantic Union Bankshares (AUB) | $33.54 | $65.94 | 49.1% |

| Acadia Realty Trust (AKR) | $18.64 | $36.44 | 48.8% |

Click here to see the full list of 175 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

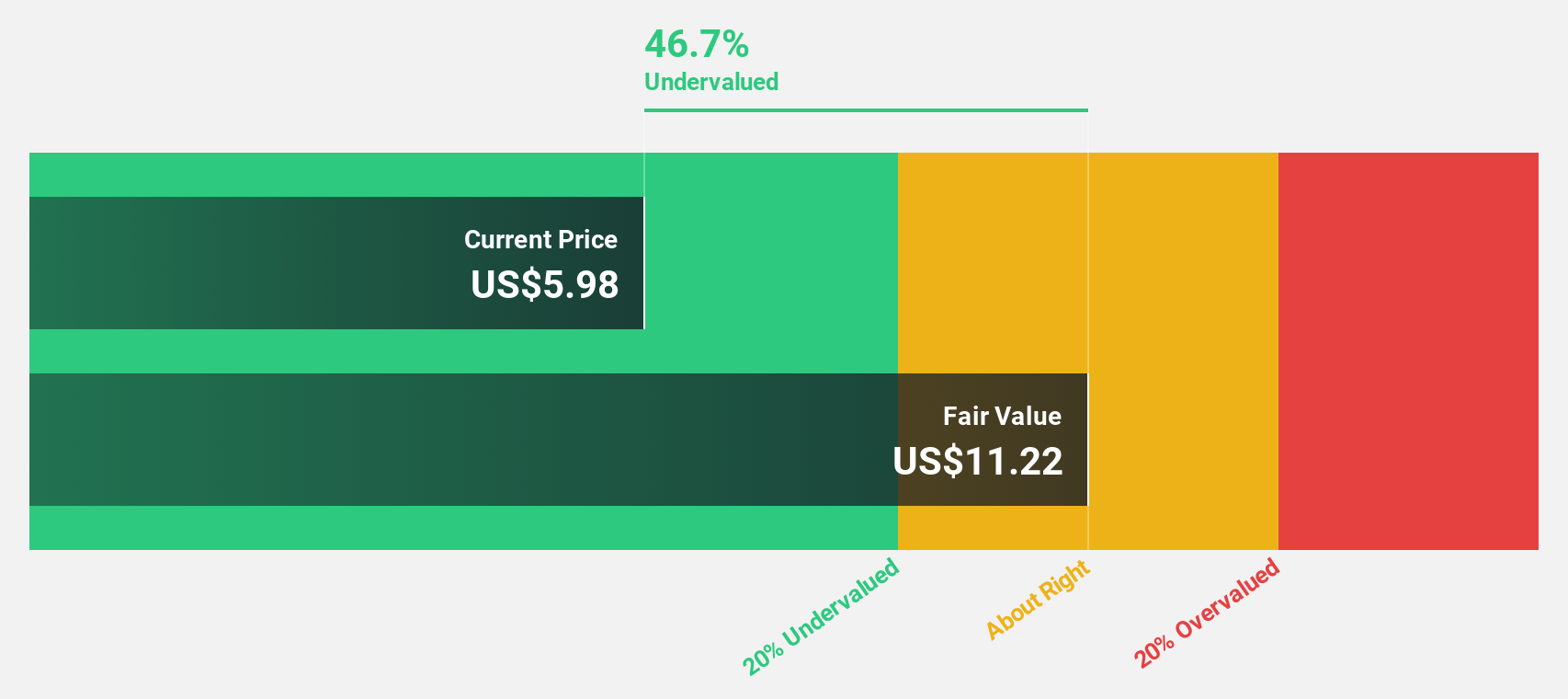

Shoals Technologies Group (SHLS)

Overview: Shoals Technologies Group, Inc. offers electrical balance of system (EBOS) solutions and components both in the United States and internationally, with a market cap of approximately $1 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated $388.76 million.

Estimated Discount To Fair Value: 47%

Shoals Technologies Group is trading at US$5.98, significantly below its estimated fair value of US$11.28, suggesting it may be undervalued based on cash flows. Despite a recent net loss of US$0.282 million in Q1 2025, the company's earnings are forecast to grow substantially by 26.33% annually, outpacing the broader market's growth rate of 14.6%. Recent index inclusions and strategic partnerships further bolster its potential for future growth and stability.

- Upon reviewing our latest growth report, Shoals Technologies Group's projected financial performance appears quite optimistic.

- Take a closer look at Shoals Technologies Group's balance sheet health here in our report.

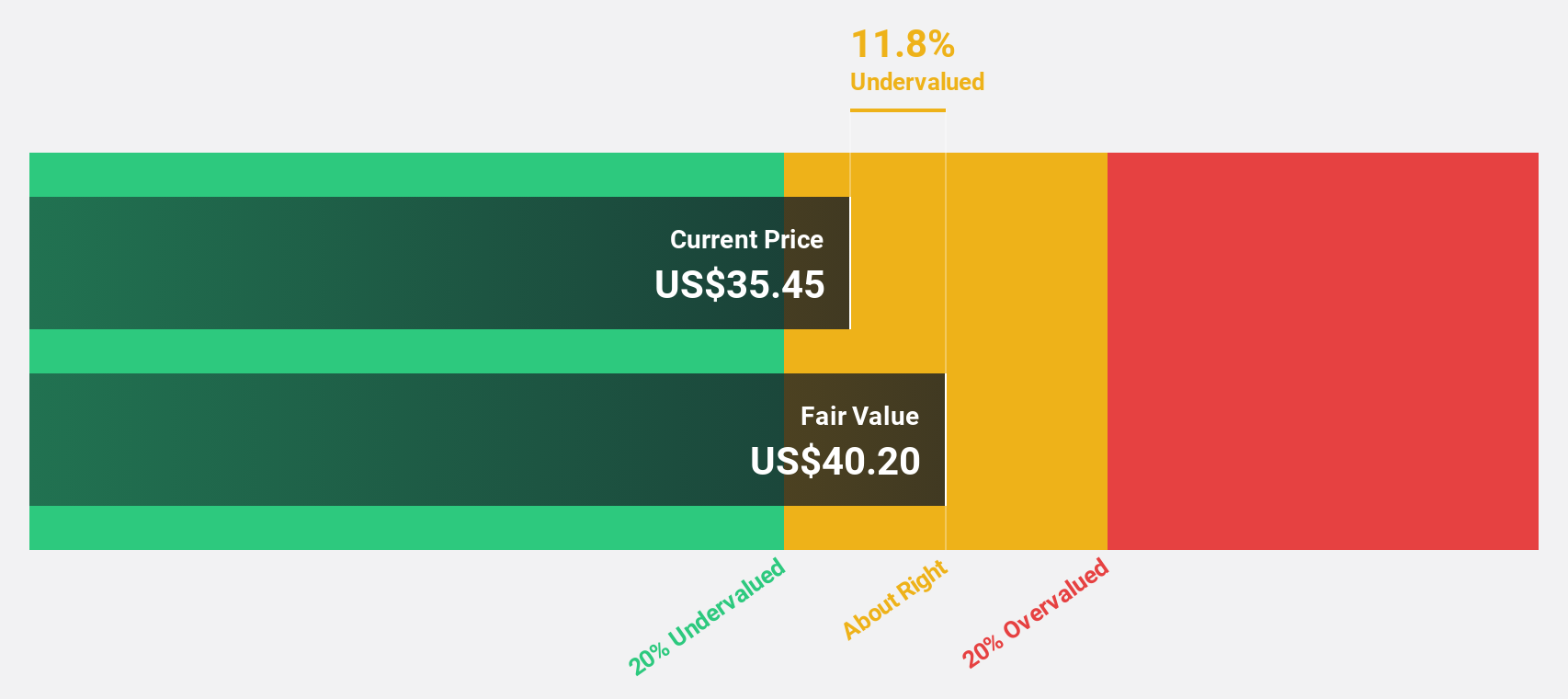

Vertex (VERX)

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail trade, wholesale trade, and manufacturing industries both in the United States and internationally, with a market cap of $5.62 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to $687.06 million.

Estimated Discount To Fair Value: 11.9%

Vertex Inc. is trading at US$35.45, slightly below its estimated fair value of US$40.26, indicating potential undervaluation based on cash flows. Recent product enhancements and strategic partnerships, such as those with Oracle and Majesco, strengthen its position in tax automation solutions across various industries. Despite not being significantly undervalued, Vertex's forecasted revenue growth of 13.7% annually surpasses the broader U.S. market growth rate of 8.7%, highlighting its promising outlook in a competitive landscape.

- Insights from our recent growth report point to a promising forecast for Vertex's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Vertex.

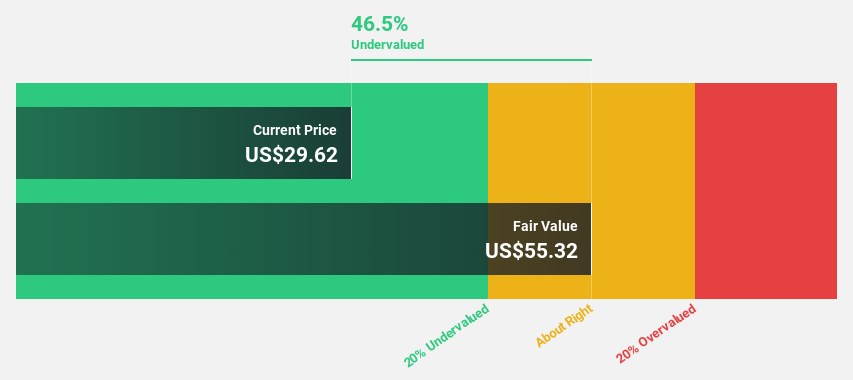

Chagee Holdings (CHA)

Overview: Chagee Holdings Limited, with a market cap of $5.07 billion, owns, operates, and franchises teahouses under the CHAGEE brand name in China and internationally through its subsidiaries.

Operations: The company generates revenue from its restaurants segment, which amounted to CN¥13.29 billion.

Estimated Discount To Fair Value: 29.7%

Chagee Holdings is trading at US$27.30, considerably below its fair value estimate of US$38.82, highlighting its undervaluation based on cash flows. The company reported strong first-quarter earnings with revenue and net income growth compared to the previous year. Forecasts predict Chagee's annual earnings will grow significantly over the next three years, outpacing the broader U.S. market, while recent expansion into the U.S. could further bolster its financial position.

- In light of our recent growth report, it seems possible that Chagee Holdings' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Chagee Holdings stock in this financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 175 Undervalued US Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10