We're Keeping An Eye On Standard BioTools' (NASDAQ:LAB) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Standard BioTools (NASDAQ:LAB) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

When Might Standard BioTools Run Out Of Money?

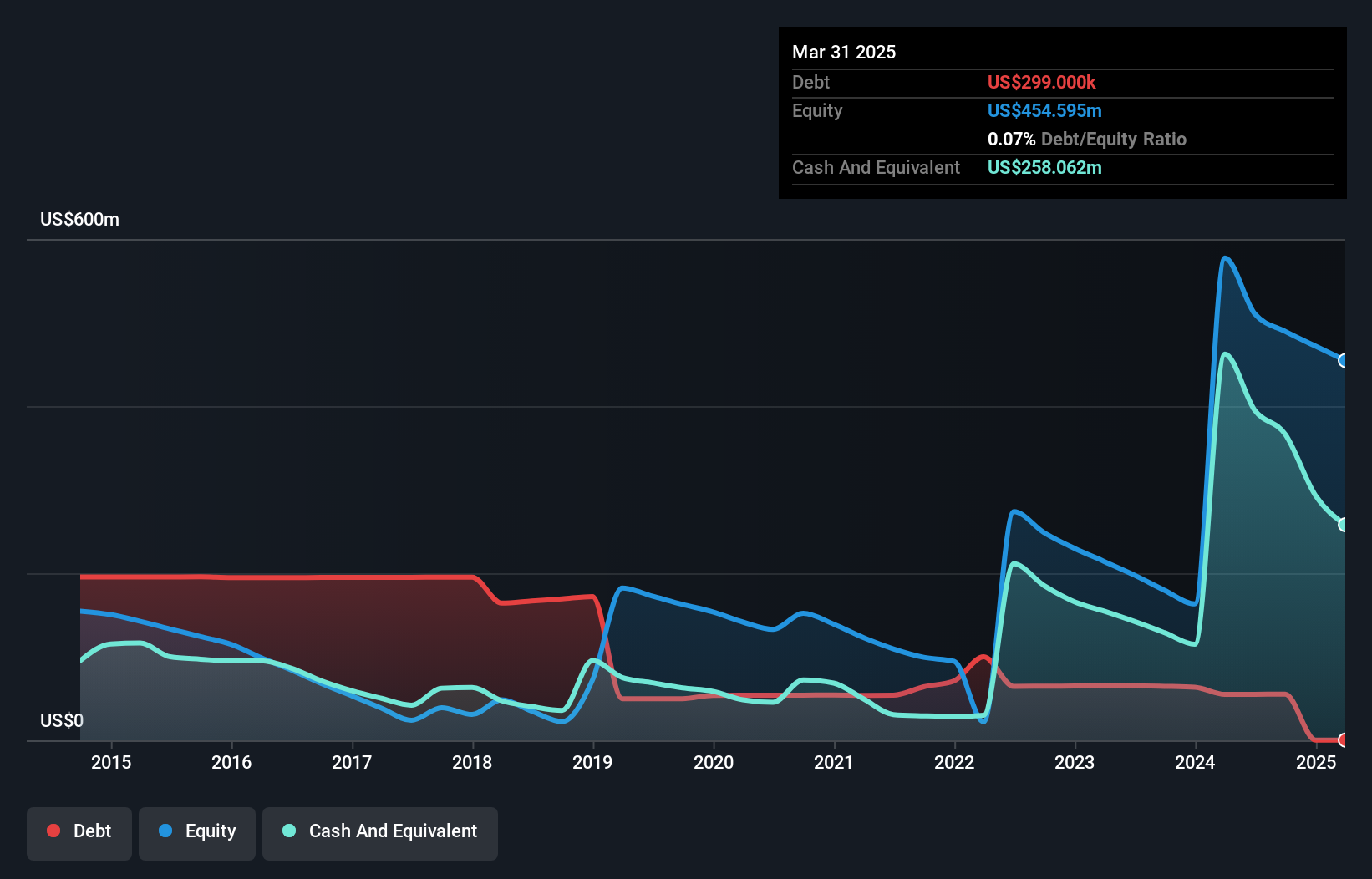

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at March 2025, Standard BioTools had cash of US$258m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was US$124m over the trailing twelve months. That means it had a cash runway of about 2.1 years as of March 2025. That's decent, giving the company a couple years to develop its business. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. You can see how its cash balance has changed over time in the image below.

Check out our latest analysis for Standard BioTools

How Well Is Standard BioTools Growing?

At first glance it's a bit worrying to see that Standard BioTools actually boosted its cash burn by 24%, year on year. The good news is that operating revenue increased by 33% in the last year, indicating that the business is gaining some traction. On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Standard BioTools Raise Cash?

While Standard BioTools seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$513m, Standard BioTools' US$124m in cash burn equates to about 24% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is Standard BioTools' Cash Burn Situation?

On this analysis of Standard BioTools' cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Standard BioTools' situation. An in-depth examination of risks revealed 2 warning signs for Standard BioTools that readers should think about before committing capital to this stock.

Of course Standard BioTools may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10