High Growth Tech Stocks in US for July 2025

The United States market has been flat over the last week but has seen a 13% rise in the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to leverage these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.83% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

IREN (IREN)

Simply Wall St Growth Rating: ★★★★★☆

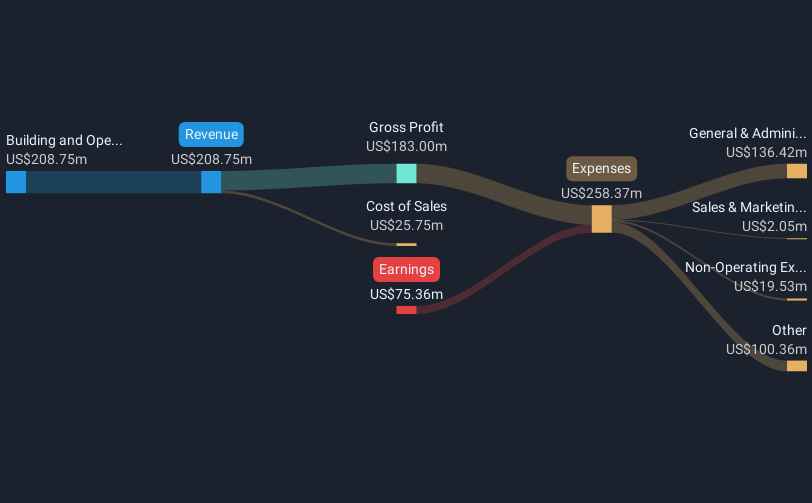

Overview: IREN Limited specializes in owning and operating bitcoin mining data centers, with a market capitalization of $4.07 billion.

Operations: The company generates revenue of $377.82 million from building and operating data center sites for bitcoin mining. With a market capitalization of approximately $4.07 billion, the focus is on leveraging these data centers to support its core operations in the cryptocurrency sector.

Despite being currently unprofitable, IREN is poised for significant growth with forecasted revenue increases at 43.8% annually, outpacing the US market's 8.7%. This tech firm's commitment to innovation is underscored by its aggressive R&D spending, aimed at enhancing its AI infrastructure—a move that could redefine industry standards. Recent strategic hires and a substantial $550 million in convertible notes underline a robust capital strategy to support these expansions. With earnings expected to surge by 116.1% annually, IREN is strategically positioning itself as a formidable player in the high-tech arena, leveraging both financial acumen and technological advancements to secure its future in an ever-evolving landscape.

- Delve into the full analysis health report here for a deeper understanding of IREN.

Evaluate IREN's historical performance by accessing our past performance report.

Elastic (ESTC)

Simply Wall St Growth Rating: ★★★★★☆

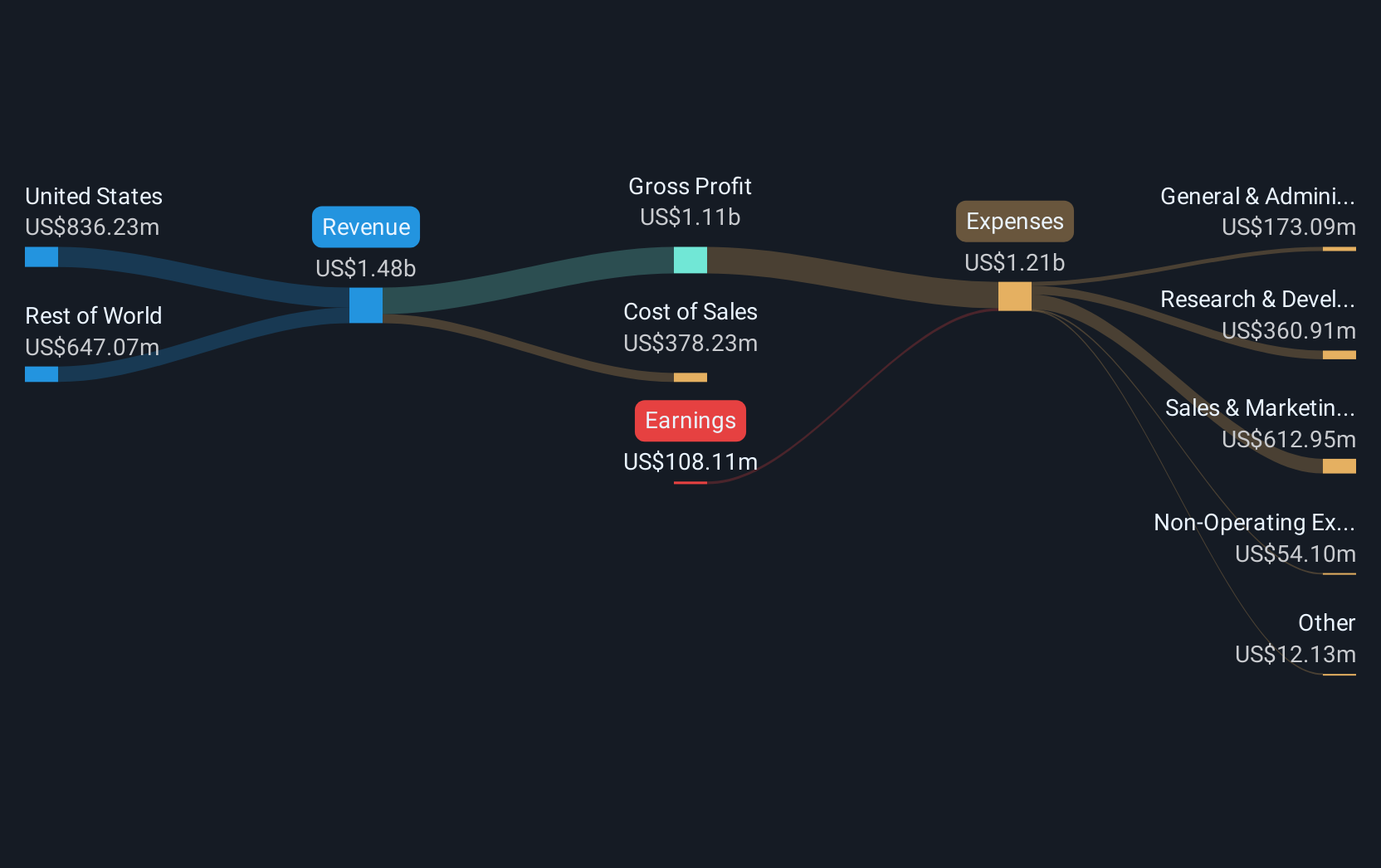

Overview: Elastic N.V. is a search AI company that offers software platforms for hybrid, public, private, and multi-cloud environments globally, with a market cap of $9.21 billion.

Operations: Elastic N.V. generates revenue primarily through its software and programming segment, which amounted to $1.48 billion. The company operates in the search AI sector, providing platforms for various cloud environments across international markets.

Elastic N.V. has demonstrated resilience and adaptability in the tech sector, particularly through its recent strategic collaboration with AWS, aiming to accelerate AI-native enterprise transitions. This partnership is expected to enhance product integrations and drive significant market penetration, evidenced by a robust revenue forecast of $1.67 billion for FY2026, marking a 12% year-over-year growth. Despite facing a net loss this past fiscal year, Elastic's aggressive innovation strategy is underscored by its substantial R&D investment—aligning with industry shifts towards more integrated and efficient AI-driven platforms. This approach not only supports sustained growth but also positions Elastic favorably within the competitive tech landscape.

- Navigate through the intricacies of Elastic with our comprehensive health report here.

Assess Elastic's past performance with our detailed historical performance reports.

ServiceNow (NOW)

Simply Wall St Growth Rating: ★★★★★☆

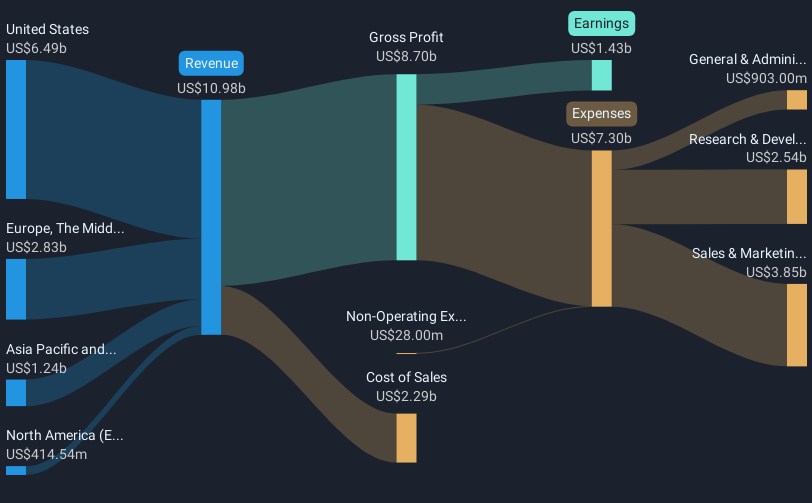

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions worldwide and has a market capitalization of $216.72 billion.

Operations: ServiceNow generates revenue primarily from its internet software and services segment, amounting to $11.47 billion. The company focuses on providing cloud-based solutions for digital workflows across diverse geographic regions.

ServiceNow, a leader in digital workflow solutions, is capitalizing on strategic partnerships and AI integration to enhance its offerings. The recent collaboration with Science Applications International Corp (SAIC) showcases ServiceNow's commitment to transforming IT risk management into proactive resilience for U.S. defense and intelligence agencies. This partnership leverages ServiceNow's AI Platform to develop real-time intelligence tools that predict issues and automate processes, ensuring mission-critical reliability. Additionally, the company's robust R&D investment strategy supports continuous innovation in AI-driven solutions, aligning with industry trends towards autonomous systems and predictive analytics. These strategic moves not only strengthen ServiceNow's market position but also underline its role in advancing digital transformation across various sectors.

- Click here and access our complete health analysis report to understand the dynamics of ServiceNow.

Understand ServiceNow's track record by examining our Past report.

Where To Now?

- Investigate our full lineup of 226 US High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10