3 Undervalued Small Caps In Asian Markets With Insider Buying

Amidst a backdrop of mixed economic signals and fluctuating market sentiments, Asian markets have been navigating through a complex landscape, with indices showing varied performances. As investors seek opportunities in this dynamic environment, identifying small-cap stocks with strong fundamentals and insider buying can offer potential avenues for growth.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Credit Corp Group | 9.1x | 2.1x | 30.87% | ★★★★★★ |

| East West Banking | 3.2x | 0.7x | 29.91% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.4x | 6.9x | 27.47% | ★★★★★☆ |

| Strike Energy | NA | 5.9x | 30.76% | ★★★★★☆ |

| Dicker Data | 19.3x | 0.7x | -16.73% | ★★★★☆☆ |

| Build King Holdings | 3.2x | 0.1x | 25.70% | ★★★★☆☆ |

| Eureka Group Holdings | 17.9x | 5.5x | 28.60% | ★★★★☆☆ |

| China XLX Fertiliser | 5.1x | 0.3x | -8.23% | ★★★☆☆☆ |

| China Lesso Group Holdings | 6.9x | 0.4x | -243.47% | ★★★☆☆☆ |

| Tabcorp Holdings | NA | 0.7x | -44.46% | ★★★☆☆☆ |

Click here to see the full list of 48 stocks from our Undervalued Asian Small Caps With Insider Buying screener.

We're going to check out a few of the best picks from our screener tool.

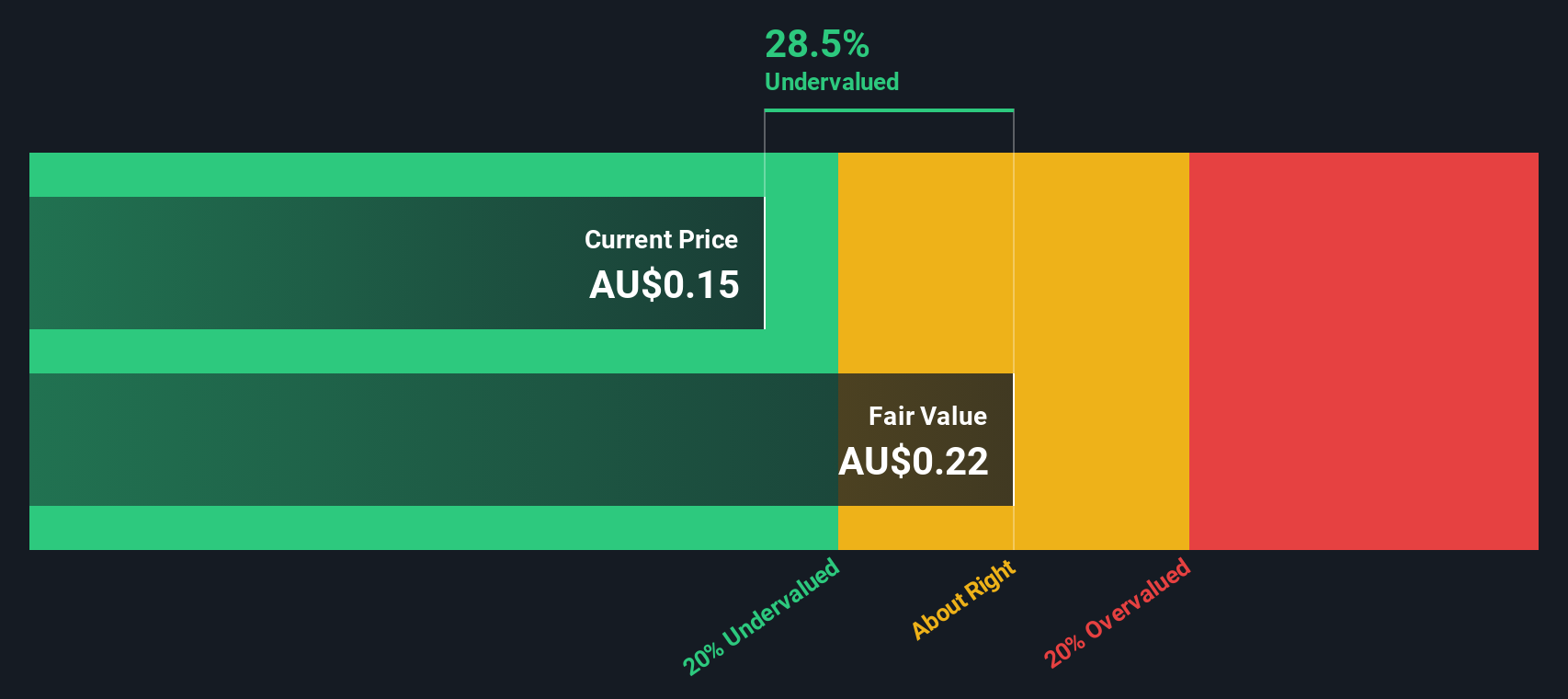

Strike Energy (ASX:STX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Strike Energy is an Australian energy company focused on the exploration and development of gas projects, with a market capitalization of A$1.27 billion.

Operations: Strike Energy's revenue model shows significant fluctuations, with recent periods indicating a return to positive revenue figures after a phase of zero reported revenues. The company's gross profit margin has varied, reaching 55.84% in late 2023 before declining to 21.16% by the end of 2024. Operating expenses have consistently been a substantial part of the cost structure, with general and administrative expenses noted as significant components throughout the periods analyzed.

PE: -24.1x

Strike Energy, a player in the energy sector, has caught attention due to insider confidence with share purchases over the past six months. Despite its small size, Strike shows potential for growth with earnings projected to increase by 52% annually. Recent executive changes include Tim Cooper stepping in as CFO and Company Secretary, bringing extensive experience and financial acumen. However, their reliance on external borrowing highlights some risk factors. The company's strategic review outcomes discussed on June 27 could shape future directions positively.

- Dive into the specifics of Strike Energy here with our thorough valuation report.

Examine Strike Energy's past performance report to understand how it has performed in the past.

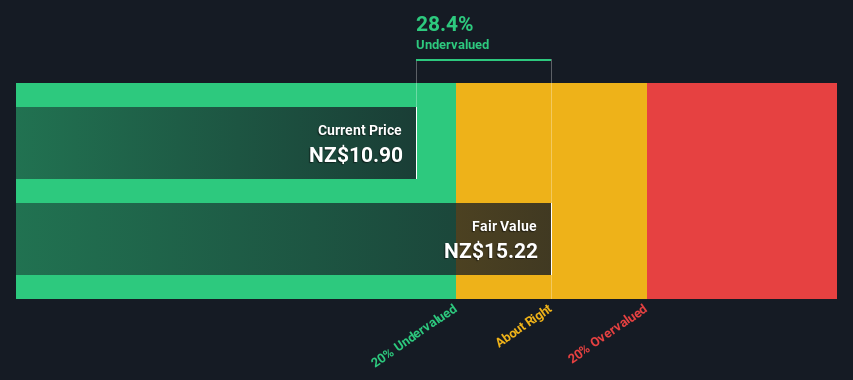

Freightways Group (NZSE:FRW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freightways Group operates in the logistics and information management sectors, focusing on express package delivery and business mail services, with a market cap of NZ$1.68 billion.

Operations: Freightways Group generates revenue primarily from its Express Package & Business Mail segment, contributing NZ$1.03 billion, and Information Management segment at NZ$226.23 million. The company's gross profit margin has shown a decreasing trend, reaching 29.52% by the end of 2024. Operating expenses have consistently risen over time, with general and administrative expenses being a significant component.

PE: 26.6x

Freightways Group, a small cap in Asia, is navigating challenges with strategic alliances. Recently, they faced potential disruptions as their joint venture partner Airwork entered receivership. Despite this, Freightways remains prepared with contingency plans to minimize operational impact. Financially, the company carries high debt levels due to reliance on external borrowing but shows promise with earnings projected to grow 10% annually. Insider confidence is evident from recent share purchases in June 2025, signaling belief in future prospects.

- Navigate through the intricacies of Freightways Group with our comprehensive valuation report here.

Understand Freightways Group's track record by examining our Past report.

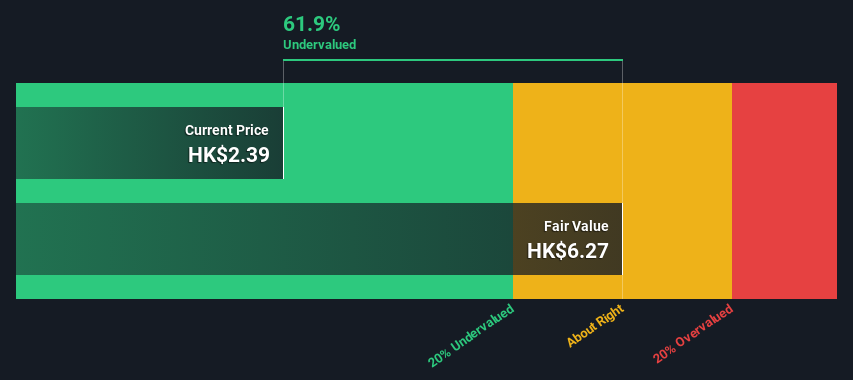

Shougang Fushan Resources Group (SEHK:639)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shougang Fushan Resources Group is primarily engaged in the coking coal mining industry with a market capitalization of HK$11.82 billion.

Operations: The company primarily generates revenue from coking coal mining, with recent revenues reaching HK$5.06 billion. The cost of goods sold (COGS) was HK$2.47 billion, resulting in a gross profit margin of 51.18%. Operating expenses amounted to HK$332.34 million, while non-operating expenses were recorded at HK$761.91 million, impacting the net income margin which stood at 29.54%.

PE: 9.8x

Shougang Fushan Resources Group, a coal mining company, has recently seen insider confidence with share purchases from March to May 2025. Despite facing a forecasted annual earnings decline of 1.9% over the next three years, the company's strategic board changes and leadership under Mr. Fan Wenli signal potential stability. With Mr. Fan's extensive experience in mining operations, Shougang Fushan is positioned to navigate challenges despite relying on external borrowing for funding rather than customer deposits.

- Unlock comprehensive insights into our analysis of Shougang Fushan Resources Group stock in this valuation report.

Gain insights into Shougang Fushan Resources Group's past trends and performance with our Past report.

Seize The Opportunity

- Reveal the 48 hidden gems among our Undervalued Asian Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10