Reflecting On Heavy Transportation Equipment Stocks’ Q1 Earnings: Oshkosh (NYSE:OSK)

Let’s dig into the relative performance of Oshkosh (NYSE:OSK) and its peers as we unravel the now-completed Q1 heavy transportation equipment earnings season.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 14 heavy transportation equipment stocks we track reported a strong Q1. As a group, revenues were in line with analysts’ consensus estimates.

Luckily, heavy transportation equipment stocks have performed well with share prices up 33.1% on average since the latest earnings results.

Oshkosh (NYSE:OSK)

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

Oshkosh reported revenues of $2.31 billion, down 9.1% year on year. This print fell short of analysts’ expectations by 4.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

“We are pleased with our start to 2025, led by strong performance in our Vocational segment, double-digit margins in our Access segment and solid progress on the ramp-up of Next Generation Delivery Vehicle production. Adjusted earnings per share of $1.92 was in line with our expectations of approximately $2.00 per share,” said John Pfeifer, president and chief executive officer of Oshkosh Corporation.

Interestingly, the stock is up 40.6% since reporting and currently trades at $124.21.

Read our full report on Oshkosh here, it’s free.

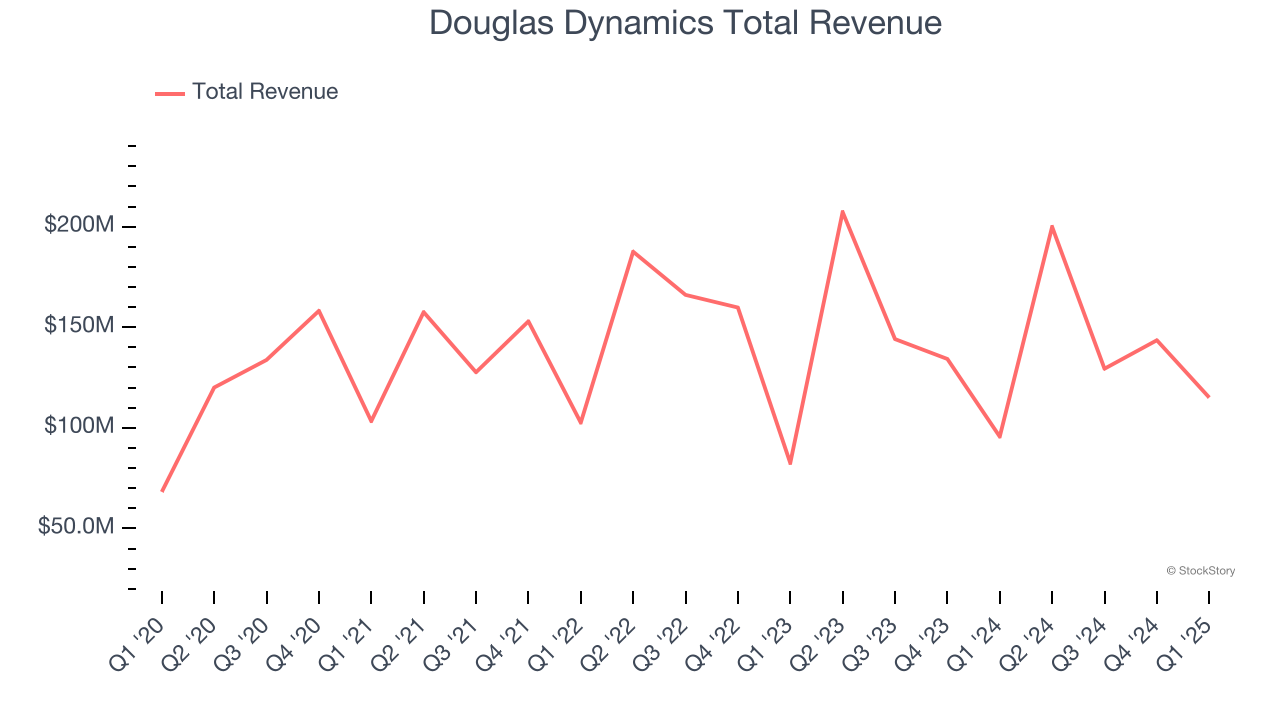

Best Q1: Douglas Dynamics (NYSE:PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE:PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $115.1 million, up 20.3% year on year, outperforming analysts’ expectations by 6.7%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Douglas Dynamics achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 28.4% since reporting. It currently trades at $31.35.

Is now the time to buy Douglas Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $380.9 million, down 26.1% year on year, falling short of analysts’ expectations by 7.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Wabash delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 15.4% since the results and currently trades at $11.49.

Read our full analysis of Wabash’s results here.

Allison Transmission (NYSE:ALSN)

Helping build race cars at one point, Allison Transmission (NYSE:ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Allison Transmission reported revenues of $766 million, down 2.9% year on year. This number came in 3.2% below analysts' expectations. More broadly, it was actually a strong quarter as it produced full-year EBITDA and revenue guidance beating analysts’ expectations.

The stock is up 4.9% since reporting and currently trades at $97.93.

Read our full, actionable report on Allison Transmission here, it’s free.

Trinity (NYSE:TRN)

Operating under the trade name TrinityRail, Trinity (NYSE:TRN) is a provider of railcar products and services in North America.

Trinity reported revenues of $585.4 million, down 27.7% year on year. This print lagged analysts' expectations by 5.6%. Overall, it was a slower quarter as it also recorded a significant miss of analysts’ EPS estimates and a slight miss of analysts’ EBITDA estimates.

Trinity had the slowest revenue growth among its peers. The stock is up 15.6% since reporting and currently trades at $29.03.

Read our full, actionable report on Trinity here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10