Village Farms International And 2 Other Promising Penny Stocks For Your Watchlist

The market has climbed by 2.1% over the past week and 14% in the last year, with earnings forecasted to grow annually by 15%. Amid these conditions, identifying stocks that combine financial health with growth potential is key, especially when considering penny stocks. Although the term "penny stocks" may seem outdated, it still represents an area of investment focused on smaller or newer companies that could offer significant value and opportunities for growth.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.40 | $506.33M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.82 | $277.76M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.92 | $153.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Talkspace (TALK) | $2.77 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.43 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84976 | $6.13M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.40 | $452.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.15 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 422 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Village Farms International (VFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Village Farms International, Inc., along with its subsidiaries, specializes in the production, marketing, and distribution of greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes across North America and has a market cap of approximately $142.67 million.

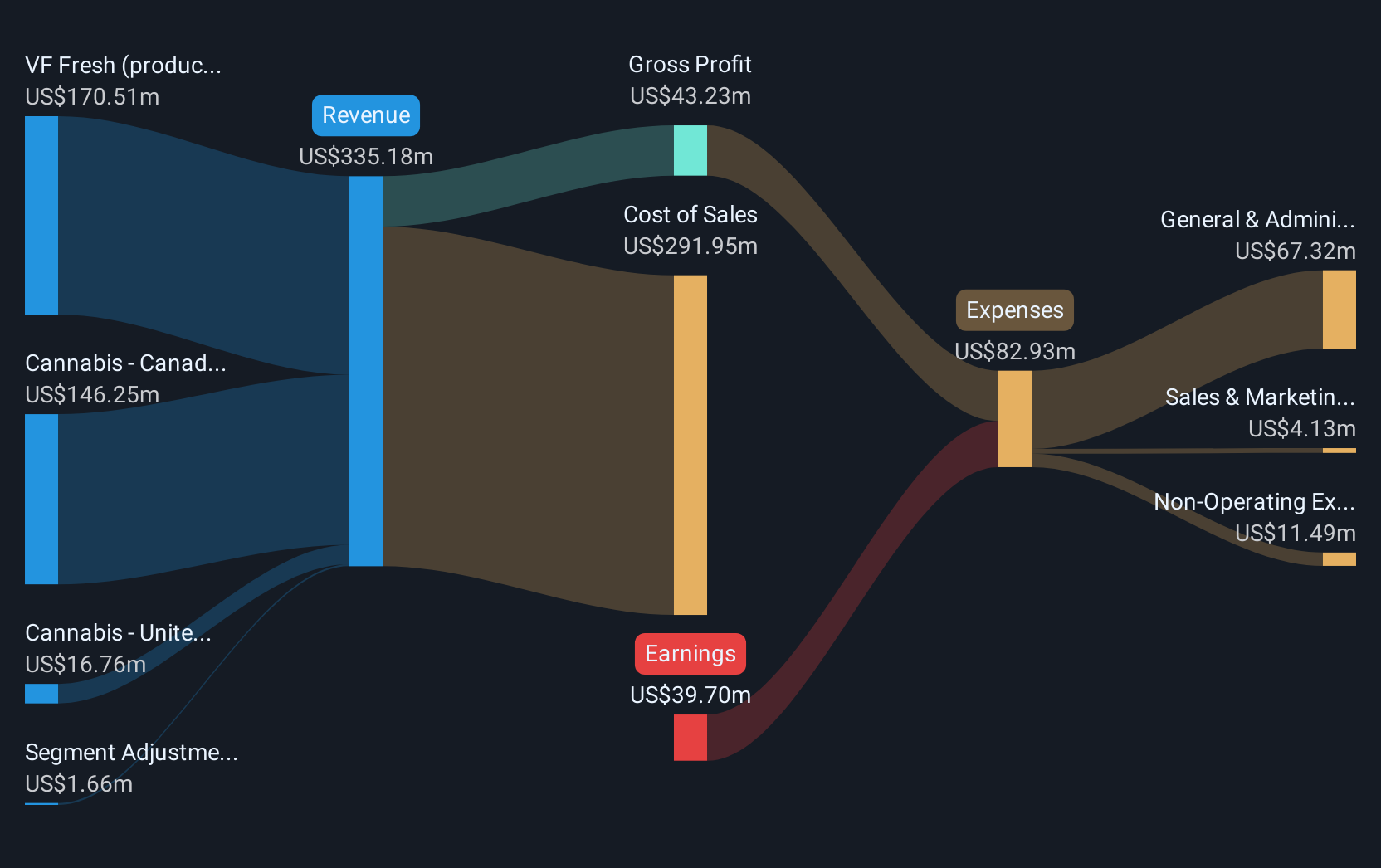

Operations: The company's revenue is primarily derived from its VF Fresh produce segment, generating $170.51 million, and its cannabis operations in Canada and the United States, contributing $146.25 million and $16.76 million respectively.

Market Cap: $142.67M

Village Farms International has navigated its challenges as a penny stock with strategic moves and financial adjustments. Recently regaining Nasdaq compliance, the company has focused on restructuring by entering a joint venture with Vanguard Food LP to privatize certain fresh produce assets, securing $40 million in cash and equity. Despite being unprofitable, Village Farms maintains a satisfactory debt level with short-term assets covering liabilities. The board's experience contrasts with the new management team, indicating potential for strategic shifts. However, volatility remains high and profitability is not anticipated soon, reflecting inherent risks in penny stocks.

- Click here to discover the nuances of Village Farms International with our detailed analytical financial health report.

- Gain insights into Village Farms International's outlook and expected performance with our report on the company's earnings estimates.

AbCellera Biologics (ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on discovering and developing antibody-based medicines for unmet medical needs in the United States, with a market cap of approximately $1.13 billion.

Operations: The company generates revenue of $23.11 million from its segment focused on the discovery and development of antibodies.

Market Cap: $1.13B

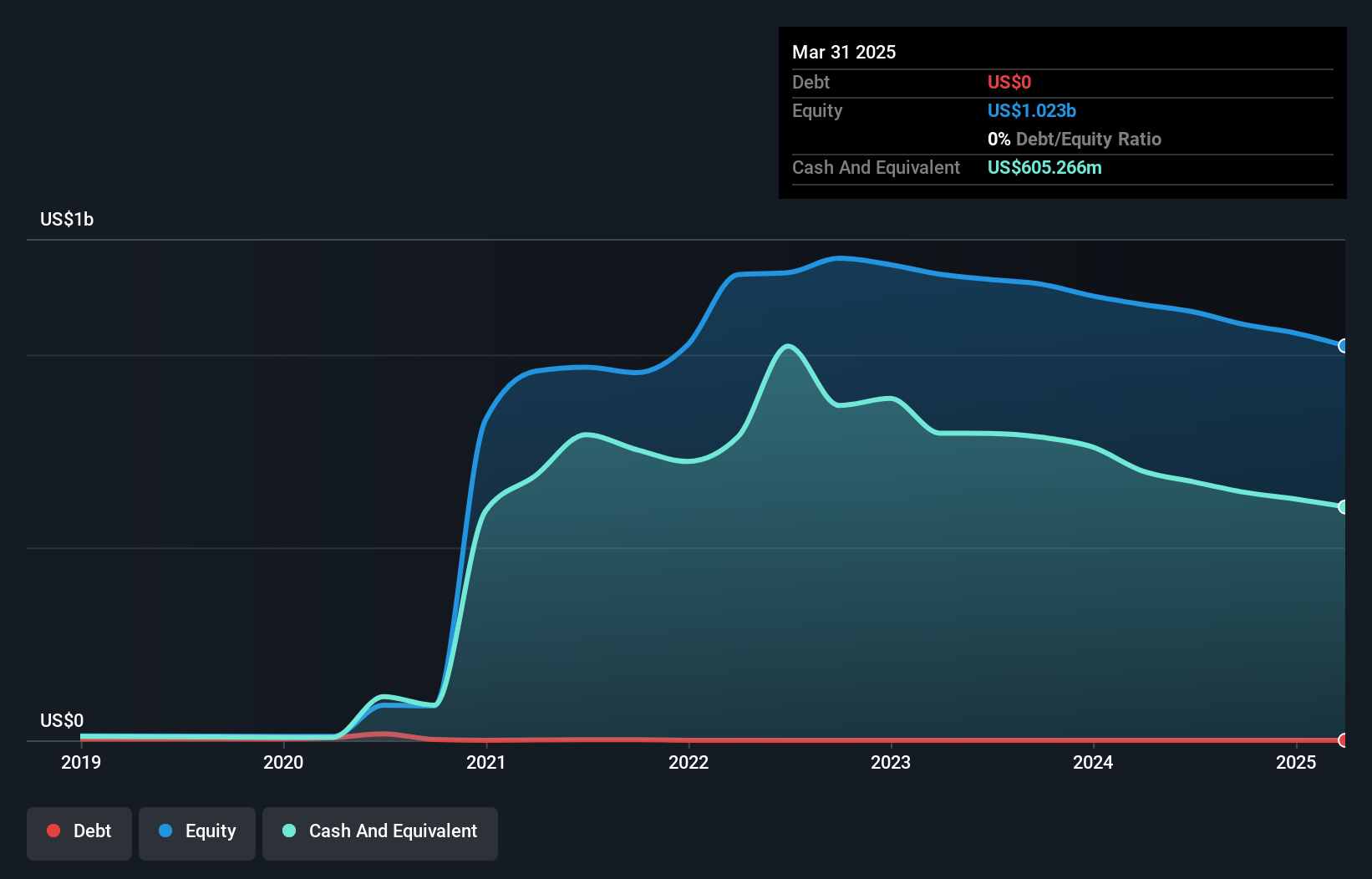

AbCellera Biologics, while unprofitable with increasing losses, presents a mix of potential and challenges common to penny stocks. The company is debt-free and has strong short-term assets exceeding liabilities. Recent clinical trial approvals for ABCL575 and ABCL635 highlight its active pipeline in antibody-based medicines targeting inflammatory conditions and menopause symptoms. Despite revenue decline to US$4.24 million in Q1 2025, ongoing patent litigation victories reinforce its intellectual property strength. AbCellera's innovative T-cell engager platform offers promise for cancer therapies but underscores the inherent risks associated with early-stage biotech ventures focused on high-growth opportunities.

- Jump into the full analysis health report here for a deeper understanding of AbCellera Biologics.

- Review our growth performance report to gain insights into AbCellera Biologics' future.

Waterdrop (WDH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Waterdrop Inc. operates as an online insurance brokerage in China, connecting users with insurance products, and has a market cap of approximately $506.33 million.

Operations: The company generates revenue primarily from its Insurance segment, which accounts for CN¥2.61 billion, followed by the Crowd Funding segment at CN¥155.58 million.

Market Cap: $506.33M

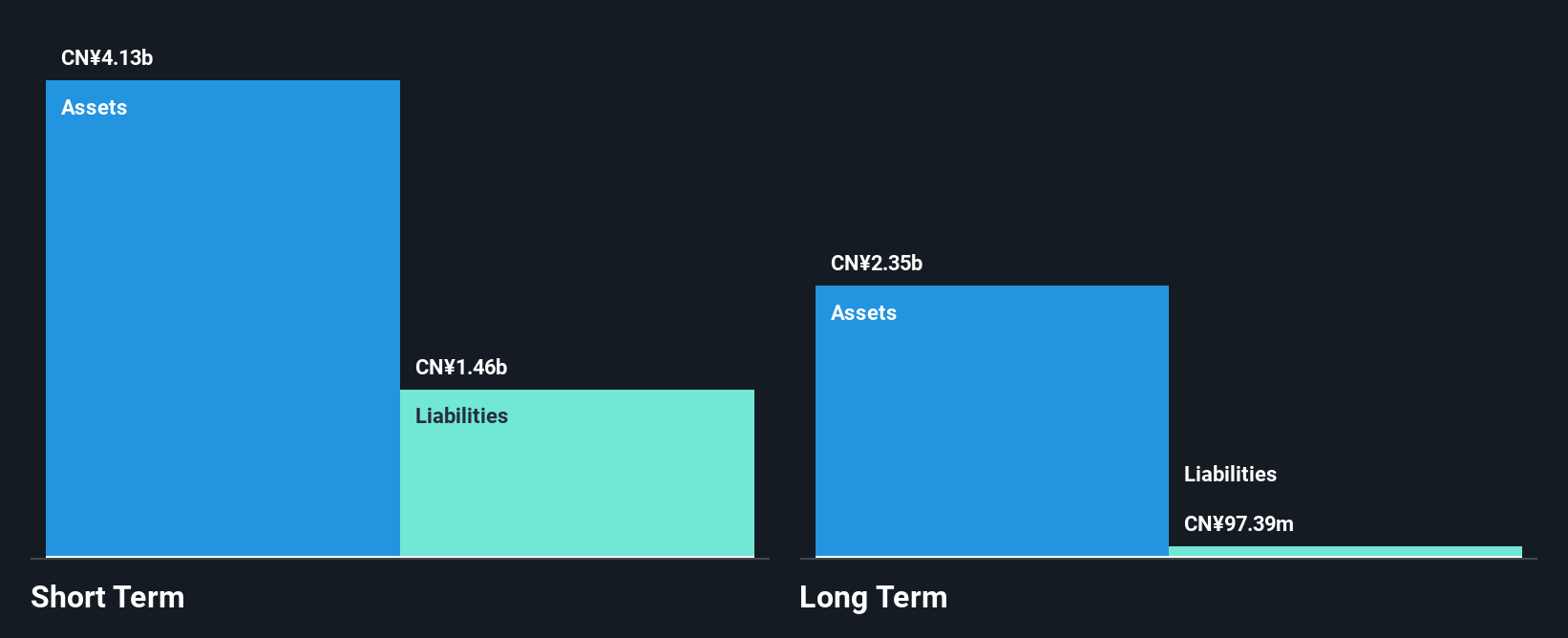

Waterdrop Inc. stands out among penny stocks with its robust financial health, demonstrated by short-term assets of CN¥4.1 billion surpassing both long and short-term liabilities. The company reported Q1 2025 earnings of CN¥108.2 million, reflecting significant growth from the previous year, driven by its insurance segment's revenue of CN¥753.69 million. Waterdrop has maintained a debt-free status while executing share buybacks totaling $4.6 million in early 2025, enhancing shareholder value without dilution concerns. Despite a relatively low return on equity at 7.6%, the company's earnings have surged faster than the industry average, indicating strong operational performance.

- Take a closer look at Waterdrop's potential here in our financial health report.

- Assess Waterdrop's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Get an in-depth perspective on all 422 US Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waterdrop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10