3 ASX Dividend Stocks Yielding Up To 8.1%

In the current Australian market landscape, with the Reserve Bank of Australia keeping rates on hold and sectors showing mixed performance, investors are closely watching for stable opportunities amid economic uncertainties. In such an environment, dividend stocks can offer a reliable income stream; here are three ASX-listed companies yielding up to 8.1% that could be of interest to those seeking consistent returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.36% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.32% | ★★★★★☆ |

| New Hope (ASX:NHC) | 10.00% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.82% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.08% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.26% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.32% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 8.15% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 8.75% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

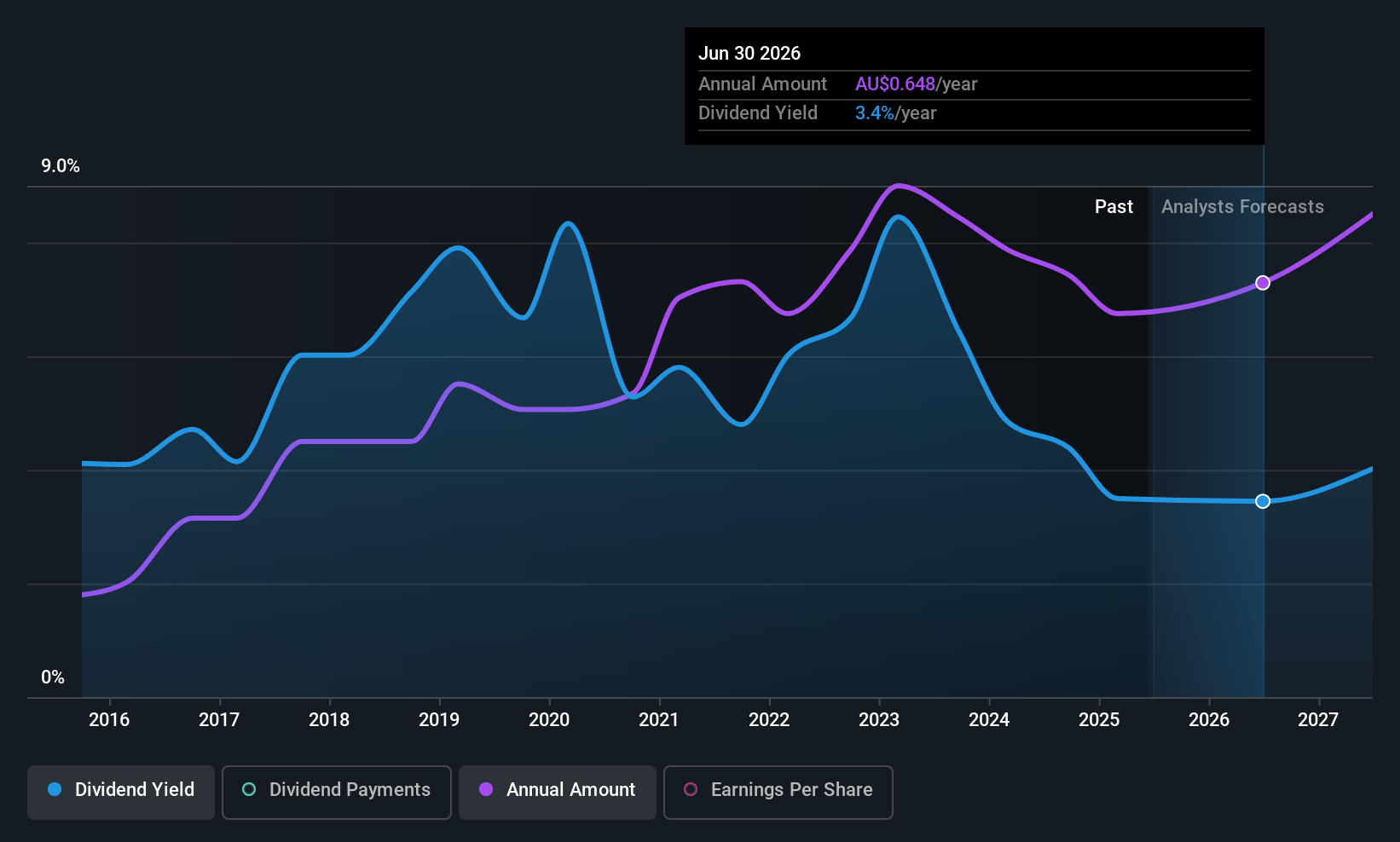

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.55 billion, is involved in sourcing and retailing household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates revenue of A$492.63 million from its furniture retailing operations in Australia, the United Kingdom, and New Zealand.

Dividend Yield: 3.3%

Nick Scali's dividend payments have been reliable and stable over the past decade, with a current yield of 3.32%. While this yield is lower than the top 25% of Australian dividend payers, it remains sustainable with a payout ratio of 78.2% covered by earnings and a cash payout ratio of 63.7%. Recent inclusion in the S&P/ASX 200 Index may enhance visibility among investors, while recent executive changes could influence future strategic directions.

- Dive into the specifics of Nick Scali here with our thorough dividend report.

- According our valuation report, there's an indication that Nick Scali's share price might be on the expensive side.

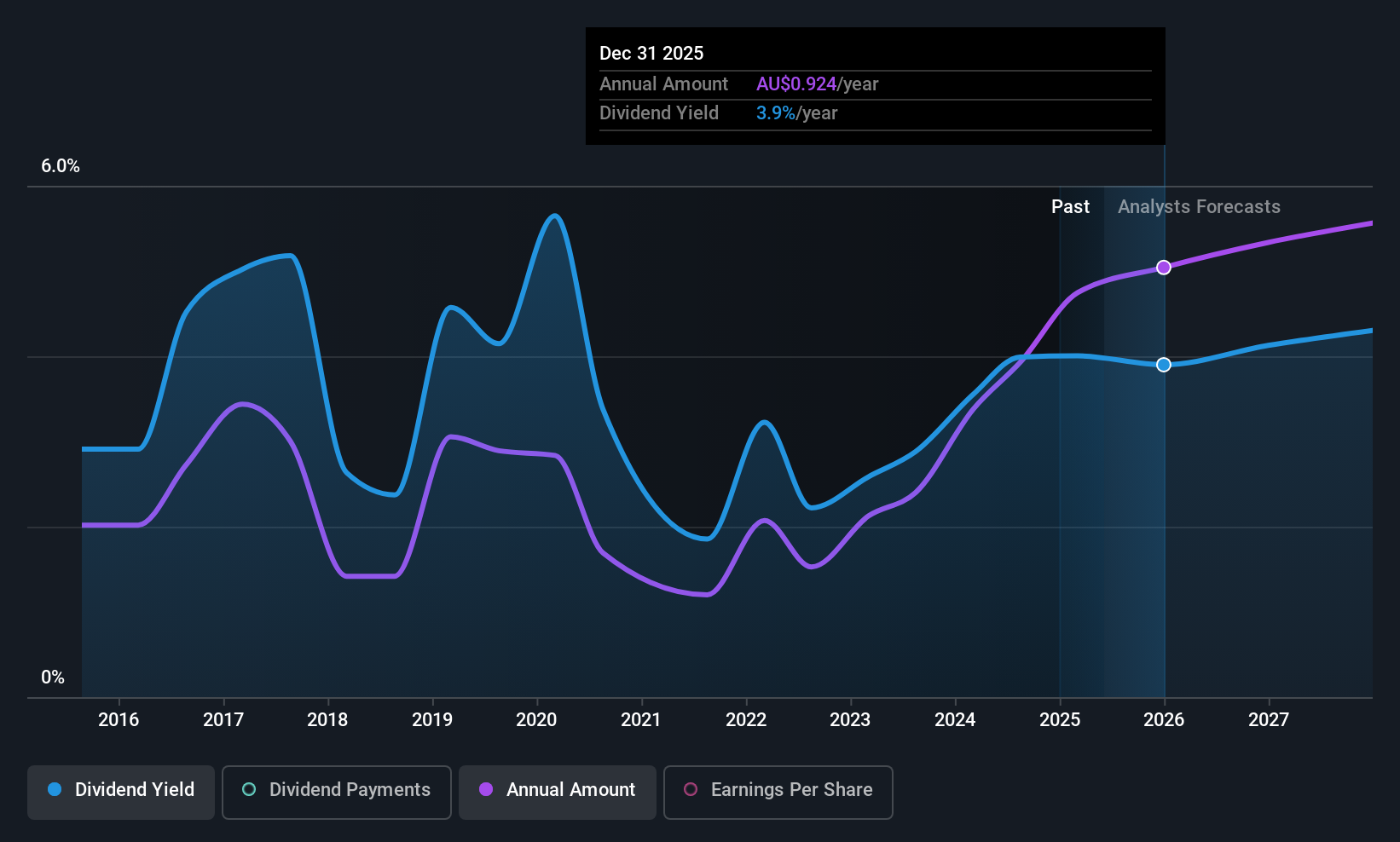

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets with a market cap of A$34.16 billion.

Operations: QBE Insurance Group Limited's revenue is derived from several segments, with International contributing $9.82 billion, North America $7.54 billion, and Australia Pacific $5.96 billion.

Dividend Yield: 3.5%

QBE Insurance Group's dividend payments have grown over the past decade but remain volatile and unreliable, with a yield of 3.51%, lower than the top 25% of Australian dividend payers. Dividends are well covered by earnings (payout ratio: 46.7%) and cash flows (cash payout ratio: 32.3%), suggesting sustainability despite volatility. Recent amendments to its constitution were approved at the May AGM, potentially impacting governance but not directly affecting dividends or financial performance.

- Click here and access our complete dividend analysis report to understand the dynamics of QBE Insurance Group.

- Upon reviewing our latest valuation report, QBE Insurance Group's share price might be too pessimistic.

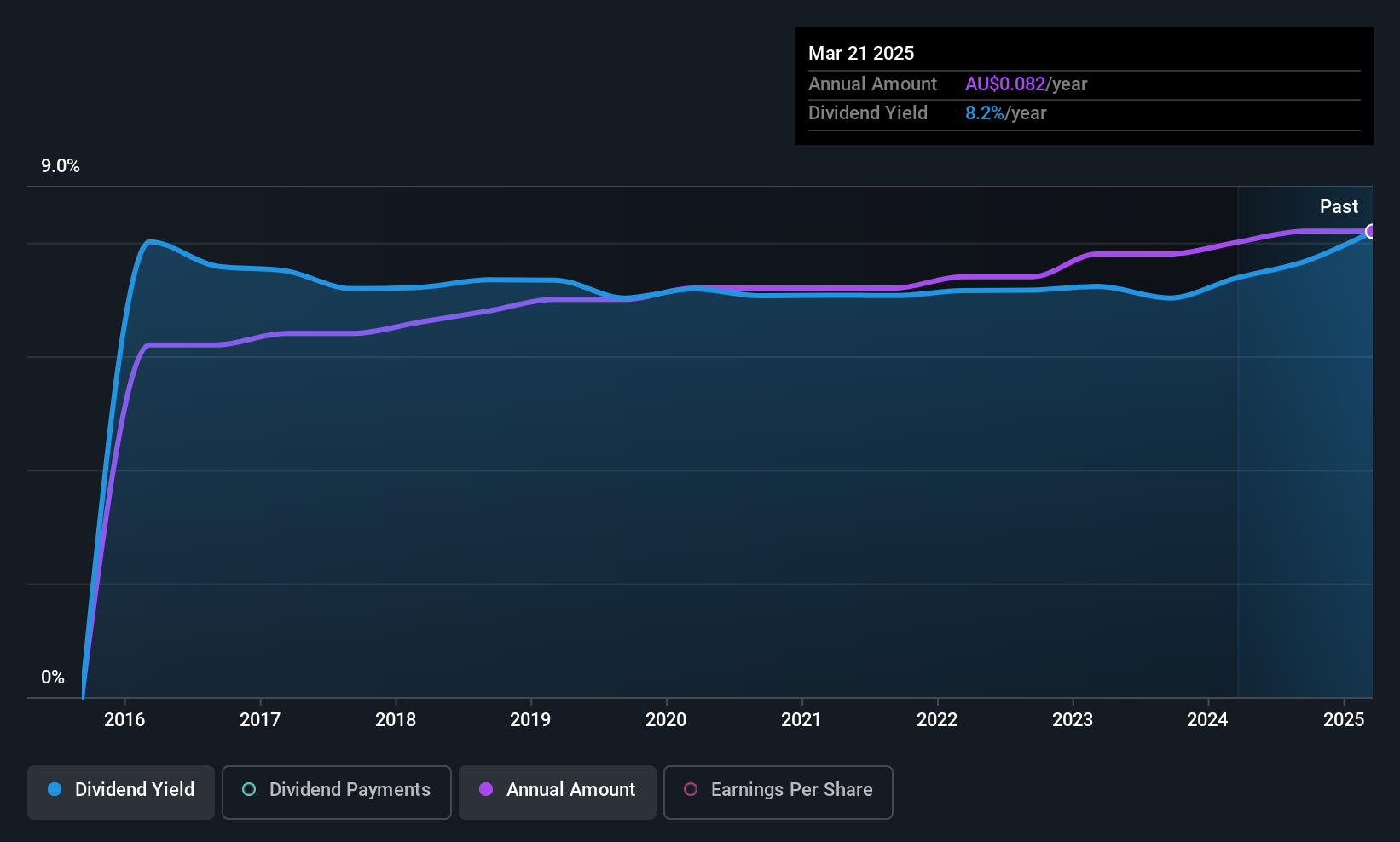

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia with a market cap of A$360 million.

Operations: Sugar Terminals Limited generates revenue of A$115.01 million from the sugar industry segment.

Dividend Yield: 8.2%

Sugar Terminals Limited offers a high dividend yield of 8.2%, placing it among the top 25% of Australian dividend payers, though its payout ratio indicates dividends are not well covered by earnings. Recent agreements with customers include cost reductions and insourcing, potentially stabilizing future returns. Dividends have been stable and reliable over the past decade, supported by cash flows despite an illiquid share price. However, sustainability concerns persist due to coverage issues.

- Click to explore a detailed breakdown of our findings in Sugar Terminals' dividend report.

- Our comprehensive valuation report raises the possibility that Sugar Terminals is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Investigate our full lineup of 28 Top ASX Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10