Asian Growth Companies With High Insider Ownership Delivering 59% Return On Equity

As global markets navigate through a mix of economic signals, including resilient job growth in the U.S. and fluctuating trade negotiations, Asia's stock markets have shown varied performances with China's indices rising while Japan's have faced declines. In this context, identifying growth companies with high insider ownership becomes crucial as these firms often exhibit strong alignment between management and shareholder interests, potentially leading to robust returns such as a 59% return on equity.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Click here to see the full list of 607 stocks from our Fast Growing Asian Companies With High Insider Ownership screener.

We're going to check out a few of the best picks from our screener tool.

d'Alba Global (KOSE:A483650)

Simply Wall St Growth Rating: ★★★★★★

Overview: d'Alba Global Co., Ltd. is involved in the manufacturing and sale of perfumes and cosmetic products both in South Korea and internationally, with a market cap of ₩2.58 trillion.

Operations: The company generates revenue from its cosmetics manufacturing and sales segment, amounting to ₩356.64 billion.

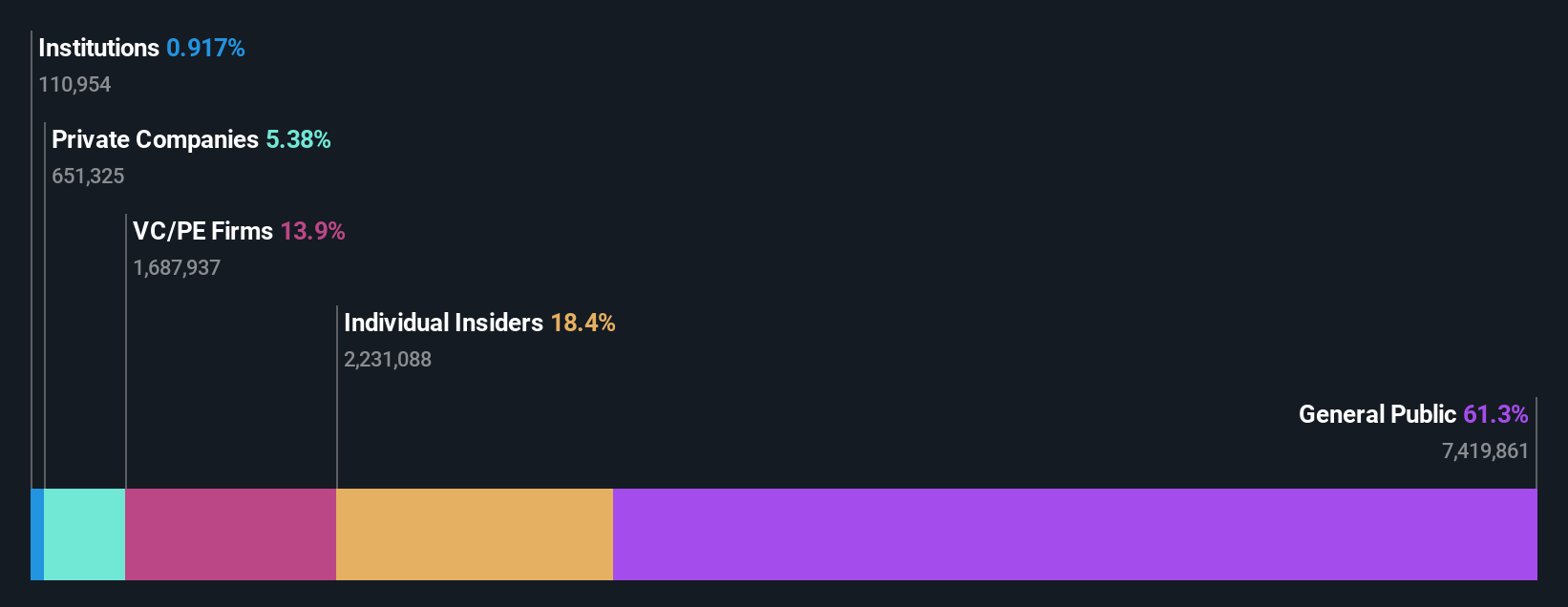

Insider Ownership: 18.4%

Return On Equity Forecast: 59% (2028 estimate)

d'Alba Global's recent IPO raised KRW 43.36 billion, indicating strong market interest despite a volatile share price over the past three months. The company is trading at 60% below its estimated fair value, suggesting potential undervaluation. With earnings expected to grow significantly at 41.88% annually and revenue forecasted to increase by 36% per year, d'Alba Global shows promising growth prospects in the Asian market without recent substantial insider buying or selling activity.

- Take a closer look at d'Alba Global's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, d'Alba Global's share price might be too optimistic.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in China, with a market cap of HK$285.34 billion.

Operations: The company's revenue segments include Domestic operations generating CN¥125.08 billion and Overseas operations contributing CN¥5.02 billion.

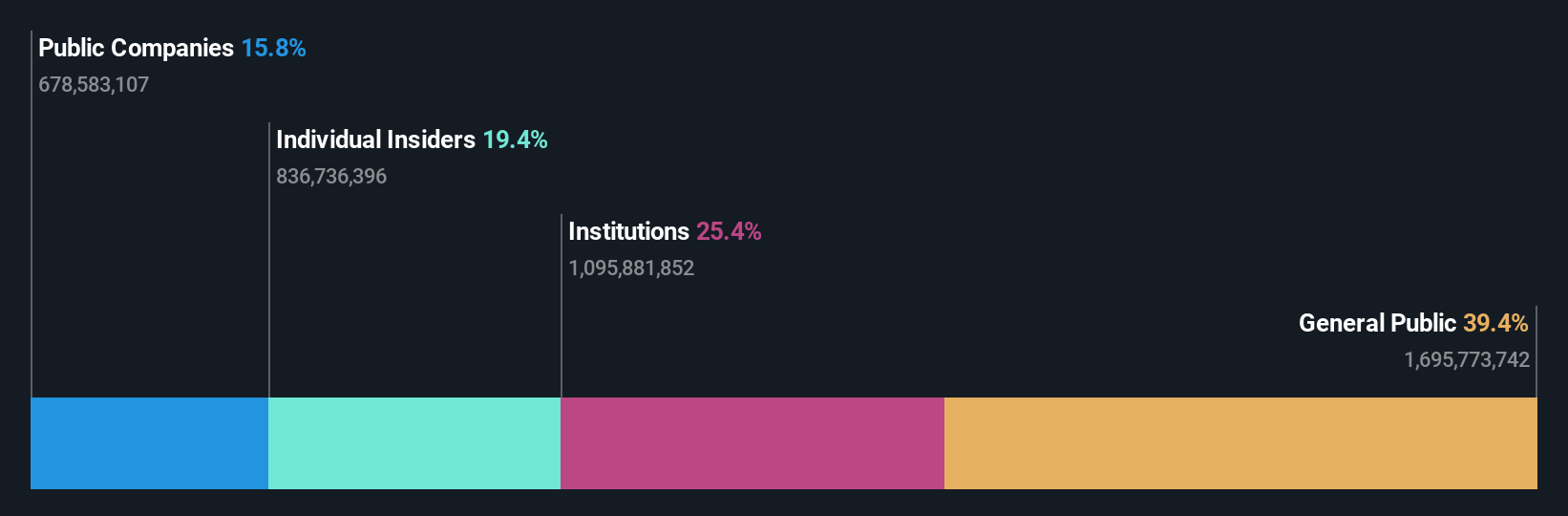

Insider Ownership: 19.4%

Return On Equity Forecast: 20% (2028 estimate)

Kuaishou Technology's growth potential is underscored by its significant insider ownership and strategic initiatives like the Kling AI 2.0 Model, enhancing content generation capabilities. Despite a modest earnings forecast of 15.25% annually, it outpaces the Hong Kong market average and shows robust past performance with a 33.4% earnings increase last year. Recent share buybacks totaling HKD 5.15 billion reflect confidence in its valuation, while revenue growth remains moderate at 8.3%.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive analyst estimates report here.

- The analysis detailed in our Kuaishou Technology valuation report hints at an deflated share price compared to its estimated value.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥29.89 billion.

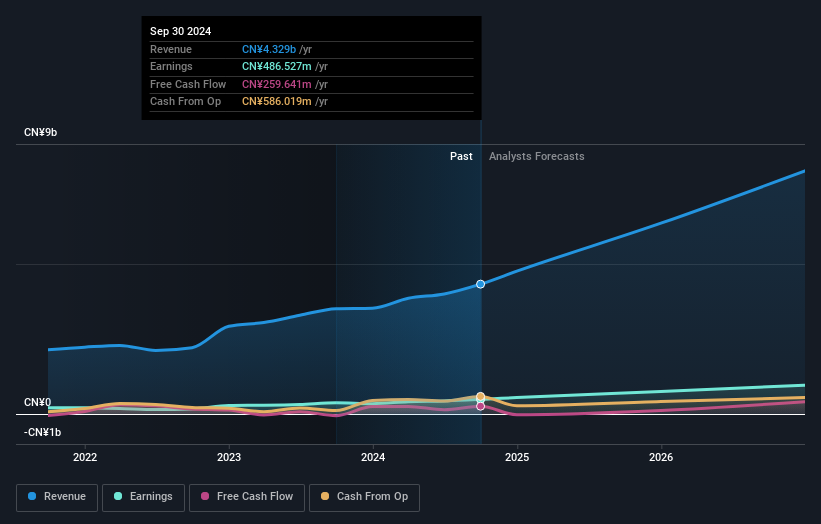

Operations: The company's revenue primarily comes from its Precision Temperature Control Energy Saving Equipment segment, which generated CN¥4.78 billion.

Insider Ownership: 18.3%

Return On Equity Forecast: 21% (2028 estimate)

Shenzhen Envicool Technology's growth trajectory is supported by its high insider ownership and strategic expansion efforts, including a recent MoU with Green AI to advance data centre cooling solutions in ASEAN. The company reported strong financial performance with 2024 sales of CNY 4.59 billion and net income of CNY 452.66 million, reflecting a year-over-year increase. Forecasts indicate significant revenue growth at 25.1% annually, outpacing the Chinese market average, while trading below estimated fair value enhances its investment appeal.

- Get an in-depth perspective on Shenzhen Envicool Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen Envicool Technology shares in the market.

Next Steps

- Gain an insight into the universe of 607 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10